Managing money effectively is crucial for financial well-being, and with the advent of digital technology, money management apps have become indispensable tools. Whether you’re looking to track your expenses, save for a goal, or manage shared finances with your partner, there’s an app out there to meet your needs. Here, we review the top 8 money management apps in the UK for 2025, helping you choose the best one to achieve your financial goals.

How Do Money Management Apps Work?

Money management apps are pretty simple. You download the app on your mobile device and connect your financial accounts.

The app will then track all your purchases and divide them into categories like housing, travel, food, and more.

Most apps will let you create custom categories for your purchases so you can get even more fine-grained details into your spending habits.

The best part of a budget app is that everything is automated. You do not have to manually record your purchase and sort them into categories. You can also have all your accounts in one place so it’s easy to keep track of bank accounts and credit cards.

Simply put, finance apps are a simple and effective way to keep track of your budget and find ways to save money.

Are Finance Apps Free?

Yes, most finance and money management apps are free to download and use the basic feature.

Most apps also have premium services you can pay for that open up more advanced features like credit checks, extra budgeting options, and financial advice columns and articles. However, for the most part, you will not have to pay to download and use a budgeting app. Some budgeting apps make their money through affiliate links. They will offer your specific third party products based on your spending habits and financial history.

For example, an app might offer a credit card or personal loan tailored to your specific profile details. Most major finance apps are available for download on the Google Play Store or Apple Store. Thanks to advances in smartphone technology and the introduction of open banking, there has been an explosion in the popularity and availability of budgeting apps.

Best Budgeting Money Management Apps in the UK

Here is our hand-picked selection of the best budgeting apps in the UK.

There are several more apps available than just these, but we determined that these are the top choices for the average person and couple.

1. Lumio: Money Management for Couples

Overview

Lumio is the leading money management app for couples. It specialises in providing both a Private Space for personal finances and a Shared Space for joint finances, making it ideal for couples who want to maintain some financial independence while managing shared expenses effectively.

Key Features

- Private and Shared Spaces: Offers separate spaces for personal and shared finances.

- FCA Authorisation: Lumio operates as an agent of a fully authorized FCA agent, ensuring peace of mind regarding financial security. You can check their authorization here.

- Easy Setup: Getting started with Lumio is straightforward and free.

- Comprehensive Account Connections: Connect any bank, savings, credit card, investment account, or even manually add offline accounts. Lumio supports over 150+ account connections and is trusted by over 250,000 users in the UK.

- Bill and Subscription Management: Automatically identifies and categorizes bills and subscriptions. Shared bills can be split, and Lumio notifies you of upcoming payments, changes in bill amounts, and payment statuses.

- Automated Transaction Categorization: Makes sharing transactions with your partner faster and more automated than apps like Splitwise.

- Net Worth Tracking: Track your net worth in real-time, whether it’s your personal net worth or combined with your partner’s.

- I Owe You Tracker: Helps couples keep tabs on who owes whom and how much.

Pricing

- Individual Pro: £3 per month or £26.99 annually.

- Couples Pro: £4.50 per month or £39.99 annually.

Ideal For

Couples who are just moving in together, saving for a wedding, getting married, or simply sharing bills and expenses. Lumio provides a tailored solution for any couple looking to manage their finances effectively.

For more information, visit the Lumio website.

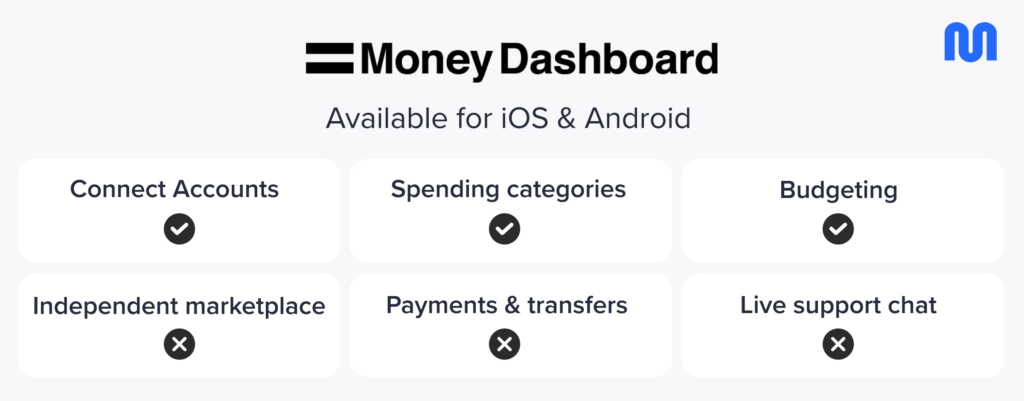

2. Money Dashboard – Now defunct 😢

First up on our list is Money Dashboard. Money Dashboard was founded in Edinburgh and currently boasts about 600,000 users, making it one of the most popular budgeting apps in the UK.

Overview

Money Dashboard is a powerful personal finance app that helps you budget, track your spending, and manage your money efficiently. It offers a detailed view of your finances, with intuitive tools for budgeting and financial planning.

Key Features

- Budgeting Tools: Create and manage budgets with ease.

- Spending Analysis: Provides detailed insights into your spending patterns.

- Account Aggregation: Connects multiple bank accounts for a unified view of your finances.

- Savings Goals: Helps you set and achieve savings goals.

Pricing

- Free: All features are available for free.

Ideal For

Individuals who need robust budgeting tools and detailed financial analysis.

For more information, visit the Money Dashboard website.

3. Emma

Overview

Emma is a popular money management app designed to help you track your spending, manage subscriptions, and save money. It provides a clear overview of your finances, helping you make better financial decisions.

Key Features

- Spending Tracker: Categorizes your expenses and provides insights into your spending habits.

- Subscription Management: Identifies and tracks your subscriptions, helping you avoid unwanted charges.

- Bank Connections: Supports connections with multiple bank accounts.

- Savings Goals: Allows you to set and track savings goals.

Pricing

- Free Version: Basic features.

- Emma Pro: £4.99 per month or £41.99 annually, offering advanced features like custom categories and data export.

Ideal For

Individuals looking for a comprehensive tool to track their spending and manage subscriptions.

For more information, visit the Emma website.

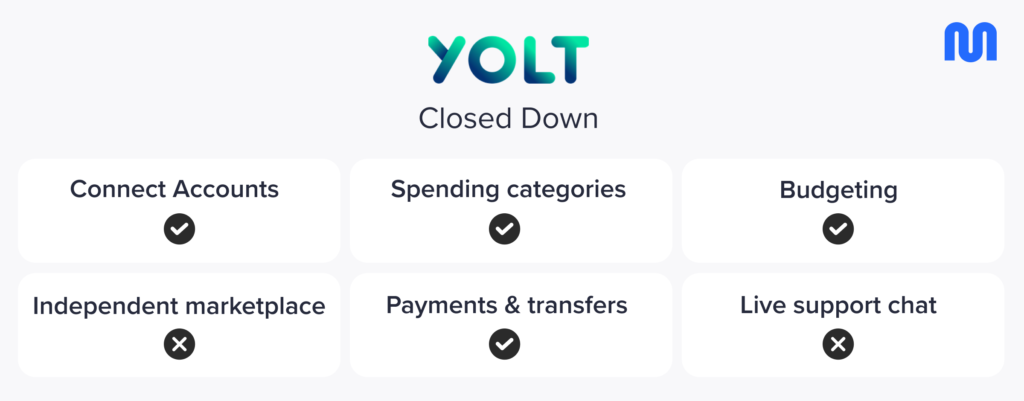

4. Yolt – Now closed (I know, another one!)

In 4th place is Yolt, which first opened in 2016 in Amsterdam. Yolt has been able to take full advantage of open banking and lets you look at all your financial information safely and securely.

Overview

Yolt is a smart money management app that helps you take control of your finances by providing insights into your spending and savings. It aggregates all your financial accounts in one place, making it easier to manage your money.

Key Features

- Account Aggregation: Connects multiple accounts for a comprehensive financial overview.

- Spending Insights: Tracks and categorizes your spending.

- Savings Goals: Allows you to set and track your savings targets.

- Daily Budget: Helps you manage your daily expenses.

Pricing

- Free: Offers all essential features for free.

Ideal For

Individuals looking for an easy-to-use app to manage their daily finances and track savings goals.

For more information, visit the Yolt website.

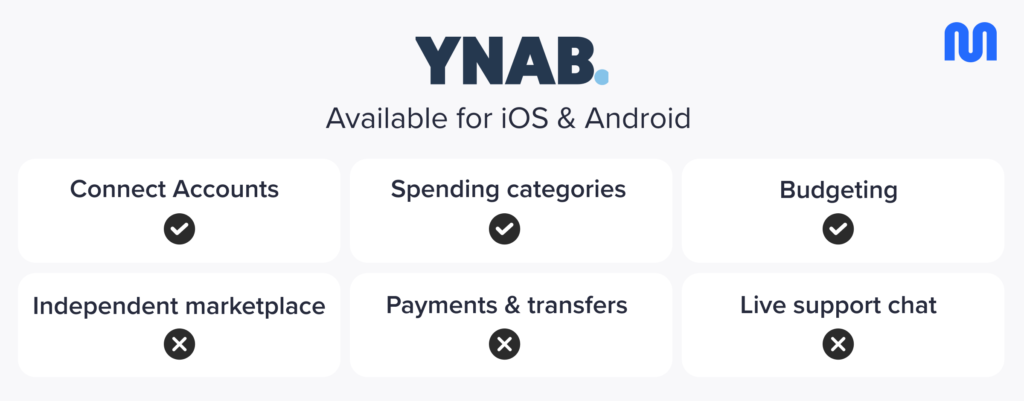

5. YNAB

YNAB is short for “You Need a Budget” and this name tells you pretty much everything you need to know about the app.

YNAB is a personal finance app that lets you manage your funds without having to provide years of historical data. It promises to help you pay off debt, save money, and create a budget to optimize your spending habits.

YNAB is a bit different than other finance apps available because it is not based on past spending. Instead, it continuously updates a prospective budget in real-time based on your current account balance and how they change over time.

This is a good feature because you do not actually need to connect all of your accounts to get results. You can also track your investments to get projected investment returns.

In addition to the budgeting features, YNAB also has a lot of educational resources to browse. It has several guides including guides on how to set a long-term budget and how to deal with your debt.

The overarching goal of the app is to smooth your budget by making you make less frequent purchases and allocating your funds responsibly through its real-time updates.

6. Snoop

Overview

Snoop is an innovative money management app that provides personalized insights and tips to help you save money. It analyzes your spending and identifies opportunities for savings, making it a unique tool for managing your finances.

Key Features

- Spending Insights: Analyzes your spending habits and provides personalized tips.

- Savings Opportunities: Identifies ways to save on bills and subscriptions.

- Account Connections: Connects with various financial accounts for a comprehensive view.

- Regular Updates: Provides regular updates and notifications to help you stay on top of your finances.

Pricing

- Free: Core features are available for free.

- Snoop Plus: £3.99 per month or £35.99 annually, offering enhanced features.

Ideal For

Individuals who want personalized tips and insights to save money.

For more information, visit the Snoop website.

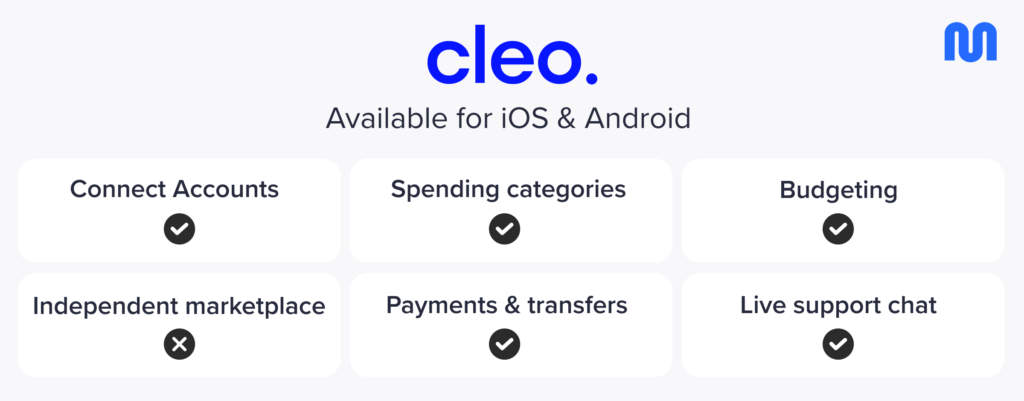

7. Cleo (Mainly US – Not UK)

Overview

Cleo is an AI-powered money management app that helps you budget, save, and manage your finances through an interactive chatbot interface. It offers a fun and engaging way to take control of your money.

Key Features

- Chatbot Interface: Interact with Cleo through a chatbot for financial advice and insights.

- Budgeting Tools: Helps you set and stick to budgets.

- Savings Challenges: Encourages savings through fun challenges.

- Spending Insights: Provides detailed insights into your spending habits.

Pricing

- Free Version: Basic features.

- Cleo+: £5.99 per month, offering advanced features like cashback and salary advances.

Ideal For

Younger users who prefer an interactive and engaging approach to money management.

For more information, visit the Cleo website.

8. Plum

Overview

Plum is a money management and investment app that helps you save automatically, invest effortlessly, and manage your finances. It uses AI to analyze your spending and save money on your behalf.

Key Features

- Automatic Savings: Analyzes your spending and saves money automatically.

- Investment Options: Offers various investment opportunities.

- Spending Analysis: Tracks and categorizes your spending.

- Bill Negotiation: Helps you find better deals on bills and subscriptions.

Pricing

- Free Version: Basic features.

- Plum Plus: £1 per month for investment features.

- Plum Pro: £2.99 per month for additional features.

Ideal For

Individuals looking for an app that combines money management with automatic savings and investment options.

For more information, visit the Plum website.

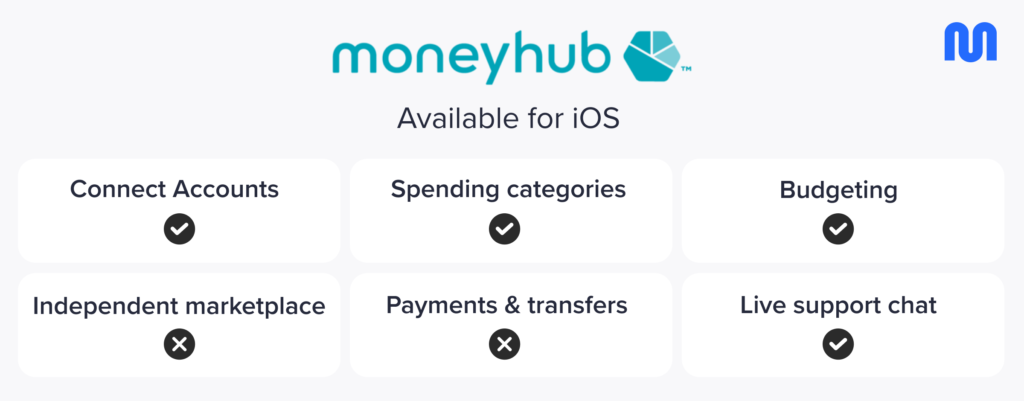

9. MoneyHub

Moneyhub is a comprehensive money management app that helps you budget, save, and manage your finances. It provides detailed insights into your spending and helps you make better financial decisions.

Key Features

- Account Aggregation: Connects multiple financial accounts for a unified view.

- Spending Analysis: Provides detailed insights into your spending habits.

- Budgeting Tools: Helps you create and manage budgets.

- Savings Goals: Allows you to set and track savings targets.

Pricing

- Free Trial: Available.

- Subscription: £0.99 per month or £9.99 annually.

Ideal For

Individuals who need a robust and detailed financial management tool.

For more information, visit the Moneyhub website.

Conclusion

Choosing the right money management app can significantly impact your financial health. Each of the apps reviewed here offers unique features and benefits tailored to different needs. Lumio stands out as the best app for couples, providing specialized tools for managing both personal and shared finances. Emma, Money Dashboard, and Yolt offer comprehensive solutions for individuals looking to track spending and save money, while Snoop, Cleo, Plum, and Moneyhub provide innovative approaches to managing finances.

By leveraging these tools, you can gain better control over your money, achieve your financial goals, and ensure a more secure financial future. Be sure to explore each app’s features and pricing to find the one that best fits your needs and preferences.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

2 Comments