Robo-advising is an awesome new development in the investing landscape. AI tools can invest autonomously based on your predetermined preferences, so you can spend more time doing the things you enjoy rather than micromanaging your finances.

Robo-advisors are great for many applications but lack that special human touch. There are some things that only a human advisor can do, such as plan for your future or make intuitive judgment calls. Ultimately, robo-advisors do a wonderful job at helping you manage finances, but give no real guidance on how to manage them.

That is why hybrid services that combine both robot and human advising exist. Wealthsimple is a hybrid firm that features robo-investing and human financial advising. Today, we are going to cover Wealthsimple and give it a full accounting. We will then give our verdict on whether it’s worth trying out.

What Is Wealthsimple?

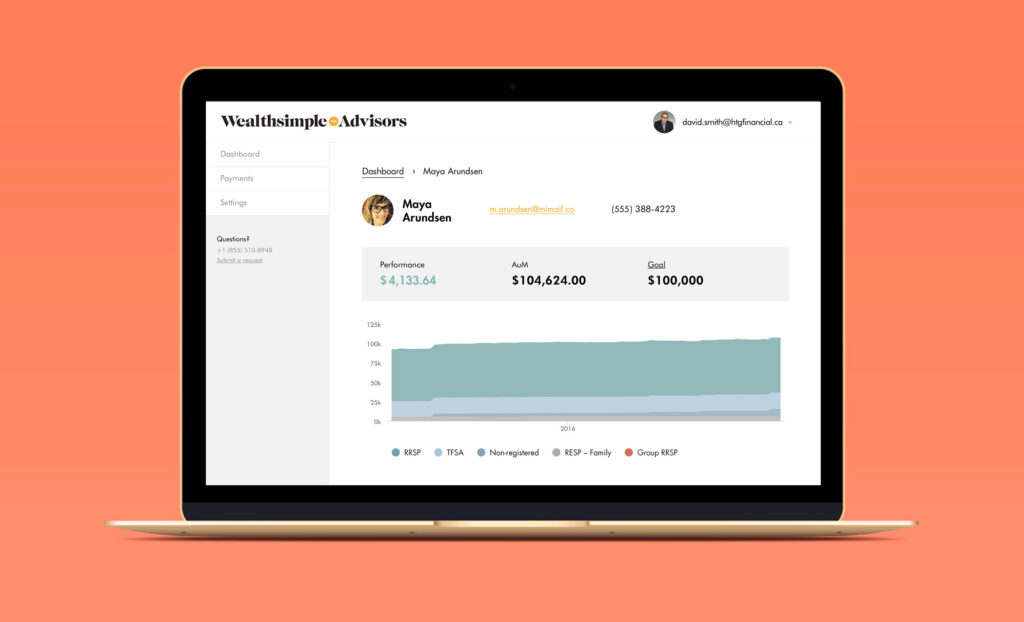

Wealthsimple is a Canadian based investment robo-advisory service launched in 2014. Wealthsimple is a welcome addition to the robo-investing market due to their addition of human advisory services. This hybrid structure allows customers to get the most out of their investments through AI routine maintenance and the guided expertise of a human advisor.

Wealthsimple is not just you’re run-of-the-mill robo advisor either. Since launching in 2014, Wealthsimple has grown to over 40,000 clients in the US and Canada, and are managing more than £750 million of their hard-earned money (stats sourced from a 2017 article).

“We also have $100 million in backing from one of the world’s largest financial companies, The Power Financial Group. And just a few months ago we were recognised with our second consecutive Webby award for Best Financial Services Website in the world.”

Wealthsimple

Their algorithms are based on Nobel-laureate Harry Markowitz’s Modern Portfolio Theory (MPT). By using index-based ETFs, Wealthsimple can build highly diversified portfolios that contain a broad mix of investment asset classes.

How Does Wealthsimple Work?

Wealthsimple works like many other investment apps. You create an account, give your financial info, then you can start investing. When creating an account, you will have to provide the usual, such as bang info, social security number, and ID. You will also be asked a few questions about your portfolio preferences. Wealthsimple allows you to make several different types of accounts, including:

- Standard taxable brokerage accounts

- Pension

- ISA

- JISA

If you live in Canada, you get more features such as:

- Retirement savings plans

- Corporate accounts

- Registered retirement income funds (RRIF)

- Registered education savings plans (RESP)

Once you create your account, Wealthsimple takes your previous answers and creates a customized portfolio. You can choose between 3 portfolio allocations:

- Conservative

- Balance

- Growth

The conservative approach focuses mostly on low-risk bonds to set up a small but very reliable growth rate. The Balanced option puts equal emphasis on stocks, corporate bonds, and municipal bonds. The Growth setting puts a heavier emphasis on foreign and global stocks for a higher risk, high-growth profile. Each of these 3 portfolio settings has between 8-10 ETFs that have a unique investment class.

Wealthsimple has 2 other unique portfolio settings: Socially responsible and Halal.

The Socially Responsible Investing (SRI) portfolio invests in companies aimed at making a difference. Companies in this portfolio include:

- WS North America SRI Equities

- WS Developed Markets SRI Equities

- Canada Nominal Bonds

- Canada Long Nominal Bonds

- US IL Bonds (hedged)

You can set weights on the SRI portfolio to focus on specific issues such as environmental impact. Within the SRI, you can choose between the Conservative, Balanced, and Growth approaches.

There is also the Halal investing option. The Halal portfolio is designed to help customers invest in line with Islamic investing principles. Essentially, securities in this class do not make profits from certain restricted industries (e.g. alcohol, gambling, tobacco, etc.) or companies that derive a majority of their revenue from interest.

Wealthsimple has 3 account types with different rates and benefits.

- Basic: £0-£100k

- Black: £100K+

- Generation: £500K+

These plans are based on how much you have invested through Wealthsimple. The Basic plan has the least amount of features but still gives you access to expert advice, auto-re-balancing, and auto-deposits.

The Black and Generation plans are for the platform’s high rollers. These plans are focused on providing expert financial advice for your investments. Even if you do not have more than £100k to invest, you can still get a lot out of the Basic plan.

What Fees & Charges Does Wealthsimple Have?

Wealthsimple, like most other investment services, make most of their money through management fees. For Basic account holders, Wealthsimple charges a 0.50% fee of assets under management (AUM). This rate is actually a good bit higher than many other popular robo-advisors. However, keep in mind that this fee accounts for the advisory services.

Once you reach the Black level and have more than £100k invested, you get a reduced 0.40% management fee. Overall, though, Wealthsimple has pretty high management fees. The good thing is that it seems to be the only fees that they charge. Everything else comes gratis.

What Else Does Wealthsimple Do?

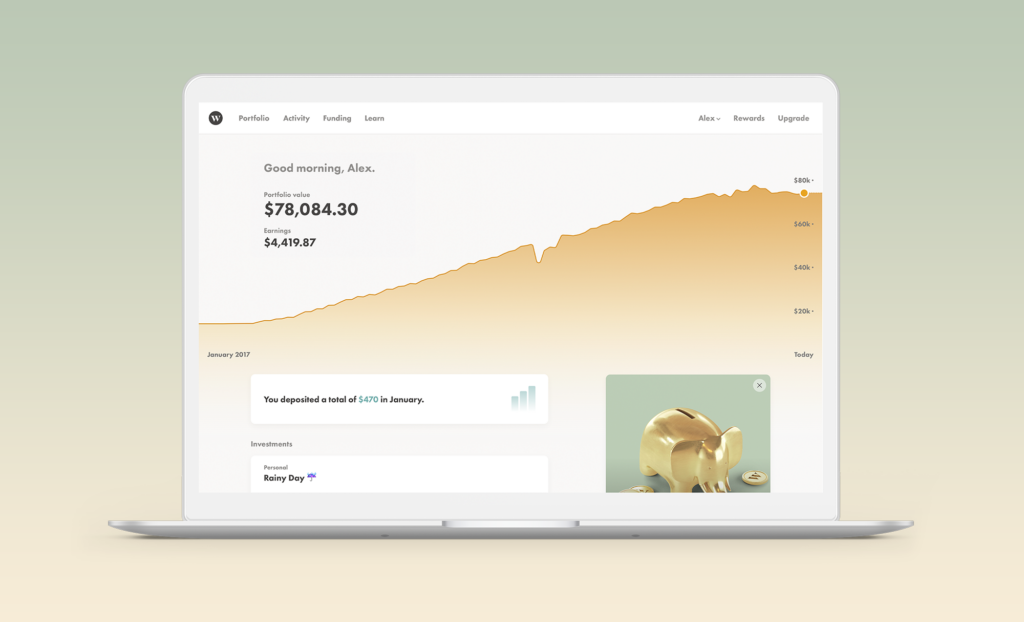

Wealthsimple is primarily an investment service, so they offer a lot of little investment services. Here is a quick rundown of what they can do:

- 401(k) assistance

- Tax loss harvesting

- Portfolio rebalancing

- Auto-deposits

- Fractional share investing (!!)

Out of these options, our favourite one if probably that fractional share investing. Fractional shares open up a lot of neat micro-financing opportunities. Fractional shares are a good idea if you do not have much capital to throw around or if you want to try new trading strategies.

Aside from investing services though, Wealthsimple offers Wealthsimple Save, their take on savings accounts. Wealthsimple Save is a way to save money by investing in low-risk ETF funds that you can quickly access. You can also set up ‘round-up purchase’ where the app will round up any charges to your car, putting the extra change in your brokerage account.

So for example, if you spend £2.50 on your daily coffee, then it will get rounded up to £3.00 and that extra £0.50 will be put into your account. It’s a great feature that encourages effortless mindless saving, which is always a good thing in our opinion.

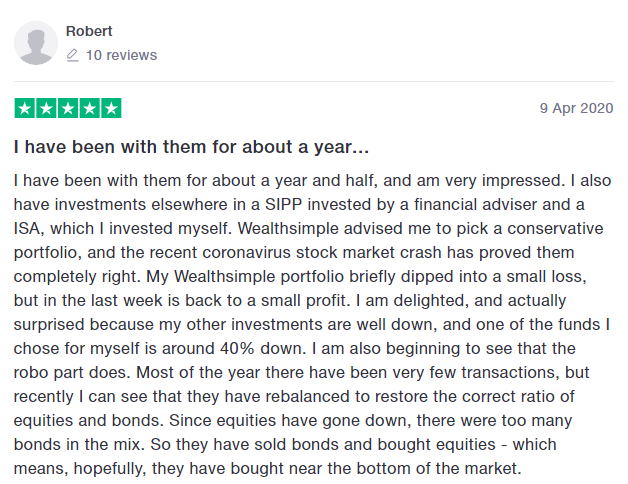

Is Wealthsimple Legit?

Yes, Wealthsimple is a legitimate service and your money will be 100% safe and secure. Wealthsimple uses bank-level encryptions and 2-factor authentication (2FA). Moreover, all of your funds are protected by the Financial Services Compensation Scheme. Up to £85k of your investments will be insured in case of insolvency.

Moreover, Wealthsimple has the backing of reputable financial institutions. It has received over £200M in investments from some of the most well-known financial organisations.

Wealthsimple Benefits

Wide-range of services: Wealthsimple has an extremely wide range of services it offers. From robo-advising and human advising to tax-loss harvesting and auto-deposits, Wealthsimple has some of the best features of a robo-investing service we have ever seen. No matter your skill or experience level, you will find something to love with Wealthsimple.

Advisory services: Wealthsimple is unique among robo-advisors by incorporating human advisory services. You can meet with a human advisor to check your finances, plan investments, and figure out your financial goals. Robo-advisors, strictly speaking, do not advise but just streamline the investment process. Human advisors can help you make long-term financial plans.

Portfolio selections: Wealthsimple has 3 portfolios and they have excellent allocations. The simple structure is easy to navigate, and each portfolio is designed with the latest economic models in mind. Wealthsimple also automatically rebalances your allocations so you don’t have to worry about micromanaging your finances. There are a few exceptions though. You cannot request rebalancing or make changes to your ETFs.

Wealthsimple Drawbacks

High fees: The single biggest drawback of Wealthsimple is high management fees. Wealthsimple charges a 0.50% rate for their accounts, which is fairly higher than a lot of other services. However, this fee does include all the extra features, so it may even out after all is said and done.

No selections: Unless you are on the SRI or Halal portfolios, you cannot request changes to the ETF structure of your plan. This is mostly to streamline the process so Wealthsimple does not have to deal with thousands of requests every day. This is a good feature if you want passive management, but might be a deal-breaker if you want to play a more active role in your investing.

Our Verdict: Should You Try Wealthsimple?

Wealthsimple is a fantastic robo-advising service. The ETF selection is diverse, the advisory services are top-tier, and everything runs as smooth as butter. There are no minimum account fees, and they offer a ton of useful services like tax-loss harvesting and automatic rebalancing. The only real downside is the cost, which is a good bit higher than a lot of other robo-advisor services. If you can get past that aspect, then Wealthsimple is probably one of the best robo-advisors you can sign up for. You can also get a lower management fee if you invest more than £100k in the app.

What Are Other People Saying About Wealthsimple?

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024