Thanks to the internet, investing is easier now than ever before. What used to be the purview of the wealthy and well-off is now accessible to more people thanks to the advent of online brokerages with their low fees and agreeable trading terms.

Online investing is probably one of the biggest changes to the financial world in decades.

However, investing takes a lot of time and effort. Most people probably won’t want to spend hours pouring over quarterly reports and financial statements to figure out which investments are the best decision.

That’s where Moneyfarm comes into the picture. Moneyfarm is a Milan-based investment app that is designed to make investing as simple and streamlined as possible.

Moneyfarm’s pre-built portfolios are designed for investors who don’t want to spend time messing with their finances and want to leave their money alone to grow.

So in this Moneyfarm review, we are going to cover the pros and cons of this investment service and see whether investing with Moneyfarm is a good idea.

We will talk about Moneyfarm’s fee structure, portfolio past performance, customer reviews, and more. We will then give our verdict on whether this robo adviser is worth trying out.

Moneyfarm: Overview

Moneyfarm is a Milan-based investment firm founded back in 2012.

Moneyfarm was founded with the goal of making financial wellbeing more achievable for the regular person via a simple and accessible investment platform and methodology. Moneyfarm has grown rapidly and was first launched in the UK in 2016.

Since then, Moneyfarm has won several financial awards, such as the YourMoney “Best Online Direct to Consumer Investment platform” in 2018 and “Best Direct SIPP 2019” by the same publication.

As of May 2020, Moneyfarm has hit the £1 billion in assets managed milestone and serves over 50,000 active investors.

Moneyfarm has built itself around its simple pre-built stocks and shares ISA portfolios and self-directed pension plans.

The goal of Moneyfarm is to have an investment platform for those who do not want to deal with the nitty-gritty details of investing and who just want to stick their money into an account and watch it grow.

To that end, they feature a relatively stripped-down platform that focuses strongly on the absolute basics of investing.

Moneyfarm is an online-only platform and so does not have any physical branches. Many people will find this to be a huge positive as they won’t have to worry about having a branch near them, but others prefer the familiarity of a traditional brick-and-mortar investment firm.

Since launching in the UK in 2016, Moneyfarm portfolios have managed to perform well and provide solid annual returns.

The product range is fairly simple as it’s focused on low-effort investing, but its portfolio past performance is very solid, at 6.1% growth annual for an all-time growth of 34.8%.

That is pretty darn good for a new firm, even considering that Moneyfarm has only been around for about 4 years.

The trick is that all money management by Moneyfarm is done by machines, not humans. Moneyfarm is a robo adviser meaning that sophisticated algorithms automatically take care of allocating your portfolio.

P.S. Need a refresher on how robo advisers work? Click here.

This design is awesome because it greatly reduces overhead costs and the savings get passed to you in the form of extra-low fees.

How Does Moneyfarm Work?

Moneyfarm is simple to set up and start using. After downloading the app, you will be prompted to make an account and enter some personal details like your email and a mobile number to receive texts.

Once you have your account details set up, you will be prompted to fill out a quick questionnaire. The questionnaire contains queries related to your financial habits and risk portfolio, investment goals, and desired asset allocation.

The point is to match you with appropriate investment opportunities based on your answers. You will also pick the kind of account that you want to make. Currently, Moneyfarm offers three products: general investment accounts, stocks and shares ISAs, and a pension fund.

Here is a quick rundown of what kinds of benefits these account types have:

- General investment account: Unlimited investing, fee-free structure, personal advice, and planning, achievement goals with multiple portfolios

- Stocks and shares ISA: Tax-free growth, flexibility, fast and free transfers.

- Private pension: Target-date funds, free drawdown at age 55, free pension transfer, expert advice.

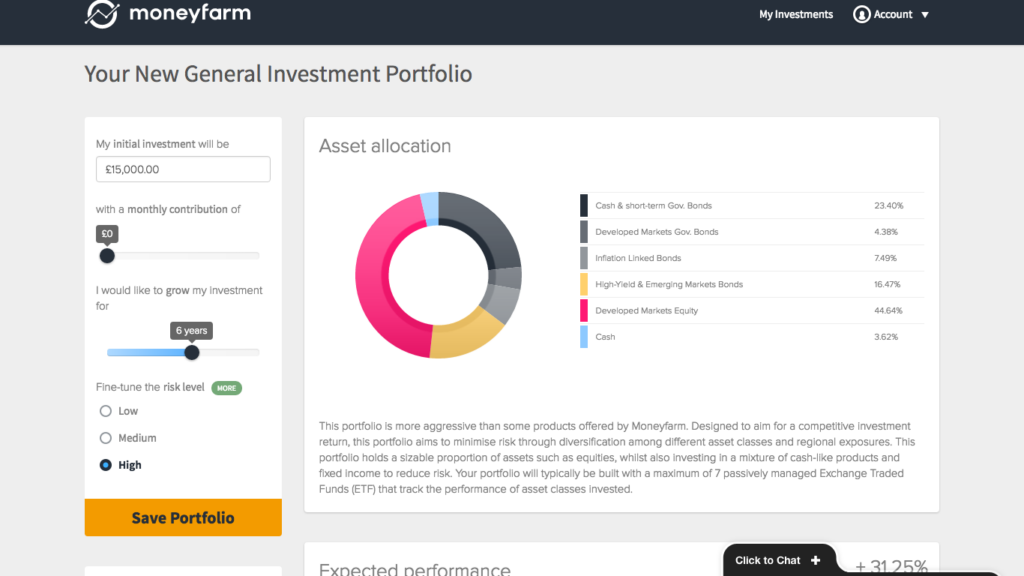

Once you finish the questionnaire and pick the kind of investment account you want to create, you will be presented with 7 pre-built portfolio options.

Moneyfarm will suggest one portfolio to you based on your responses to the questionnaire, but ultimately you have complete control over which one you choose. and whether you pick a general investment account, Moneyfarm stocks and shares ISA, or Moneyfarm pension.

Each of the 7 portfolios can be ranked on a scale from “conservative” to “risky.” Those on the lower end of the spectrum are made up of mostly lower-risk level fixed-income investments, such as government bonds, corporate bonds, and emerging market bonds.

For example, portfolio 1 consists of 53% cash and short-term government bonds with no exposure to emerging market equities or commodities. Portfolio 7 is composed mostly of developed markets equities (66%) and have very minimal exposure to bonds.

No matter which portfolio you choose, your allocations will mostly be split between developed market equities and bonds. Take note… you can’t choose the exact makeup of your portfolio.

Whereas other online brokers are like a buffet and let you choose which securities to have, Moneyfarm is more like ordering a meal from a menu: What you see is what you get.

This pre-built portfolio focus is a great choice for beginner investors who do not know anything about stocks or those who don’t have the time or effort to spend micro-managing their portfolio.

But, it might be seen as too restrictive for more experienced investors who want to customize their portfolios.

Last but not least, the only thing left is to fund your account. Enter your bank details and it will take about a day to verify your bank account. Then you can fund your portfolio, sit back, relax, and watch your money grow without having to lift a finger.

Also, if you do not want to put any money into a portfolio yet, you can create a “virtual” portfolio for free just to see how it would manage and to get used to using the platform.

The virtual portfolios are a good idea if you are brand new to investing and want to get your feet wet without having to rusk any money at first.

How Does Moneyfarm Manage its Portfolios?

Moneyfarm handles its investments a little bit differently than other robo advisers.

First off, asset allocations are based on volatility or specific securities, not risk calculations about the security type alone. For example, if a “low-risk” bond suddenly starts trading in a very large volume, then it may become riskier, despite the fact that it’s categorized as a low-risk bond.

As such, it will be considered for modification during the next round of adjustments to portfolio allocations.

What this means is that Moneyfarm does not only trade assets based on assumptions about inherent levels of risk of the security type.

Moneyfarm rebalances its portfolios every 3 months so if there is a low-risk asset that is experiencing a sudden surge of volatility, it will get re-allocated.

Three months is a suitable time period because it is long enough to avoid problems from over trading but is also short enough that excess risk does not creep in.

Overall, this method of managing risk is a good idea and something different from other robo advisers. Most robo advisers trading in exchange-traded funds (ETFs) just stick your money in an indexed fund and let it grow possible.

It’s good to see that Moneyfarms takes a little bit more of a sophisticated approach.

What Are Moneyfarm Fees?

It is free to make a Moneyfarm account but they do have a minimum investment amount of £1,500. A lot of other review websites state that Moneyfarm has a £1 investment minimum: This is not true.

The FAQ on their website clearly states you need to deposit at least £1,500 either as a new contribution or transferred funds.

It is possible that Moneyfarm recently changed this requirement though. Moneyfarm recommends starting with at least £2,500 though, with monthly £100 direct deposits.

Moneyfarm makes all of its money through annual account management fees. Account fees differ depending on how much money you have invested through the platform. Here is a quick breakdown of how annual account management fees work.

- £1,500-£10,000 – 0.75%

- £10,001-£50,000 – 0.60%

- £50,001-£100,000 – 0.50%

- £100,000+ – 0.35%

As you can see, the more money you have invested in the platform, the lower the annual fee you will have to pay.

These fees are pretty low, but they are not as low as some other robo advisers out there. Either way, it’s cheaper than a traditional human-managed brokerage firm, and you can expect to make similar returns.

Included with that fee is everything else you get with Moneyfarm: free trades, free advice and financial planning, a huge library of investment resources and educational articles, and regularly quarterly rebalancing on your Moneyfarm portfolio.

You also get free withdrawals whenever you want, night or day. So the small percentage fee is well worth it in our opinion.

Is Moneyfarm Legit? Is My Money Safe?

Yes, Moneyfarm is a legitimate organization.

They are authorised and regulated by the Financial Conduct Authority (FCA) and they separate your assets from company assets so your money cannot be taken away by creditors if they go under.

Moneyfarm accounts are also covered by the Financial Services Compensation Scheme in the event that Moneyfarm enters administration.

As far as your personal data goes, Moneyfarm stores all your data encrypted on secure servers and does not sell your info to third parties. Any information that is given to partners is anonymized and used for validation purposes.

Also, Moneyfarm has an excellent online reputation. Their Trustpilot page has a 4.6 out of 5 rating from over 450 customer reviews.

The vast majority of customers praise the interface and how streamlined the whole approach is. There are also several customers who say that customer service is friendly, knowledgeable, and genuinely helpful.

Moneyfarm Pros & Cons

Pros

- Streamlined process. Investing with Moneyfarm is extraordinarily straightforward and easy to use. You just make an account, pick a portfolio, and voila, you are done.

- Good portfolio performance. Moneyfarm has only been around for 4 years in UK markets but has managed to show impressive growth on par with other larger online brokerages.

- Simplified fee structure. The only fees you will pay with Moneyfarm is the annual account management fees. That covers every other service you get with the platform, including no trading fees, financial planning, rebalancing services, and customer support.

- Good customer service. The customer service team for Moneyfarm is friendly and helpful. You can contact them via email or phone.

Cons

- High minimum investment amount. You need to deposit at least £1,500 to start investing. Some robo advisers let you invest with as little as £1.

- Limited investment selection. Your investment choices are fairly limited with Moneyfarm. You cannot change portfolio compositions on your own and there are only 7 portfolios to choose from.

- Available only in the UK and Italy. Currently, Moneyfarm is only available to UK and Italian residents. The company plans to expand its offerings to other countries in the future though.

Conclusions

Overall, Moneyfarm is one of the best ways to invest your money.

Moneyfarm accounts are easy to setup have good performance figures, great customer feedback, investment advice, a low management fee, good exposure to stock market tickers around the world, and has ease of use.

Moneyfarm offers a great way to manage your investments.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

1 Comment