Am I saving enough money? How much money do I need for retirement?

These are the questions about financial security that plague many of the minds across the United Kingdom. After all, earning money can be tough, and saving is even tougher because spending your money can be just plain easy.

Unfortunately, there is never truly one correct answer as to how much money is enough, because finances are always going to be different for each and every person.

Of course, a good way to compare yourself to get a good idea of where to start, you can look at those around you.

In this article, we’ve put together a comprehensive guide on UK saving statistics.

This information is intended to present a non-biased look at the financial savings among British residents. With this data, we intend to illustrate an overview and provide insights into the savings health of the modern UK citizen.

UK Savings Averages

As you spend your wages, it is very easy to watch every last pound from your paycheck head towards your home, credit card, and living expenses.

However, if you’d like to stop working and enjoy your retirement financially worry-free, then you’ll have to save some money along the way.

We’ve also included a handy Savings Goal Calculator below, should you wish to find out how much you need to save monthly to hit your targets!

How much does the average British person have in savings?

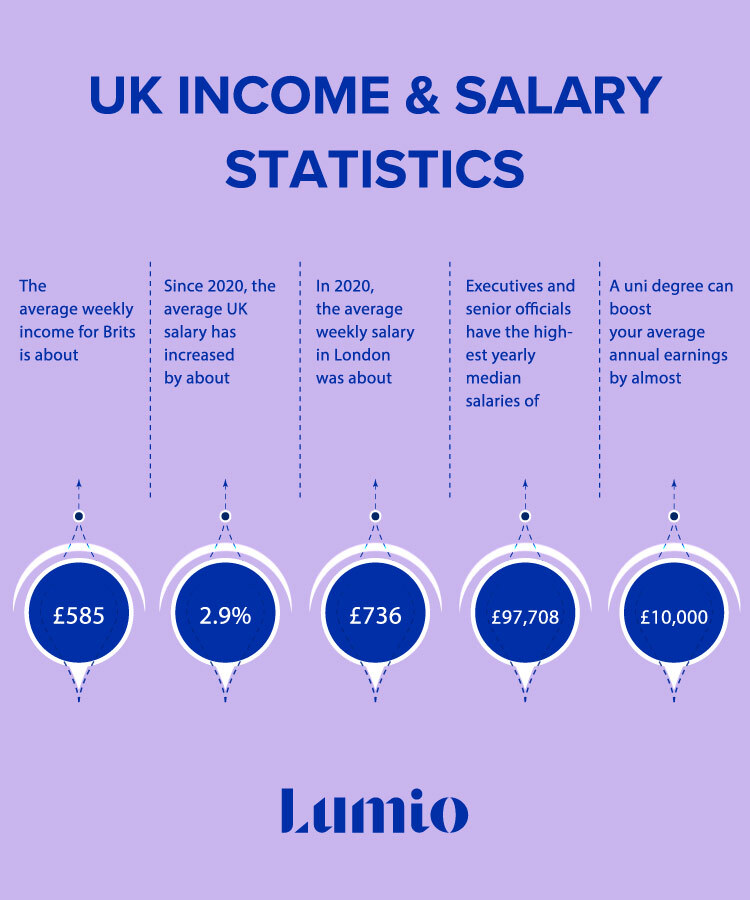

In 2023, the average resident of the UK has approximately £6,757 in financial savings. Although this amount is the average of all British adults, this figure still seems somewhat low when thinking of average UK living expenses.

In the event of an emergency, a large minority of the British population may actually be in a bit of trouble. In fact, about one-third of the adults living in Great Britain have savings less than £600 in 2020.

Beyond this, nearly one in every ten (9%) UK residents have no savings whatsoever. Although this is a bit tragic, there is light at the end of the tunnel. Shockingly, the state of the world in 2020 has actually led British people to pay off more of their debt than ever.

In March of 2020, the UK personal debt bubble shrank for the first time since 2013. This dramatic shift is the result of £3.8bn in credit card, mortgage, and personal loan debt that was paid off across Great Britain.

Perhaps with less money being spent on holidays and travel, more money is being saved than ever.

How much does an average British person save a month?

There are many ways to systematically save money, like stowing away a few pounds each week, month, or paycheck. Consistency is key when saving, so it is best done by setting goals or maintaining habits.

In the UK, the average Britsh person saves about £105.43 per month. Although this number varies dramatically across different income levels, on average, UK residents save about 8.21% of their monthly income.

Interestingly enough, there is a slight gender gap in monthly British savings. In a recent study, 55% of British men and 43% of British women consistently add money to a savings account each month.

Whereas this 11% difference is not that significant, what these percentages really showcase is a staggering half of the UK population without a monthly savings contribution.

Of course, age comes into play here as well. On average, people tend to save more as they get older, with those gearing up for retirement at age 55 or older saving the most each month.

What is the average retirement age for UK residents?

Currently, the average retirement age for UK residents is 65 years old. However, by the end of 2023, this number is expected to reach an average of 66. The average retirement age for UK residents is expected to rise to 68 by the year 2039 (at the latest).

As you may imagine, the older a person gets, the more they tend to have saved up for retirement. Even though life hits us all with unexpected events, statistically, most people are able to hold onto more and more money as they grow older and wiser.

In the UK, here are the average total savings by age group in 2023:

- Eighteen to twenty-four: £2,481.16

- Twenty-five to thirty-four: £3,544.16

- Thirty-five to forty-four: £5,995.92

- Fourty-five to fifty-four: £11,013.99

- Fifty-five and over: £20,028.60

What is the average retirement income in the UK?

Depending on your living expenses (and whether or not you’d like to flee the country for someplace cheaper), the amount of money required to safely retire is going to vary greatly for individuals across the UK.

With that in mind, most UK citizens believe that income from a pension somewhere in the range between £10,200 and £42,000 per year is likely to sustain a liveable retirement.

Anything beyond that would be considered overly-luxurious, but you probably won’t find anyone complaining about having too much money or leisure. Of course, you may find yourself in a completely different financial situation.

Thankfully, there are many online tools available to help you calculate the amount of money you may need for retirement in the UK.

UK Saving Statistics by Country in 2023

We’ve been painting with fairly broad strokes so far, so let’s say we dive into the numbers a bit more.

Here, you will find saving statistics for different countries and regions throughout the UK in 2023.

Saving Statistics in England

London is not only the capital of England, but it is also the capital of personal savings in the country. The average Londoner has approximately £28,978.40 in savings, which is over three times the amount of the UK average.

More so, London has far and below the lowest rates of residents with little or no savings. Instead, most people living in the city have a few pounds stowed away for a rainy day.

Domestically, the next highest saving region is the West Midlands with an average of £13,318.35 in personal savings accounts. Meanwhile, the East Midlands has the lowest regional savings with only £6,438.48 saved by the average resident.

Saving Statistics in Scotland

In 2023, the average Scottish person has approximately £7,297.19 in savings. This is among the lowest regionally in the UK, only ahead of the South West, Northern Ireland, and the East Midlands.

Although Scottish people tend to save more often than the rest of the UK, they tend to save less overall. Interestingly enough, the population of Scotland has fewer people with £100 or less in savings than the UK as a whole.

With that said, the country has a greater than average percentage of its citizens with £1,000 or less in savings.

Saving Statistics in Wales

In Wales, the average resident has £9,648.91 of financial savings in 2023. This is right around the UK average. However, Wales is a land of extremes as most people are either saving a lot of money or practically none at all.

Despite its reasonably high average, Wales has the highest regional population percentage (9.08% of residents) with £0 in savings.

Saving Statistics in Northern Ireland

Northern Ireland has the second-lowest regional savings with £6,710.00 saved by the average resident. Much like Scotland, however, Northern Irish citizens still tend to have a little bit of money put aside in case of an emergency.

Only 9.09% of Northern Ireland residents have £100 or less in savings, which is well below the average among other UK regions.

Most Common Forms of Savings in the UK

Naturally, the numbers that we have presented thus far do not account for those people burying large amounts of cash in their garden. Instead, today’s technology makes it easier than ever to record, track, and analyze the different ways UK citizens are saving their money for retirement.

Traditional Savings Accounts

Now more than ever, there is not simply “one kind” of savings account. Instead, the financial landscape paved by traditional banks and new fintech companies is more diverse than ever in 2020. Today, individuals can utilize:

- Short term savings accounts

- Long term savings account

- Adult and Junior Individual Savings Accounts (ISAs)

- Money market accounts

- Notice accounts

- Fixed-rate bonds

- and more

In 2020, approximately 15% of UK citizens have a cash ISA. This number, along with the amount of UK residents with money invested in stocks and shares have been steadily trending upwards for the past 20 years.

Investment Accounts

Secondly, many residents in the UK let their money work for them by investing their savings in high-yield stocks and bonds that can trump the interest rate offered by a bank’s saving account. Although this is considered riskier, the potential earnings payoff is enough for most people to invest their savings to better secure their future.

In 2020, roughly 2.2 million people have a stocks and shares ISA in the UK. This is about 3% of the population. What this tells us is that very few people are able to save money each month, and even fewer people are able to invest it.

Financial Apps

Lastly, an increase in the use of finical apps is one of the key takeaways from 2020. Worldwide, fintech apps saw a 90% increase in market share, and accounted for about 5% of all app store downloads.

This dramatic shift in traditional savings is one of the most important things to look out for as British saving trends develop over the next decade.

In the UK, apps like Lumio (created specifically for individuals & couples), Chip, Cleo, Starling Bank, Monzo, and more let you save money, manage your spending, and take control of your finances digitally. Whereas 72% of UK adults reported the use of online banking in 2018, this number has skyrocketed in the unprecenteded year of 2020.

Conclusion

Ultimately, saving for retirement is never easy and today’s statistics clearly show that is true. We hope that this article has helped you gain perspective on the current state of UK indiviudal savings , so that you can adopt the habits and explore the avenues for smart finical health.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

5 Comments