For many people, trading and investing is a seemingly incomprehensible bundle of jargon and difficult to understand topics.

That is one reason why lots of people are put off from investing. But what if we told you that share trading and investing does not have to be so difficult and inaccessible?

That is where Trading 212 comes in.

Trading 212 offers a wide range of features to help beginners get a handle on investing and make smart financial decisions.

So today we are going to cover Trading 212 and give it a full accounting. We will cover its features, pros, cons, and any applicable fees.

Then we will give our verdict on whether we think Trading 212 is worth trying out.

(P.S. Check out our comparison of Etoro vs Trading 212 here).

Trading 212: Overview

Trading 212 is an online trading platform that is based out of London. The company was founded back in 2006 and allows forex trading, currencies, gold, commodities, crypto, stocks, and other kinds of asset classes.

It obtained its license to operate in the UK in 2013 and is currently regulated by the Financial Conduct Authority of England and Wales (FCA).

The company runs on a freemium model. The basic services are free to use, but you have to pay for any extra features or services. The application is designed specifically for an online trading environment, with an emphasis on mobile trading.

As a user, you can create an account and browse their listing on your smartphone, wherever you may happen to be.

Trading 212 offers a DIY platform with over 1,800 instruments for trading. While they offer traditional asset classes like stocks and bonds, Trading 212 also ups that ante by allowing several other kinds of unique assets such as currencies, commodities, and more.

The diverse list of assets is one of the unique features of the platform.

The company have racked up nearly 2 million downloads and has been ranked the No.1 trading platform in the UL and Germany, It was also one of the first brokerages in the UK to switch to a commission-free trading model for regular day-trades.

Since Trading 212 has stood the test of time and has been around since 2006, it has evolved into a stable brokerage that has adapted and survived through many shifts in the market, most notably the financial crisis of 2008-2009.

Trading 212 includes stocks and ETFs from some of the most popular stock exchanges in the world such as the London Stock Exchange, NYSE, NASDAQ, and Euronext. They also offer a full-fledged CFD trading arena that is tailored to beginners because it is so easy to use.

You can invest in over 4,000 stocks and ETF completely zero commission. Trading 212 also allows fractional trading so you can start with very small amounts.

The majority of supported stocks for Trading 212 are based out of the US or UK and include some financial heavyweights such as Apple, Facebook, Twitter, Amazon, HSBC, British American Tobacco, and more.

Trading 212 also allows for financial manoeuvres such as short-trading and selling with leverage. They also allow for dividend reinvestment where any dividend gains are invested in more stocks.

For UK investors, Trading 212 allows ISA accounts for tax-free trading up to a certain amount.

How Does Trading 212 Work?

Trading 212 works like most traditional DIY investing platforms. You sign up, create an account, connect a payment method to fund your account, then you can start trading.

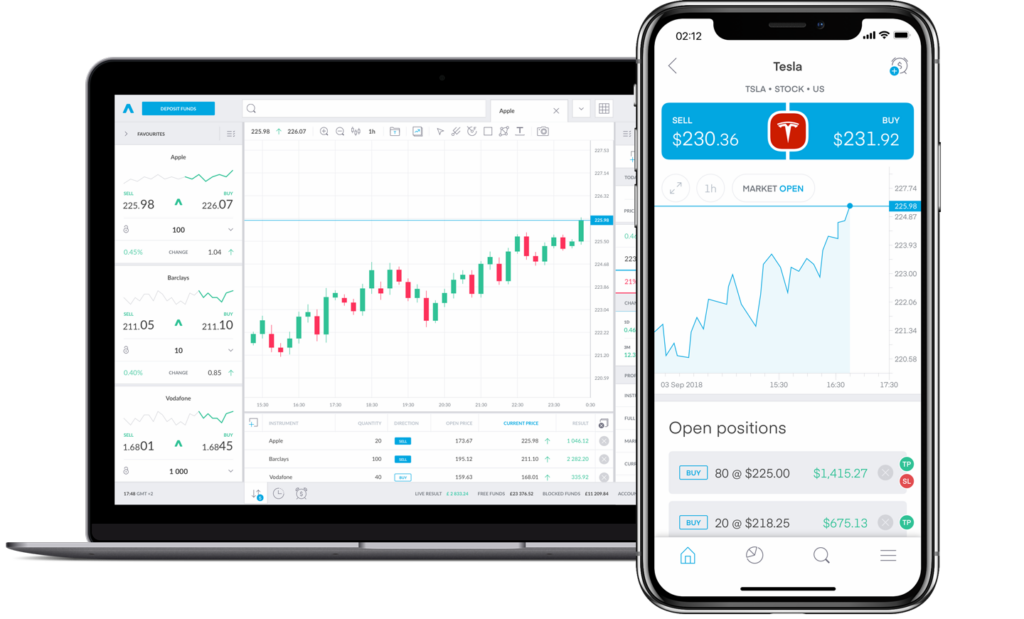

It has a fairly simple layout that is organized and has information about your stocks right in the middle. On the left-hand side are all the instruments and trading signals you can set up, along with your pending orders and watch list.

The centre of the screen and the main attraction is the detailed graph instrument. This graph allows you to switch between your investments.

The graph shows a running history of the asset’s performance over time and you can add whatever metric you want such as moving average and the like. You can adjust the time frame of the asset’s performance from just the current day to several years back.

Lastly, the right-hand side contains useful videos and tips about how to trade. You can also find various reports on the right-hand side under the video bar.

Overall, the trading interface is excellent.

It has a wide range of information and good resources so you always know what you are looking at. To some, the interface might look a bit cluttered because there is so much information.

It is not as smooth or neat-looking as some other trading platforms but in terms of the information you get, it performs very well.

Like we said earlier, Trading 212 does not charge commissions on regular trades. You can make as many regular trades as you want and you won’t have to pay for them. However, they do charge extra for non-free services and these fees are transparent.

How to Open an Account on Trading 212

If you are a complete beginner, Trading 212 offers a demo account so you can try out the platform.

The demo is basically a simulation and gives you a rough idea about how trading on the platform works. You can use the practice account on both a desktop and a mobile device.

If you like the demo and decide to make an account, then you will have to provide some information to verify your identity. You will have to supply proof of ID, such as a copy of your driver’s license, national ID, or a scanned copy of your passport.

You will also have to provide proof of address through something like a utility bill, bank statements, or some other official document that says your address. These identity proof requirements are meant to guard against money laundering.

Next, you will need to answer a short series of questions. The point of these questions is so the company can understand how experienced a trader you are and whether working with you poses them low risk.

In fact, you can get rejected from the platform if the company decides that working with you is too risky. The application process takes about 10-20 minutes in total.

Once you are accepted, you can pick one of the three account types they offer. Trading 212 offers a regular trading account (called Trading 212 Invest), an individual savings account (ISA) of a contract-for-differences (CFD) account.

A CFD account allows you to be paid based on the difference between the opening and closing trades and is a very popular option for currency and commodity traders. You can make a lot of money when trading CFDs.

Once you pick your account, you can start browsing stocks and build your portfolio. Trading 212 Invest is designed mostly for investing and trading equities and can be used by anyone. ISA accounts are only for UK based traders and their CFD accounts are open to all international traders.

Trading 212 Asset Classes

As we said, Trading 212 offers over 1,800 assets from over 7 global stock exchanges. Here we will give a quick rundown of the different asset classes you can trade.

Stocks

Most of Trading 212 assets are stocks and individual shares trading. Trading 212 has listings for some of the biggest companies in the world. You can pick and choose which shares you want to build a properly diversified portfolio.

This flexibility is a great feature for a primarily mobile app-focused investment app. Many mobile trading investment apps offer pre-built portfolios that you cannot really customize. Trading 212 gives you absolute flexibility as you can pick whatever you want.

ETFs

Trading 212 also offers hundreds of ETFs including some of the most popular ones in the market today. ETFs are a great option if you need to diversify your portfolio and they cover several sectors and industries.

For example, one of the most popular ETFs on the platform is the iShares Core Global Aggregate Bond which includes shares and bonds from over 500 companies.

Cryptocurrencies

Trading 212 also offers a widespread of cryptocurrencies including major players such as bitcoin, Ethereum, Monero, Litecoin, and more. Cryptocurrencies are relatively uncommon for online brokers so it is a good feature that Trading 212 adds them to their lineup.

Cryptocurrencies can be traded just like regular shares. You can also trade many of these cryptos as a forex pair along with popular currencies such as USD, CAD, CHF, EUR, GBP, and more. Cryptocurrencies are usually high risk

Commodities

Trading 212 also allows for commodity trading CDFs. Assets in this class include popular commodities such as gold, silver, crude oil, natural gas, and copper. They also allow for more unconventional commodities such as sugar, coffee, cocoa, and cotton, among others.

Overall, there are 11 commodity classes you can invest in and you can speculate on commodities and forex pairs. Commodities carry a relatively high risk.

Indices

You can trade indices on Trading 212 and these are a good way to make money with speculation.

There are hundreds of individual companies contained within each index including major ones like the S&P 500 and the FTSE 100. Overall, Trading 212 has over 30 distinct indices, including some less liquid indices in Russia, South Korea, and the Netherlands. This inclusion allows investors access to emerging global markets.

Forex

Lastly, Trading 212 offers investors a wide range of forex currencies to invest in. Trading 212 is not the best forex broker in the market but they offer a lot of currency pairs that include some less liquid currencies from places like Turkey or South Africa.

Overall, there are over 200 forex pairs to trade meaning you can get fairly broad coverage in the forex market.

Training 212 Features

Educational Materials

Trading 212 is designed for beginners so they include a large library of educational resources and articles for first-time investors. Articles and videos cover more general topics about investing but also delve into specifics about certain industries or sectors.

One thing we really like about the educational library is the webinars and trading guides. The best part of the library is you do not even have to have a Trading 212 account to use it. You can browse the library for free even if you are not a Trading 212 client.

Minimum Deposits

Trading 212 Invest trading only requires you to deposit £1 to get started investing. There is no minimum deposit or balance you have to keep. £1 sounds like it would be way too low to actually invest in anything, but Trading 212 offers fractional share investing so you can actually get started with just £1.

You can connect a wide range of payment methods including a traditional bank account, and credit cards and debit card along with other options like Skrill, Dotpay, Giropay, Apple/Google Pay, and PayPal.

However, for CFD accounts, you need to deposit at least £10 to get started. However, there is no minimum account balance you need to maintain. Withdrawals and deposits take a few business days to go through. There is no charge for using a debit card to

Bonuses and Promotions

Trading 212 does not seem to currently be offering and special bonuses but they have in the past. Past bonuses have included a £50 welcome bonus for making your first deposit and reduced or zero commission trading on certain types of trades.

However, the EU has recently changed some regulations that limit the kind of bonuses brokerages can offer, as a means to prevent overtrading.

Tools

Trading 212 has a lot of trading tools to help you assess investments. For example, they have an economic calendar that updates in real-time and technical analysis tools for your charts.

In addition to the educational resources we mentioned earlier, there is also a trading forum where you can talk to other investors about tips/strategies and a FAQ section for common issues.

Is My Money Safe With Trading 212?

Trading 212 is a trading company registered in England and Wales and is regulated by the FCA. It is also regulated in several other countries in Europe by their respective financial agencies. You can find information about these regulations on Trading 212’s website, including registration numbers.

Trading 212 also protects your funds by keeping them separate from the company itself. That way, if the company goes belly up, creditors cannot come for your money.

Your funds are also protected by the Financial Services Compensation Scheme (FSCS) which insures you up to £85,000 in deposits, and the Investors Compensation Fund (ICF) of Bulgaria which insures you up to 90% of deposits with an upper limit of £20,000.

So your investments with Trading 212 are perfectly safe, or at least, as safe as they would be with any other brokerage firm. There is little to no risk of losing money and they have a good track record of making money.

Trading 212 Fees

Trading 212 is very transparent with its fee structure. For regular stock trades, they do not charge any trading fees. They also do not charge any withdrawal or deposit fees. Surprisingly, Trading 212 also does not charge for currency conversions.

Things are a bit different with the CFD accounts. CFD accounts do not have a deposit or withdrawal fee but they do have a 0.5% currency conversion charge. There are also margin requirements for stocks, commodities, and indices.

Lastly, ISA accounts also do not charge any trading fees either. They also have a £1 deposit minimum. They do not charge an inactivity fee. and there are no fees for bank transfers.

So if Trading 212 doesn’t charge any fees, then how do they make their money?

They make their money through SWAP rates. SWAP rates depend on the specific product and they are applied in bulk to your account balance once per day.

What Are People Saying About Trading 212?

Trading 212 has very positive reviews.

On Trustpilot, Trading 212 has a very high 4.4 out of 5 rating from over 6,000 reviews. The vast majority of reviewers claim that the platform is incredibly easy to use and had helped them get some experience as investors.

Many reviews also said that the company has excellent customer support services. There were also several comments about how easy the mobile app interface is to use. A handful of reviews were negative, but in reality, the majority of those sound like they were from people who just don’t understand how investing works.

Trading 212 Pros & Cons

Pros

- Intuitive user-friendly platform with a great mobile experience

- Wide range of asset classes to choose from

- No minimum deposit

- You can fully customize your portfolio however you want

- Foreign exchange has hundreds of currency pairs

- Tons of educational materials and training videos

- No fees on regular trades

- No withdrawal or deposit fees

- Good customer service and customer support

- Brokerage, CFD, and ISA

Cons

- Lengthy registration process

- You can get denied from the platform

- No short-trading on equities

- No live chat option

Conclusions

So, do we recommend Trading 212? Absolutely.

Trading 212 is an excellent online brokerage for a beginner investor who wants to learn how to invest. They have a wide range of asset classes and you get full control of your portfolio.

Trading 212 also has specialized accounts for more experienced investors and you can make an ISA. There is a large educational library with tons of videos, articles, and webinars for specific topics in investing.

So we highly recommend trying out Trading 212, it’s a great DIY investing platform for the beginner investor.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024