Investing can be seen as more than just a method to make money but a way to enact positive change in the world. In fact, investing is possibly one of the easiest and most direct ways that you can contribute to causes that aim to make positive changes in the world.

Fortunately, there are several platforms that have popped up that are dedicated to helping investors put their money to work in the most positive way possible.

These ‘ethical’ investment platforms emphasize socially responsible investing and specialize in investing in companies that follow certain guidelines meant to enact positive change.

Areas of interest to socially responsible investors might include things like

- Climate change

- Sustainable agriculture

- Gender equality

In this article, we’ll go over 4 contenders for the best ethical investing apps to add to your financial tool kit. After that, we’ll also discuss whether ethical investing is, in fact, actually profitable, and go over the pros and cons in detail so you can make an informed decision.

P.S. Also consider checking out our guide on the best ethical banks in the UK.

4 Best Ethical Investing Apps

Wealthsimple

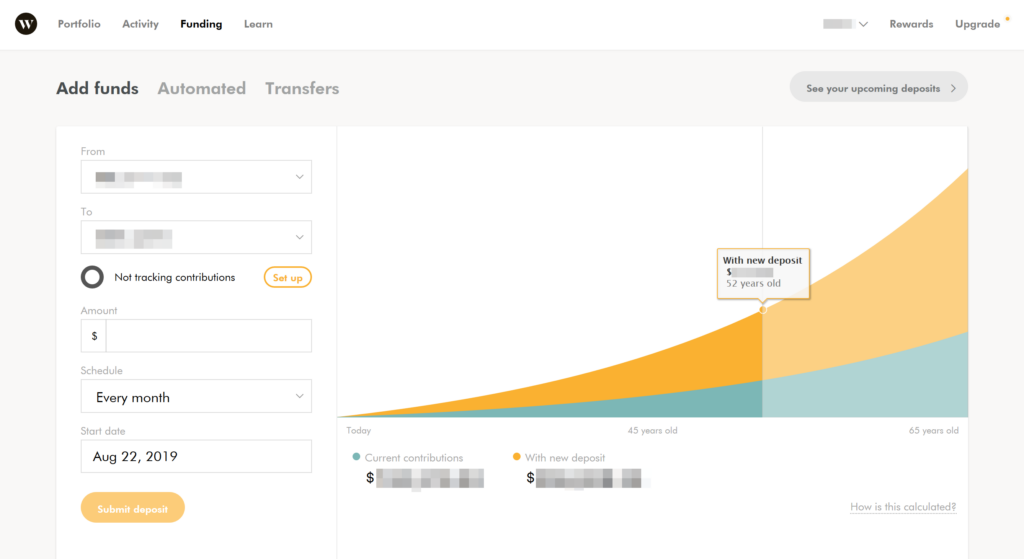

Wealthsimple is an extremely popular investment app in the UK that has received praise and accolades for its socially responsible investment portfolio.

It is a robo adviser brokerage based out of Canada that specialises in low-cost ETFs and automatic rebalancing. Like any good robo adviser, with Wealthsimple, you can set portfolio allocations to whatever you want and the algorithm will automatically buy/sell assets to maintain those allocations as market conditions change.

Wealthsimple’s socially responsible investment portfolio (SRI) is built on a few key principles and selection criteria.

The Wealthsimple SRI automatically excludes shares from “controversial” companies and excludes the top 25% carbon emitters in each industry. Also, at least 25% of all funds in the portfolio must come from companies with at least 3 women on the board of directors.

Wealthsimple’s SRI portfolio contains a diverse mixture of stocks, bonds, and commodities. All domestic and international stocks are screened to exclude fossil fuels, tobacco, weapons, and other controversial industries like pornography and alcohol.

The Wealthsimple SRI also has a sizable allocation in short-term corporate bonds to diversify assets and government bonds to hedge against falling growth rates. The SRI portfolio also invests a portion into physical gold as a hedge against inflation.

Examples of the kinds of industries that are included in the equities portion include aerospace, clean energy, logistics, electric cars, alternative agriculture, and much more.

Moreover, Wealthsimple is also just a good platform for investing and has received a lot of praise from the investor community. The robo adviser design is user-friendly and a good choice for someone new to investing.

Check out our full review of Wealthsimple here.

tickr

tickr (yes, that is a lowercase “t”) is an investment platform that is explicitly designed to promote socially conscious and ethical investing.

It describes itself as an impact investing app and was originally founded by Matt Latham and Tom McGillycuddy with the goal of making socially responsible investing straightforward and streamlined. tickr was founded in 2019 and has since built up a loyal following and growing online presence.

tickr’s main focus is giving a low-cost way to invest in socially responsible enterprises.

tickr portfolios are focused on things like sustainable energy, environmental conservation, green development, and more.

The actual portfolios are composed of ETFs and structure according to themes. The 4 available themes are:

- Climate change

- Equality

- Disruptive tech

- Combination portfolios

These funds are managed by tickr’s team of expert investors and carry a mixture of global equities, corporate/government bonds, and more. tickr has a £5 minimum investment and there is no limit for general investment accounts (GIAs). tickr also has options for ISAs which have the standard annual deposit limit of £20,000.

tickr is still a relatively small company but they are growing rapidly. To date, they have raised over £2.5 million in external financing, but we could not find any reliable information about the total assets under management (AUM). Suffice to say though, tickr is a good option if you want a twist on socially responsible investing.

Want to dive deeper into tickr? Check out our full tickr review here.

Wealthify

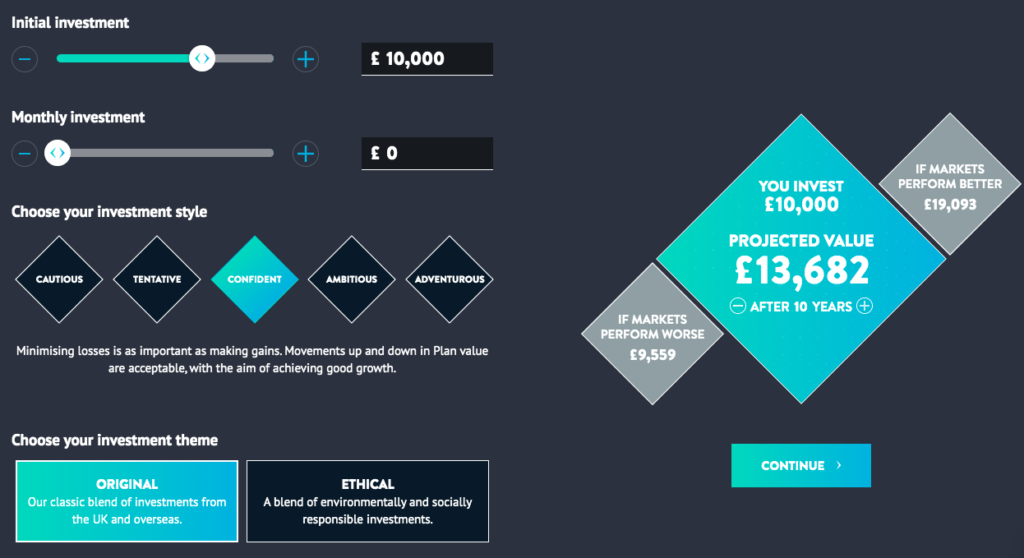

Wealthify offers a range of ethical investment portfolios with the classic robo adviser rebalancing functionality. Through Wealthify, you can invest in funds that are signatories of the Principles of Responsible Investing (PRI) and actively managed to have the greatest positive impact.

Like many other ethical investment platforms, Wealthify excludes industries that are considered controversial or harmful to the environment, such as tobacco, deforestation, and companies that are known to have unfair labour practices.

Wealthify ethical investment portfolios are built out of a range of mutual funds and ETFs. All ETFs contain a mixture of corporate bonds, government bonds, domestic stocks, and foreign stocks.

The 5 ethical plans are divided based on the amount of exposure they give you and include: cautious, tentative, confident, ambitious, and adventurous. As you go up the list, the allocation is riskier and puts more exposure in stocks and shares rather than bonds and fixed-income investments.

In addition to the robo adviser services, Wealthify has a team of experts that are constantly looking out for more ethical funds to add to their list. Wealthify will also continuously analyse the makeup of portfolios to make sure that companies that are represented are in fact sticking to ethical practices.

It is very easy to activate the ethical portfolio function on the app – just tick the box when looking at your portfolio.

Want to dive deeper into Wealthify? Check out our full Wealthify review here.

Nutmeg

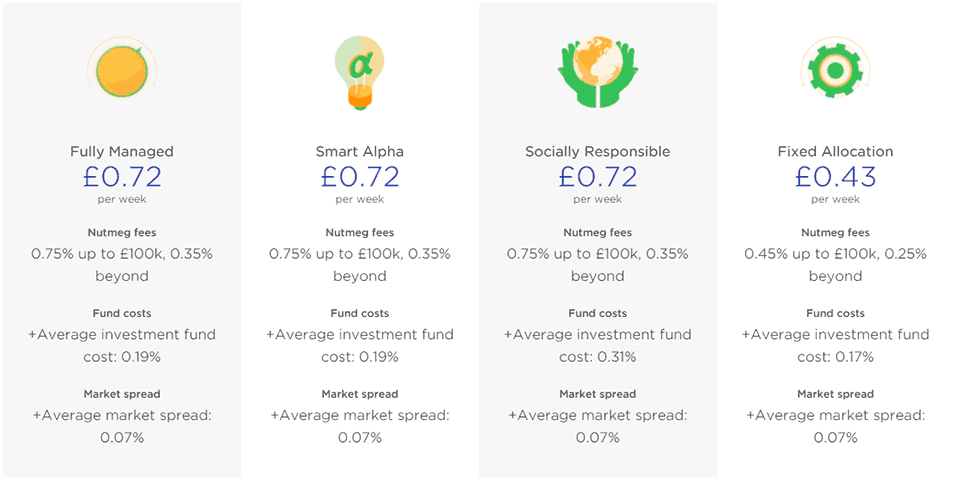

Nutmeg is another online robo adviser that offers a socially responsible investment portfolio along with its normal robo adviser services. Its socially responsible portfolios are designed to incorporate companies that have high ESG standards and avoid controversial activities.

All of Nutmeg’s portfolios are expertly managed and monitored to make sure that all represented companies maintain their ethical practices and outlooks.

Nutmeg’s ethically responsible portfolios are determined by the company’s selection criteria. Nutmeg looks at each company’s carbon footprint, employee conditions, and the number of independent directors on the board, among other issues.

Their team of vetting experts also scores investments based on their track records in concepts of environmental, social, and governance. Nutmeg excludes companies that are involved in gambling, alcohol, genetic modifications, and tobacco.

Nutmeg also allows you to pick risk levels between 1 to 10 where each has a different asset allocation. Lower levels emphasize bonds and other fixed-income investments while the riskier investment allocations have more exposure to domestic and foreign equities.

Nutmeg also has a very simple fee structure and charges a 0.75% annual management fee and a 0.35% fee when you invest more than £100,000 in the platform.

So, Is Socially Responsible Investing Profitable?

The good news is that yes, socially responsible or ethical investing is at least as effective at generating returns as traditional investing without a focus on ethical dimensions of analysis.

This initially might seem counterintuitive. After all, wouldn’t emphasizing ethical and sustainable practices ultimately mean you would have to sacrifice some profit?

As it turns out, the answer is no.

According to a widely circulated 2015 study performed by economists at Oxford University, environmental, social, and governance (GSE) investing is just as effective and even possibly more effective as traditional investing.

The study found that companies that incorporate “robust” sustainability initiatives operate more smoothly, which translates to higher cash flows.

The meta-analysis further suggests that incorporating sustainable practices can actually be better for investment returns, indicating that sustainability and profit are not mutually exclusive, but are in fact complementary.

So, despite intuitions to the contrary, there is no inherent contradiction between ethicality and profitability.

Pros and Cons of Ethical Investing

Pros

- Doing good in the world. The main pro of ethical investing is it allows you to put your money to work in the most positive way possible. If your values are important to you, then so should guiding your actions to have the most positive impact.

- Positive social effects. Investing in companies focused on things like affordable housing, sustainable agriculture, racial justice, gender equality, and the like all produce positive effects in our society and communities.

- Incentivizing ethical practice. By limiting investments to ethical companies, socially responsible investing has a selection effect that works to increase the proportion of socially conscious companies in the market. If more people want to ethically invest, then companies will fill that niche.

- Profitable. Despite what people might assume, ethical investing and profitability are not incompatible. A strategy of investing in companies that have positive social impacts can be just as profitable if not more profitable than a traditional investing strategy.

Cons

- More research. Socially responsible investing requires a fair amount of research over and above the basics like financial fundamentals and technical analysis. Platforms directed at ethically investing are meant to cut down the amount of research you have to do, but you still need to do some on your own.

- Ethics are subjective. What is and isn’t socially responsible will differ from person to person. For example, someone might want to invest in a company that promotes and supports traditional marriage values while others might think that such a company is doing something wrong.

- Can’t be a purist. Every company might have practices that you approve of and practices you disapprove of. If you want to be a moral purist, then you probably won’t be able to invest at all. So we recommend taking a more-or-less utilitarian approach to balancing company practices. Does the company do more good than bad and do the positives outweigh the negatives?

- Companies lie. We are not so naïve to believe that companies are always truthful about their practices. Companies often lie or obfuscate facts about their supply chains, sourcing methods, or employee conditions to avoid PR problems and responsibility for harmful effects. That is why it is so important to do diligent research on any potential companies.

Wrapping Up

Ethical investing is the new way to handle your money and an ethical investment platform can help you find investments that do some good.

Investment firms in the past did not really care about things like carbon emissions or environmental performance. Ethically responsible investing is a way to access the benefits of investment funds and put the money from those investments to good use.

There are several investment platforms to use that have ethical investment options along with low minimum investment, robo advisers, and a mission to improve positive factors on the earth.

So if you want to invest with a mission and want portfolio options that pick socially conscious investment niches, then these investor platforms are the best for ethical investing in the UK.

You can get good investment advice for putting your money in the hands of the right people.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024