Do you find yourself regularly struggling to manage your bills each month? You’re not alone, as a large number of people have trouble keeping their bills in check and their cash flow well managed.

Fortunately, there are answers. To help you determine the best bill management apps for your needs, we’ve compiled this handy list of apps that help you save money and also keep a close eye on where you’re spending.

If you’re ready to take control of your personal finances, join us as we share the best bill management apps the U.K. has to offer.

Bear in mind, many of these are not strictly “bill management apps”, but rather fully-featured solutions to manage your finances from the comfort of your device.

With that out of the way, let’s dive in.

What Are The Best Bill Management Apps In The U.K.?

Here are our top picks for getting your spending habits under control. From managing your savings account to tightening up your debit card spending, you’ll find the help you need in the personal finance apps below.

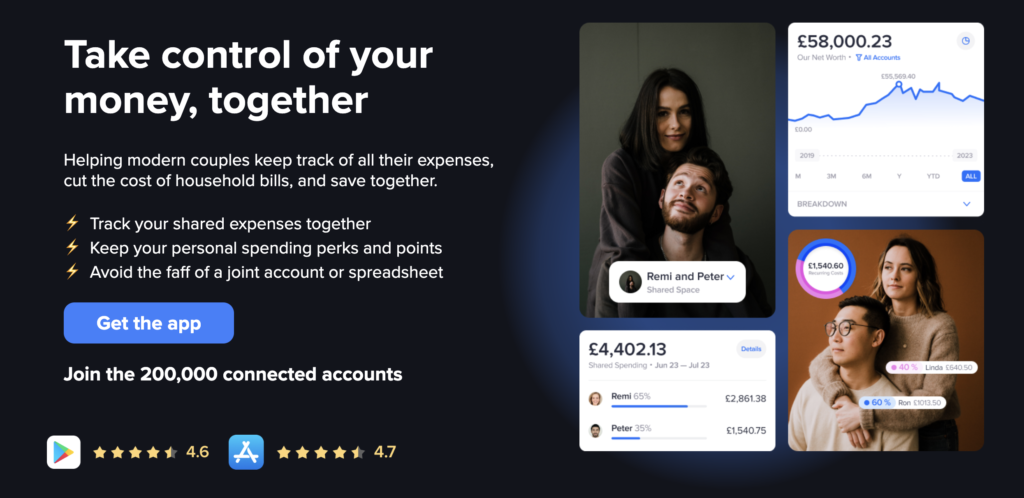

1. Lumio: Couples Finances

Lumio is the simplest way for anyone in a relationship to manage their money. With a secure private and shared space, Lumio makes it easy for couples to track, share and save together as a couple – without giving up their financial independence.

Lumio allows you to connect your bank accounts, savings, credit card, pension, and investment accounts in one place and you can share any bill, expense or a whole account into your Shared Space with your partner.

What Is Lumio?

Lumio helps modern couples keep track of all their expenses, cut the cost of household bills, and save together.

It’s not a traditional budgeting or bill management app as it does so much more than simply tracking your spending and finances.

Lumio’s main feature is called Spaces. Spaces allow you to switch between your personal finances and your shared finances. So, whether you are in an early relationship and splitting the occasional meal out or living together, Lumio gives you all the flexibility to manage money together as a couple.

Lumio already has more than 200,000 connected accounts and was recently shortlisted for Personal Finance App of the Year at the British Bank Awards. Lumio is a registered Agent of Moneyhub – which is authorised and regulated by the Financial Conduct Authority – so you know you’re in safe hands.

Lumio Key Features

Private Space and Shared Space

- A single source of truth for your personal and shared finances. Effortlessly switch between a secure view of your personal and shared finances.

Track all your accounts and balances in one place

- Connect any bank, savings account, credit card, investments and pension, and you can share any balance, transaction or information you want to share with your partner. You are always in control of what you share.

- Lumio has a list of more than 200 Financial accounts to connect from. Want to add an offline account or asset? You can create a manual account to track your account balances and net worth.

Track & cancel wasteful household bills & subscriptions

- Once you securely connect your account, Lumio automatically identifies any bills, subscriptions or direct debits, and picks out all your recurring payments.

- You can share any bill with your partner, and Lumio will keep track of all your bills as a couple, so you always know where you stand.

- Lumio lets you know when your bills go up, so you can deal with it on the spot.

Real-time expense tracker

- You can share any bill, expense, or an entire list of transactions from your account into your Shared Space.

- Lumio keeps track of any shared expenses with a live breakdown of who paid for what – and a real-time I Owe You tracker so you always know where you stand.

- Full list of automatically categorised spending.

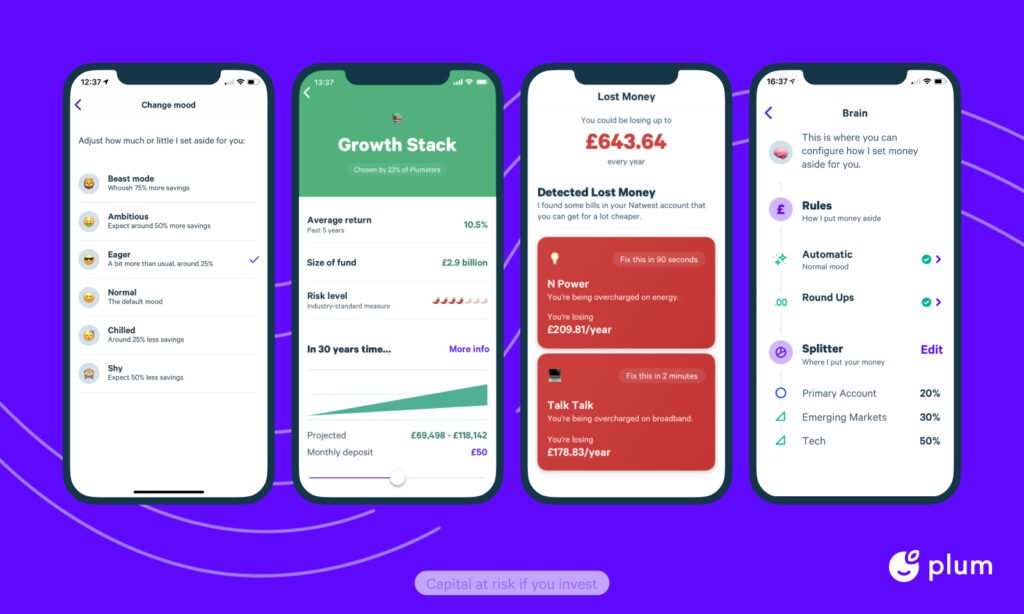

2. Plum

Fintech’s personal finance app, Plum, is a startup that connects to your bank account and uses a series of complex algorithms based on artificial intelligence to calculate your finances accurately. Plum is aimed at people who haven’t been successful in saving money in the past, as it has several useful features that can help you increase your savings potential.

Plum was launched in 2016, is regulated and licensed by the Financial Conduct Authority, and gives you protection from the FSCS (Financial Services Compensation System).

As mentioned, the appeal is that the Plum app works to calculate the amount that it thinks you’re able to afford. It then transfers the money you can afford to spend on bills without your intervention. If this sounds like the kind of guidance and direction you need in your financial life, keep reading to learn more about Plum.

What Is Plum?

Plum is an investment and savings application that allows users to manage their funds through their mobile phones at the touch of a button. Users can choose from multiple Plum accounts, each charging you corresponding fees. But if you’re already on a tight budget and can’t afford to pay for one of these accounts, Plum offers their basic account, which is entirely free and is an effective savings tool in its own right.

Plum features three primary accounts for you to choose from. Additionally, there are also SIPP and ISA offerings, with various degrees of services and options that work together to save you money.

With it, you get both Plum Easy Access and Plum Instant Acess. Both come with Plum Basic, so you don’t have to worry about paying for anything extra that you don’t want or can’t afford.

Plum Easy Access

Plum Easy Access is a new feature included in the Plum Basic account. The account pays 0.25% AER in interest without commission on the account. You have to wait one business day to withdraw funds, but all the powerful features of Instant Access are here for your benefit. What’s more, your funds are protected by the FSCS (Financial Services Compensation Scheme).

Another essential feature of Easy Access and Instant Access is that Plum will automatically suggest ways for you to save money on everyday household bills. Although this is nothing more than a comparison site in nature, you can remove some work from the process and switch automatically to make sure you stick to a profitable provider. You can also choose to use the rounding function, where Plum rounds your entire transaction to the nearest £1 and deposits that amount into your Plum savings account. Although this is a good way to save money, it is not entirely innovative, and many commercial banks have been offering this method for many years.

Plum Instant Access

Instant Access is efficient, intuitive, and most importantly, free of charge. Artificial intelligence is used to analyse how you currently spend money. It then determines the corresponding amount you need to save every few days to make ends meet and pay bills on time. The biggest appeal of this feature is that you barely notice the money being taken from your funds. What’s more, you can control how much you save by choosing what Plum calls “Mood.” If you desire, you can withdraw these funds to your bank account after 24 hours.

Investec Bank provides an instant account where your funds are deposited in a segregated account. This account is very useful if you save money on disposable items or postpone it for a period of time. In doing so, you can easily get rid of some financial problems at Christmas, for example. With that said, there is a slight disadvantage to this account. And that disadvantage is that you don’t see any interest build over time.

As such, it’s not the best place to keep your savings for an extended period of time.

It does, however, give you immediate access to your funds. And if you think you may need to use your savings right away, you can access your funds in as little as 5 minutes. If you’re interested in saving your capital for the long haul, you might want to consider switching over to Plum Easy Access (above).

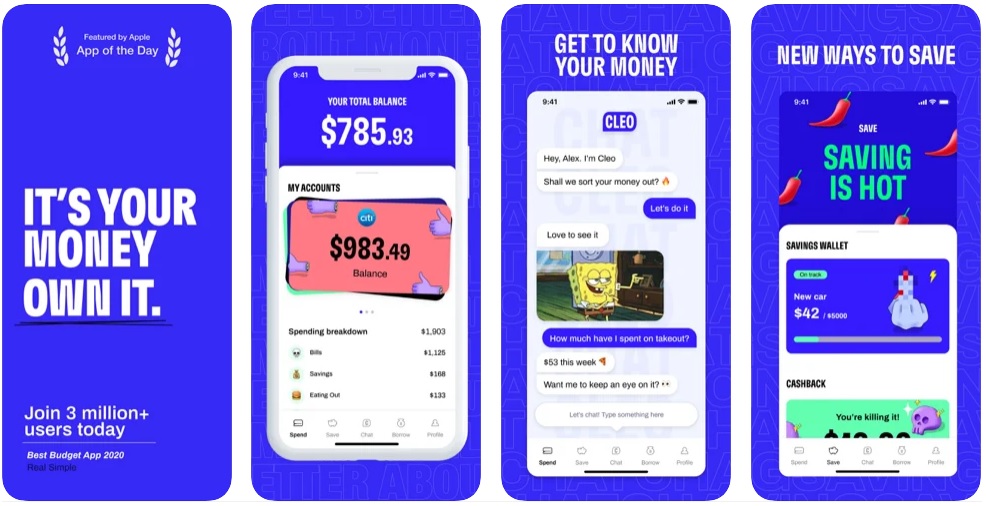

3. Cleo

If you’re looking for more personal finance apps to consider, Cleo may hold the key to your financial freedom. Artificial intelligence once again takes centre stage, as Cleo uses A.I. to manage your bank account and funds. It’s no secret that personal finance apps save money. And Cleo is one of the more impressive offerings to do so. But where Cleo differs from its competitors is mainly in its presentation.

What Is Cleo?

Cleo is yet another Fintech startup. The personal finance app was founded in 2016 and is headquartered in London. The Cleo app is sometimes referred to as “Meet Cleo.” Cleo is available for both Android and iOS devices, and houses over 3 million users.

If you want speed and efficiency in your personal finance app, Cleo is right up your alley. The Cleo app is very popular among the crowd of young millennials, and this is by design.

Cleo has a stylish user interface that does all the work for you. What’s more, it mixes witty satire elements to make your personal finance management more interesting than other budgeting app offerings. Users need to link their bank account details to Cleo.

From there, the A.I. chatbot analyses your various spending patterns and actually gets started right away with determining the best use of your assets.

You can use the money dashboard via Facebook Messenger or through the mobile app version. As you can see, Cleo was built with the younger crowd in mind. What’s more, Cleo only takes about 25 minutes to set up with your bank account attached. If your bank is not supported, you can also get setup help, which walks you through the setup process so you can get started saving money. Cleo also lets you link multiple bank accounts to the app, and using its various features is a breeze.

For example, when you enter or say “budget”, the Cleo app starts to create a budget with you. Like many other personal finance apps, Cleo is one of the many free budgeting apps available today. That said, you still get access to some truly beneficial features through the free option. As such, you can more easily test the platform before investing in Cleo Plus.

Features

Cleo is stocked with helpful and useful features from the start. Perhaps the most essential basic feature is that Cleo has is the ability to track your expenses and your spending habits. By connecting your bank account to the app, you can view your spending categories, balance overview, and bank account overview. In this regard, Cleo is more like a personal finance assistant than just a budgeting app. Even still, the app can easily set budgets for different expenditure categories and track your budget throughout the month.

Also with Cleo, users can set their own budget or rely on artificial intelligence recommendations to set spending limits. This feature is perfect for those who are struggling with a budget or need a little help to track their expenses. And when you make a purchase, Cleo will notify you when you are approaching the established budget limit. You can also ask Cleo whether spending in certain categories such as seeing a movie or buying food is a good financial decision. You can also set budgets for different time periods, which is very useful when you want to control spending on holidays or weekend vacations.

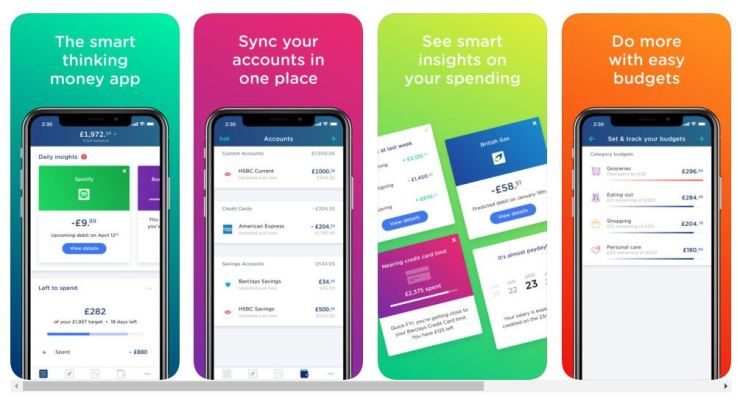

4. Yolt

Yolt opened in Amsterdam in 2016 as a registered trademark of the ING Group — it’s designed for technology-savvy people. Yolt is part of the effort to get all the big banks to participate in open banking, which means that through an app like Yolt, you can have all the banking information you need to ensure the safest and most effective money management.

What Is Yolt?

Yolt works with banks and credit card companies to consolidate all your accounts into a simple and attractive budget app that you can access via your smartphone.

You can collect your checking account, savings account, and credit card so you can understand at a glance what you want to do. Next, Yolt will analyse your consumption behaviour data to provide tips, suggestions, and better loan offers.

Yolt was launched in the U.K. in 2017, and is also available in Italy and France, and currently has more than 500,000 users.

Open Banking

Open banking refers to a recent legal development in the U.K. Open banking requires banks to share their financial information with third parties such as Yolt upon request. The judge decides that individuals own their financial information and therefore should have the right to access this information through secure third-party services.

With Yolt, you can view all the data previously stored by the bank and group it intelligently so that you can understand the entire financial situation in a clear and organised manner.

5. Monzo

Monzo was founded and headquartered in the United Kingdom. It was one of the first app-based mobile banks to enter the market. This bank was established in 2015 and is used by nearly 5 million people. Although Monzo provides some services for U.S. citizens, most of its features and functions are only available to U.K. customers. Monzo allows you to make quick payments, create shared accounts and tags, open accounts and spend overseas, and have a complete travel record when you return.

Monzo provides a full range of mobile banking functions, allowing you to easily check your spending and/or savings. You can create a budget, track your savings, and benefit from the cheapest Monzo international transfers and cash withdrawals.

Like many banks, Monzo offers a combination of free and paid accounts. The amount you pay for Monzo depends on the card and account type you choose. Unsurprisingly, the more you pay for Monzo, the more Monzo features unlock for you to use.

The cost of this personal plan is £15 per month. Your monthly withdrawal limit abroad has increased to £600, and you can deposit up to five cash for free. In addition, the premium plan also includes:

- Airport lounge discounts

- Telephone insurance

- International travel insurance

- High-quality metal cards

- 1.5% interest

The plan also includes everything Monzo needs, such as a full U.K. checking account, free spending abroad, Apple and Google Pay, and budgeting tools. You will also receive a business debit card and digital receipt to help you manage your business expenses.

Feel free to check out our full Monzo review here.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024