Crowdfunding is one of those seemingly nebulous terms that get thrown around investment circles a lot nowadays, often without any real explanation.

In its essence, crowdfunding is the process of a start-up business or organization gaining capital through the collective effort of family, friends, customers, and individual investors.

Crowdfunding takes advantage of the connectivity of the internet to raise funds and get people in on the early stage of a business.

In lots of ways, crowdfunding is kind of the same as regular approaches to business. You are basically asking people for money to fund your start-up, which is pretty much what traditional approaches to investment are doing.

The key thing with crowdfunding is its focus on the “average Joe” rather than a small handful of wealthy capitalists or angel investors.

A crowdfunding platform is designed to make this kind of networked reach out much easier to facilitate. Crowdfunding platforms give business owners a way to streamline the presentation process so they can get the investments that they need to get things rolling.

Seedrs is an equity crowdfunding platform that is designed with the goal of helping businesses showcase their products or services to raise money from individuals, businessmen, or investors.

Seedrs was founded in 2009 and since then has become one of the most well-known equity crowdfunding platforms in the UK. They’ve been hot in the press with the recent announcement to merge with Crowdcube, which should open up more possibilities for funding opportunities. The merger is set for early 2021, and is expected to have a total merged value of £103 million.

In this article, we’ll give a comprehensive overview of Seedrs and answer some important questions you might have surrounding the platform.

Is Seedrs a good platform for investing? Can it help companies and investors make money?

We will answer all of those questions and more in this Seedrs review.

Also consider checking out…

- Our Crowdcube Review

- Our Roundup Of The Best Crowdfunding Platforms In The UK

- How Does Crowdfunding Work?

What Is Seeders?

Seedrs is an investment crowdfunding platform based out of East London. The company was founded in 2012 by Jeff Lynn and Carlos Silva as part of a joint project they undertook while at the Saad Business School at the University of Oxford.

Since its founding, Seedrs has had a fairly impressive track record. In 2012, the platform raised $1 million in seed funding from private investors and businessmen including some well-known venture capitalist firms.

By May 2012, Seedrs became the first equity crowdfunding platform to become regulated by the Financial Conduct Authority (FCA).

In 2017, Seedr hit a new milestone by successfully raising more than £10 million in funds, and later that year it launched a venture capital fund aimed specifically at passive startup investors.

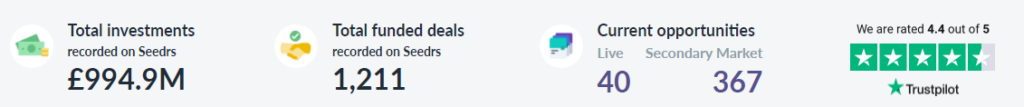

As of 2020, the company has raised nearly £1 billion (yes, that is a “b”) in total funds since its founding and funded more than 1,000 projects.

Seedrs has received a very warm reception from the investment community. One of the best features is that it provides liquidity to certain assets that many other platforms render as relatively illiquid. This flexibility allows for more investment opportunities and more opportunities to earn more money.

For readers across the pond, you can sort of think of Seedrs as a UK version of platforms like Kickstarter. The main difference is that Seedrs offers early-stage investors equity in the company, while Kickstarter does not.

This focus on equity changes the nature of the crowdfunding mechanism as it gives the opportunity for more individuals to get some ownership in the project.

How Does Seedrs Work?

Seedrs has a pretty standard setup. Project owners can feature their projects on the platform and give an investor pitch to raise money.

The company provides investors with important information regarding the products/services, market dynamics, business plans, etc. Investors can then choose to invest whatever amount they want and get a proportional share of the equity.

Although Seedrs is based out of the UK, it is also open to international investors from all over the world.

For each project featured on the marketplace, the owners can define an equity share that investors will be entitled to. Seedr allows companies to raise funds for IPO, seed money, and more, all while building a network of investors.

From the business side, here is how things work. Each company will establish an amount of money that they want to raise on the platform and sets a time frame.

If the business does not reach that target amount within the specified time frame, then the money is returned to investors. If your business does meet the target amount, then entrepreneurs have to pay a 75% charge off the profits they make when the shares are actually sold.

In return for all of this. Seedrs will manage your business’s investments and give you regular updates on the status of your project and time frame.

Business owners can create videos and showcase marketing plans to drum up interest and build investor confidence. Seedrs will also feature successful campaigns at a higher search level so more people can see the opportunity and you can get more funds for your project.

Once the investment goal is reached and the timeframe closes, Seedrs will close the project and start working on the paperwork with the startup.

Because of the way Seedrs is set up, the company owners only have to deal with Seedrs itself rather than all the individual investors.

This is a useful feature as Seedrs will take care of all the legal paperwork and tax documentation you will need to account for your capital.

Here is how equity works on Seedrs.

The company showing their product will establish the appropriate equity share: say 5%, along with the amount to be raised; say £75,000.

The amount to be raised is applied to the pre-money valuation (say it’s £1,425,000 in this example) so the total valuation would be £1,500,000. The 5% share represents 5% of the total £1,500,000 valuation (5% of £1,500,000 is £75,000).

To be clear, these are just example numbers and probably will differ depending on the specific project. The total valuation is based solely on what the owners think is an appropriate equity share.

How Can I Get Started on Seedrs?

If you want to be an investor, getting started on Seedrs is pretty simple. Just go over to the website and create an account.

You will have to provide some identifying documents and link a verified payment method. Seedrs allows bank accounts and debit cards as legitimate payment methods (no credit cards though). You also do not have to be a UK-citizen to create an account as Seedrs is open to international investors.

Once you have an account set up and your identity verified, you can start browsing projects to invest in. Most pitches are open for a maximum of 60 days, but the project might be closed earlier if the target funds are met.

So, if you find a good opportunity, then you better act sooner or later, or else you might lose the chance to invest.

Seedrs requires a minimum investment amount of £10, although many individual projects might require a higher investment amount. No matter what you invest in on the online platform, you will at least need to throw down £10, most likely more though.

If you have a business that you want to fund on Seedrs, then the process is a bit different. First, you have to submit a campaign that the company will vet.

They have a simple online form you fill out that has details about the campaign. They will then examine it to make sure that all claims are fair and not misleading, then approve your project to be featured on the marketplace.

Next, you can make a video showcasing your campaign and prepare a marketing plan to show investors. These are very important parts as most investors won’t bite unless they have a sufficient amount of information.

The campaign then launches privately so that your network can invest before anyone else. If the campaign does a good job during the private phase for 40 days, then Seedrs will open it up for investing from the public.

When the campaign hits 100%, it can stay open for a few more days to get some overfunding. The campaign will then close and Seedrs will start filing legal and tax documentation.

Once all that is taken care of Seedrs will disburse all the raised funds, minus their 7.5% fee.

Also, once you complete a successful campaign fundraiser on Seedrs, you get to become part of the Seedrs Alumni Club. The Alumni Club is an exclusive network of Seedrs-funded businesses that gives you access to partners, events, resources, and networking contacts.

The Alumni Club is a good place to grow your business even further after the initial funding and launch phases.

Seedrs has some good features that make it an attractive online platform for raising funds. There are no membership or pitching fees, and you do not have to pay any ongoing admin costs.

They also take care of all payment processing and manage your campaign accounts. The only fee you have to pay is the 7.5% fee at the close of the campaign.

How Much Money Can I Make With Seedrs?

As an investor, Seedrs offers a lot of lucrative offers but many of them carry a moderate-to-high level of risk. Investing in startups or IPOs is inherently much riskier than investing in the shares of an established company.

There is always the possibility that a funded company will fail before it can build up any traction. But, there is also the possibility that they take off, and as an early-stage investor, you can make a ton of cash.

Here are some facts and figures about start-up investment returns. According to a 2009 report called “Siding with the Angels,”, out of 1080 UK start-ups from 1998-2008, the average return if you invested in all of those companies would be a massive 22%, which is almost 3 times the average market return of 7%-10%.

There are some caveats though: the majority of those profits came from the top 9% of companies.

This means that there is the possibility of amazing returns by investing in startups, but you need to safely diversify your assets among several projects.

This is the same diversification principle that holds in the “normal” investment world. As always, there is always a chance that your investments will fail.

Tax Advantages

One other good thing about using Seedrs is the potential tax-advantages. Most projects on Seedrs are eligible for what is called the “Seed Enterprise Investment Scheme” (SEIS).

This scheme allows investors to get up to a 50% tax relief on their investments. So if you invest £10,000, then you could get up to a £5,000 deduction on your income tax bill. That is definitely a good incentive to invest.

The SEIS can also help you reduce your capital gains tax burden.

If you make capital gains off a qualified sale of investments earlier in the year, you can invest that money in a SEIS-covered project and substantially reduce the capital gains tax you would have to pay on that money, completely eliminating it in some cases.

Based on some quick calculations on our side, if you take full advantage of both of these possibilities, you could get up to a 78% tax relief on your investments for that year. There is a lot more info about taxes on Seedrs’ website so head over there to get more info.

Seedrs Equity Crowdfunding Pros & Cons

Pros

- Lots of opportunities. As an investor, there is a huge number of projects you can invest in.

- Seedrs handles logistics. As a business, Seedrs will handle all the interactions and financial transactions from individual investors so you do not have to.

- Great tax benefits. Seedrs can net you some awesome tax benefits if you play your cards smartly.

Cons

- High-risk. Startup investing is notoriously high-risk, but it has the potential for great returns.

Final Words

Investing with the online platform Seedrs is a good experience.

This experience can net you a lot of cash if you know how to take a risk. Businesses have a lot to gain from funding their startups through Seedrs and it has a good market atmosphere to distribute shares and other equity crowdfunding opportunities.

Hopefully, this Seedrs review has given some good investment advice so you can make a point of pursuing smart investment opportunities.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

1 Comment