If you’re investing in 2020, there is an essentially unlimited amount of information online to help you optimise your portfolio. Once you’re up and running, the projections, data, and charts can become so addictive that you end up spending way more time than anticipated tracking your investments.

If you’re going to do something, might as well do it as well as you can, right?

For UK-based investors spending a lot of time and money in stocks, bonds, cryptocurrencies and more, there are a lot of different services designed to help track your portfolio. To help you separate the wheat from the chaff, we go into detail about six of the UK’s best online portfolio trackers.

Google Finance

If you google “best portfolio trackers in the UK,” then Google Finance will probably show up as one of the top results. Naturally, this is because you are using Google’s Search Engine, however their Finance Platform is actually one of the most user friendly ways to look at market performances. Although it lacks some of the complicated features of other portfolio trackers, Google Finance is a great way to receive quick performance snapshots.

Let’s start with the layout. Simple is good, and Google is aware of that. The Google Finance homepage contains an intuitive search bar at the top, tabs to explore different markets, and simple displays with news stories and currency rates.

The platform is divided into the home page, world markets, local markets, and “Your Stocks,” which allows users to track the performance of specific stocks prices.

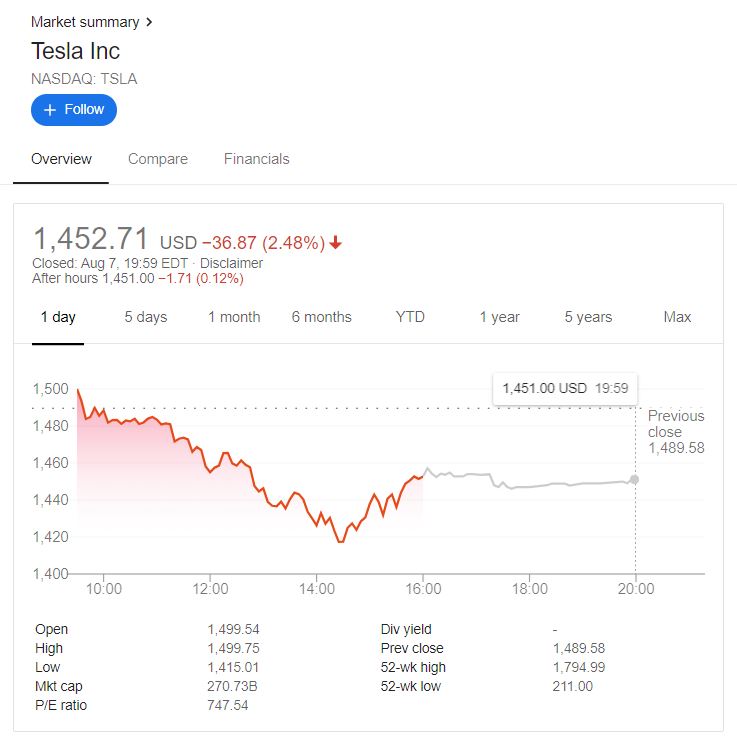

Finding out a lot of information and tracking specific stock performance is easy with Google Finance. To start, simply type your stock into the search bar. From here, click on your company and the market summary page will load. Google allows you to see stock price fluctuations over a 1 day, 5 day, 1 month, 6 month, YTD, 1 year, 5 year, or maximum time frame.

Beyond that, you can see the company’s public quarterly financials such as revenue, net income, diluted EPS, net profit margin, operating income, net change in cash, cash on hand, and cost of revenue.

One of the best features of Google Finance is how easy it is to compare and track the stocks that you are most interested in.

If you are on a company’s profile, simple click “compare,” and then find the other stock you are interested in. Here, the company’s stock prices will display as lines on the same graph over a time period of a 3 month minimum. Google also provides a quick comparison chart between the two companies with aspects such as market cap, number of employees, P/E ratio, and dividend yield.

Yahoo Finance

“Yahoo!” and “finance” have been intertwined since basically the dawn of the internet. With that in mind, experienced investment managers may know all too well that Yahoo Finance Portfolios are one of the best ways to track your stock performances.

Unlike Google, Yahoo offers portfolio tracking that can be as complicated as you would like it to be. The veteran digital platform has so much data and capability that it could even suffice for one of today’s savviest investors.

Specifically, Yahoo Finance was launched in 1994 and has stayed true to its commitment in being one of the internet’s leading voices for finance news. Beyond the headlines, the company has also developed many great tools and features on their website to help private investors make educated decisions on stock performances.

Below the search engine, Yahoo has an impressive amount of navigational options. This gives visitors the chance to see their tracked portfolios, explore market data, read news stories on specific industries, or even head to dedicated sections for Brexit.

Yahoo Finance’s real advantages are showcased when looking at a single stock’s individual market page. The system is extremely easy to navigate and is packed to the brim with data, company information, financials, analysis, and projections. For you impact investors out there, there is even a tab that measures the company’s environment, social and governance (ESG) risk ratings affecting sustainability!

Although it is not incredibly easy to compare two stocks at once, the amount of detail that can be displayed at any time on Yahoo Finance is just downright impressive. Beyond stocks, the platform is also a hub for currencies, cryptocurrencies, and personal finance. Ultimately, when you are searching for anything financial online, heading to Yahoo Finance will help you get the answer.

Bloomberg

As one of the largest organizations in New York City, Bloomberg is officially “a privately held financial, software, data, and media company.” More than anything, the name Bloomberg is synonymous with delivering business and financial news around the world. Most of the content on Bloomberg’s site is free for a limited amount of time, however unlimited access can be purchased with a subscription.

The company’s website, which draws tens of millions of readers monthly, has dedicated sections for learning more about Bloomberg itself, as well as its countless media ventures and industry products. As the biggest name in the industry, you’d expect to see some pretty detailed stock information, right?

Well, not exactly. Of course Bloomberg makes it easy to look at some basic stock information, and if that’s all you need — then great. The Watchlist is a great place to look at individual stocks as well as market trends. Simply search for your company and boom, there are data and charts for price, key statistics and quick comparisons. If you sign up for a Bloomberg account, then you will be able to track different stocks individually.

Beyond that, Bloomberg does not offer any specific stock advice, trends, or projections for free on their website. Instead, users looking to do a little more than just track a few stocks can consider paying for the Bloomberg Terminal. What originated as a specifically designed computer is now a paid software available for PC and mobile devices. By using the company’s premium software, investors are given a wealth of additional information about the markets and their stocks.

So clearly, some may think that Bloomberg may be primarily interested in getting your money, rather than help you track your investments. However, the company has grown for decades with an enormous amount of happy customers paying for the industry’s best information.

Genuine Impact

Although it does have a web browser version, Genuine Impact is perhaps the best digital portfolio tracker built for mobile devices. To get started, you can download the Genuine Impact app for free from either the Google Play or Apple Store.

Unlike most of the other platforms on this list that have ties to enormous organizations, Genuine impact is a lean, mean, investing machine that touts its popularity on Product Hunt. Oh yeah, and it was built in 2020! That’s right, as a response to the economic effects of the coronavirus, genuine impact was created.

It’s tough to project what may happen with this young company, which was created during one of the largest economic downturns in the century. However, the company’s founders have been very vocal on their mission to “help you go beyond your potential as an investor.”

In the same comment on the Product Hunt page, founder Truman Du introduced features like portfolio management, curated stock options, and investment analysis. The app was crowdfunded and shows serious promise for first-time and experienced investors trying to navigate in the wake of a global health pandemic.

Investopedia

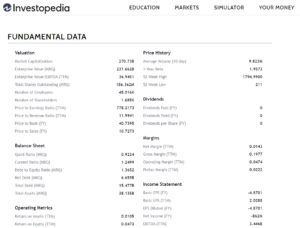

Investopedia is a vast digital resource for any and every financial question. The website has a wealth of helpful articles and even a stock market simulator. When it comes to tracking stocks, the website’s Markets Today page is one of the most attractive and informative ways to watch your money grow.

The homepage is filled with what you might expect: major market prices, trends, and news. Though once you dive deeper into your individual stocks, this is where Investopedia becomes endlessly fascinating.

Once you dive deeper into your individual stocks, this is where Investopedia becomes endlessly fascinating.

From the search bar, type in any company name and head to their dedicated product page. Here, your screen will fill with the stock price chart that can be tracked down to each specific minute. From there, you can easily compare other company data, run advanced scripts, and even customize the type of chart that the stock prices are displayed.

Of course, all of this interactive capability is built upon a detailed company description with key financial data. What Investopedia lacks, however, is the ability to track your stocks. Aside from bookmarking company pages, there is no real way to utilize the website as a “one stop shop” for easy portfolio tracking.

Atom Finance

Lastly, we would like to introduce you to Atom Finance. For those who are unfamiliar, Atom Finance is a new app that lets you see advanced market data, completely free of charge. The New York-based company has raised millions of dollars in funding, allowing it to grow its team and develop the product.

Right away, Atom gained a lot of popularity. Since 2019, hundreds of thousands of users have taken to the Atom Finance App to use its advanced features. The free app has a tonne of information on individual company trends, data, and projects. It is easy to compare different companies and synchronise portfolio options.

Currently, there is a waitlist for the company’s forthcoming Atom+. What is almost certainly a premium feature, Atom+ is slated to deliver real-time commentary on market price fluctuation and trends. As certainly an interesting product, it is one to look out for in the future.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024