For many people, one of the biggest barriers of investing is getting past the complicated nature of it.

When you hear people talking about obscure concepts like “disintermediation” or “imputed interest,” it might seem like investing is a thing only for those who have specialised knowledge.

Thankfully, there are a ton of investing trading platforms designed to make investing more accessible to the average Joe.

eToro and Trading 212 are two very popular investment services in Europe and have exploded in popularity in recent years. Whereas eToto specializes in “social trading” and hopping on trends, Trading 212 focuses on commission-free investing with robo-advisor components.

We’ve put together this comparison article to discuss eToro and Trading 212, their pros and cons, and which trading platform is the best for which type of investor.

We’ll give a quick overview of each platform individually, and then move on to comparing the two trading platforms on a number of features and metrics.

eToro Overview

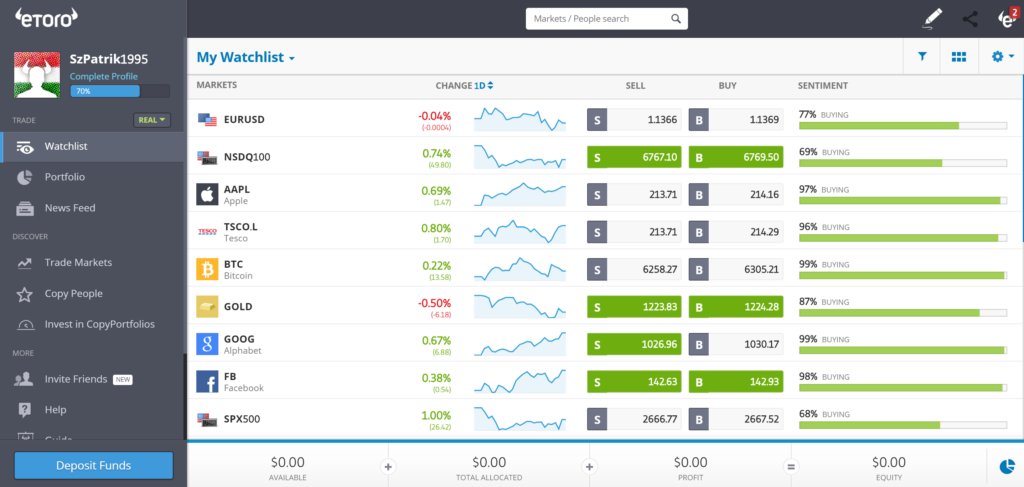

eToro is a relatively new trading service that specializes in cryptocurrency exchange and a feature which is known as “social trading”.

eToro is an Israeli-based brokerage firm that is regulated by the Financial Conduct Authority (FCA), and has become known for its cryptocurrency trading platform.

It was originally focused on foreign exchange of currency but has recently retooled its interface to handle the risky market of cryptocurrency trading.

We should probably put this risk warning here though: Cryptocurrency trading is extremely risky.

In fact, about 75% of investor accounts lose money when trading CFDs on eToro. As such, eToro is probably a better choice for investors who already have some experience navigating forex markets and who know a thing or two about cryptocurrencies.

For investors based in the UK, you can also trade stocks, commodities, and other derivative assets like contracts and differences.

eToro’s main feature is its “social trading” function. This feature allows you to essentially copy the market movements of highly rated traders on the platform.

You can look for highly-rated traders that have a history of good returns and copy their portfolio spreads with the goal of capitalizing on their insights.

The platform allows you to adjust your investment strategy in tandem in real-time.

Keep in mind that eToro is not currently authorized for any other kind of trading except cryptocurrency trading in the US. However, they plan to expand their asset repertoire in other regions by the end of the year or the beginning of next year.

If you live in the UK, you can trade from nine asset classes including stocks, commodities, forex, CFDs, indices, ETFs, and cryptocurrencies.

eToro also has a neat virtual trading feature which lets you basically open a demo account to try out the platform before you actually commit and start putting in real money. The demo account is a practice account so you can get a feel for the platform.

eToro definitely has a unique focus with its emphasis on crypto and social trading. They also recently crypto wallets that let you buy/sell cryptos, convert them, and pay for goods and services like you would with a regular wallet.

eToro does not charge a commission on regular trades but it does charge a “spread fee” on crypto trades. Exact fees are subject to market conditions and change fairly frequently, so make sure you check back for updates regularly.

Trading 212 Overview

Trading 212 is a London-based trading platform that aims to make trading more accessible to the average person.

To that end, Trading 212 is designed for beginners to help them get a handle on the investing world and experience.

The company was founded in 2006 and allows trading for forex, currencies, gold, commodities, cryptos, stocks, and other asset classes like bonds and ETFs. Trading212 obtained its UK license in 2013 and is authorized and regulated by the FCA.

Compared to many other trading platforms designed for beginners, Trading 212 has a lot of uncommon asset classes. Whereas most beginner platforms focus mostly on stocks and ETFs, Trading 212 also gives access to more unconventional assets like commodities and currencies.

Their tradable assets include selections from the most popular exchanges in the world including the NYSE, NASDAQ, Euronext, and London Stock Exchange. Trading 212 has over 4,000 commission-free stocks and ETFs and also allows for fractional trading of assets.

For UK investors, Trading 212 allows for tax-advantaged accounts like ISAs and tax-free trading up to certain amounts. You can even set up automatic dividend reinvestment.

One of the best features of Trading 212 is its interface.

While searching for assets, you can click on the listing to get a detailed description of its trading and return history. You can superimpose technical indicators like moving average and the like if you want to get a more nuanced view.

On the right-hand side of the trading wizard is a useful column full of information videos and tips about investing.

If you are not yet convinced, you can open a demo account on Trading 212 so you can get a feel for the platform.

Like eToro, the demo account for Trading 212 is basically a simulation where you play with fake currency to see how your investments would have fared. When you want to actually trade, you only need £1 to get started.

Additionally, if you want to learn a bit more about investing, Trading212 has a high library of educational resources focused on topics in investing.

You can read articles and watch videos about general topics, as well as more in-depth analysis of entire industries or sectors.

eToro vs Trading212

Ease of Use

When it comes to ease of use, Trading212 completely blows eToro out of the water.

This makes sense after all; Trading212 is designed to be very beginner-friendly while eToro has a specific focus in a particular niche that only experienced investors should throw themselves headfirst into.

Trading212 stands apart thanks to its extremely intuitive interface and a high degree of presented information.

Every stocks listing has a module that shows in-depth historical information and market movements over the historical timeline of that asset and you can apply simple technical indicators to get more info.

There is also a ton of educational resources on the app that you can look at if you get stuck or need to brush up on your fundamentals of investing.

That is not to say that eToro has a bad app interface; quite the opposite actually. eToro has a really good app interface for what it is doing.

It’s just that when it comes to sheer ease-of-use from a layman’s perspective, most people will be able to pick up and run with Trading212’s app much quicker than with eToro.

eToro’s focus is all about crypto trading and crypto CFDs, which are notorious for being fairly complex investment vehicles.

Available Investments

As far as what kinds of assets you can trade, both platforms seem to be evenly matched.

eToro is focused specifically on crypto investing, but it also has a lot of other asset classes that you can trade commission-free (that is, if you live in the UK. US investors only get crypto investing for now).

Trading212 bucks the trend by being a beginner-friendly platform that offers a wide range of so-called “unconventional” assets like commodities and currency, things which you normally do not find on beginner-oriented platforms.

However, if we are just going by sheer numbers of assets available, then Trading212 takes the cake.

It has over 4,000 available stocks and ETFs that are listed on some of the world’s largest and most lucrative exchanges. eToro, in comparison, only offers available stocks from about 250 global companies and funds from about 10 available indices.

Again, this is not necessarily a bad thing about eToro as it is designed for something very specific; crypto investing and copy trading.

However, if you are concerned with having the most possible investment choices, then Trading212 should be your first choice.

Fees

Both eToro (full review here) and Trading212 offer commission-free trades on things like stocks and ETFs. However, eToro charges what is called a “spread fee” on crypto trades which basically amounts to an extra capital gains tax when you calculate everything out.

eToro also has “overnight” fees for cryptos that you hold in leverage, which essentially comes out as an interest charge.

eToro also requires a £200 minimum deposit to get started, whereas, with Trading212, you can get started with a minimum deposit of little as £1.

Trading212 does not charge trading fees, withdrawal fee, or deposit fees. They do, however, have currency conversion charges for CFD accounts.

Lastly, they also have some fees related to margin requirements for commodities and indices. However, they do not charge any trading fees for ISAs and there are no inactivity fees. eToro, in contrast, charges a £10 per month inactivity fee if your account has been dormant for 4 months.

So overall, Trading212 comes out on top when it comes to which platform has fewer fees.

Commission-free regular day trades and no inactivity fees, as well as a lack of fees on crypto trades, are a great asset (pun intended) to the platform.

Support and Education

Both eToro and Trading212 have a large library full of videos and articles about trading and investing.

Even better, both platforms let you peruse the materials even if you do not have a trading account open with them.

However, Trading212 also has access to a traders forum where you can connect to the community and ask questions and get tips about investing. eToro does not seem to have any similar functions.

Trading212 also has more videos, webinars, and trading guides built specifically to help you make a trading strategy.

In many ways, this is not that surprising because, again, Trading212 is designed for newbies who want to get their feet wet.

So if you are an experienced investor, then an educational library is probably not very high up on your list of desired features.

Both eToro and Trading212 have reportedly great customer service. If you look at testimonials for both platforms, one recurring theme is how friendly and knowledgeable the customer service representatives are.

So it’s good to know that no matter which platform you consider you will get all the assistance of a knowledgeable and professional support team.

So, eToro vs Trading 212: Which Platform Do We Recommend?

It depends on what exactly you want from a trading platform, but we would say that all other things being equal, you should go with Trading212.

Trading212 just has more broad appeal and would probably be a better fit for most people who are interested in investing. The simplified layouts, great resources, small minimum deposit, and surprisingly diverse asset classes and portfolio allocations are all reasons we favour the platform.

That is not to say that eToro is a bad platform by any means; it just might be too restrictive and complex for the average person who wants to get into investing.

The main problems with eToro are its complex fee structure, relatively restricted investment selections, and high-risk profile.

Like we said earlier, nearly 75% of investor accounts lose money when trading CFDs on eToro. That is a pretty high margin of loss, even for a platform that specializes in crypto trading.

So unless you are willing to take the high risk, we recommend picking something other than eToro.

Conclusions

Online investing platforms abound in this day and age, and it can be hard to figure out which one works best for you.

If you are a beginner investor, then you should be looking for a platform that streamlines a lot of the traditionally complex features of investing like fee structures and making trades.

When it comes to eToro vs Trading212, both platforms have their advantages and disadvantages, but for the average investor, Trading212 is probably the best choice.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

Very well researched article. Having used both of them I cant agree more on the content. Trading 212 is unparalleled as of May 2021. Only drawback is they don’t offer Crypto trading.

I think we can directly deposit and purchase in base location currency( example Euro) in 212 . Whereas in etoro deposit amount is getting converted into dollar and again while withdraw conversion would happen(ex. dollar to euro). THis is one of the down side of eToro.

So 212 is worth considering !