Investing on your own is hard work. Not only do you need to round up the necessary investment capital, but you also have to search through the market to find promising investments. While there are a handful of big companies that you can more or less always expect to do well, getting the most out of investments involves doing some serious research into the market.

The problem is, most people don’t have the time to do serious market research.

Even if they do, not everyone will be able to fully appreciate what financial statements, quarterly reports, balance sheets, and the like mean and how they can use them to their advantage.

That’s where Morningstar comes in.

Morningstar is a leading market research firm that publishes research, ratings, and investment tools for all levels of investors. For a yearly subscription, you can get access to all of Morningstar’s proprietary research and expert recommendations.

But, how good is this market research publication? Is Morningstar worth the subscription? Can its advice help you make good investments? We will answer all these questions and more in our Morningstar review.

Morningstar: Overview

Morningstar is an investment research firm and wealth management platform that was first founded in 1984 in Chicago, USA. They have been famous in the financial world for their recognised rating system and analyst tools.

Morningstar Premium is their proprietary package for individual investors that gives them access to all of their research, recommendations, and technical tools for a subscription. Morningstar Premium is one of the most comprehensive information sources you can find on stocks. It’s especially useful if you are a hands-on investor and like to play a very active role in managing your investments.

While Morningstar offers some of its research and screening tools for free with the Morningstar Basic package, you can’t get the top investment picks or analyst reports without signing up for Morningstar premium.

Morningstar Premium Tools and Features

Morningstar is a package of various tools, reports, and research libraries for your investing convenience.

Analyst Reports

Morningstar ratings and analyst reports are probably one of the most well-known parts of the publication and include a curated list of investments that Morningstar’s in-house team thinks are poised for growth. The analyst reports have a detailed section giving their explanation about particular investments and ratings to compare them to similar securities and historical performance. The entire report has a lot of information, so it can be a little intimidating at first if you are not incredibly familiar with investing. However, it houses every relevant piece of info you need.

A full analysis of a selection includes taking into account business strategy and outlook, economic moat, risk, and stewardship. In other words, each analyst report combines all relevant financial and business data about a particular investment as a quick wrap-up/summary.

In addition to ratings and explanations, Morningstar’s team gives each investment a star rating between one to five stars. A star rating system at 3 is considered fair value, 1 is overvalued, and 2 is undervalued. This star ranking system is a convenient shorthand so you can find the stocks that have the best value.

Best Investment and Fund Analysis

In addition to analyst reports, Morningstar has what is called its best investment and fund analysis tool. This tool will compile what are considered the best investments, pooled from information provided by over 220 independent analysts. These selections are diverse and range from stocks, bonds, ETFs, core bond funds, foreign bonds, and more.

Each fund has a selection that gives an exhaustive account of specifics about the fund, fund managers, and what the underlying assets are. Each list is curated specifically for a category, like top stock picks, best ETFs, index funds with the best returns, etc. The kind of information you get on each pick is in-depth too.

Portfolio Manager Tool

Morningstar’s portfolio management tool is another feature they are known for. The portfolio tool allows you to track your investments, plan your strategy, create watchlists and alerts for picks, and make predictions. You can choose from basically any stocks you want to build your portfolio and subject it to whatever tests you want to see what happens.

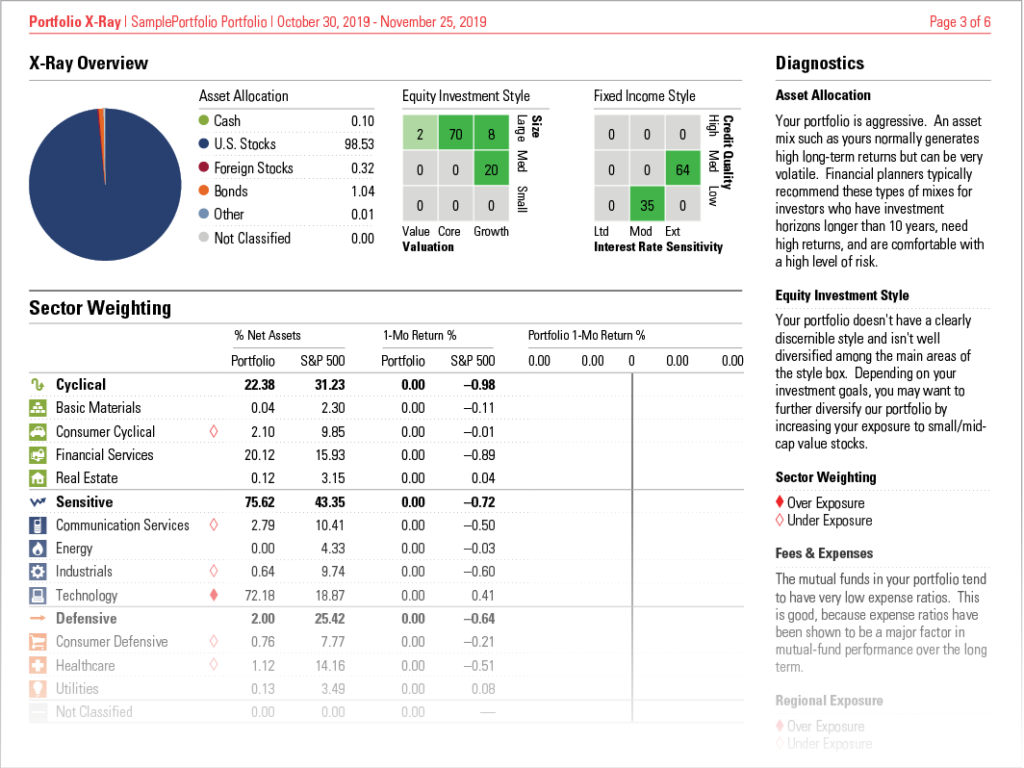

Once you build a portfolio, the Portfolio X-Ray tool takes a look at everything to gauge your asset allocation and sectors that your investments are concentrated in. The tool will also indicate if you gave accidentally duplicated exposure for any company by investing in them through both funds and shares.

Another feature that works in conjunction with the management tool is the screener tool. With the stocks screener tool, you can search for picks based on categories, asset type, sectors, and ratings. Morningstar lets you screen picks through their rating system, and contain useful data points such as risk, tax costs, expense ratios, dividend yields, ecological sustainability, and more. The free version comes with a variety of categories, but access to all of the screener tool’s functions is only available via Morningstar Premium.

Articles

Morningstar has put together an impressive library of research in the nearly 40 years it has existed. When you sign up for Morningstar Premium, you get access to all of this research.

The article library includes historical data on picks but also how-to and instructional articles on things like tax planning, college savings, retirement planning, investment screening, and more.

Morningstar Premium articles cover a range of topics from simple to advanced investment techniques, with input from professional financial advisors and analysts.

Advising Services

Also, when you sign up for Morningstar premium, you will get an option for one-on-one advising with a licensed professional through the firm Personal Capital. Personal Capital is a well-known investment firm that specialises in managing individuals of high net worth.

However, if you want to take advantage of this offer, then you need to provide an initial $100,000 investment with personal Capital through their platform. You can also get this opportunity without having to go through Morningstar.

Morningstar Pricing

Morningstar offers two main pricing tiers for its investment tools and research tools: Basic and Premium.

- Basic: Free

- Premium: £19 per month (£159 per year)

The free Basic plan gives you access to the portfolio management tool (with restrictions) and a solid chunk of the article archive. The Premium plan includes the full article archive, full portfolio management tools, analyst reports, and top investment picks.

You have the option of paying for the Premium plan monthly for just under £20 a month or you can opt for annual billing and only pay £159 for the year.

Opting for annual billing will save you nearly £100 for a year’s subscription. Morningstar also offers a 14-day free trial of the Premium service so you can see if it works for you.

You can also sign up for Morningstar premium for 2 years for £289 or 3 years for £399.

If you cancel a monthly subscription, then your service will just end at the end of the month and you will not be charged anymore. If you cancel a yearly plan, the company will refund you a pro-rated amount based on how many months were left in your subscription.

What Are People Saying About Morningstar?

Morningstar is among one of the most well-known and trusted investment research firms in the world. They’ve done well to build up an excellent reputation as a leading investment research firm.

However, reviews online are mixed.

We checked out Morningstar’s Trustpilot page and here is what we found.

They have a very low 2.0 out of 5 rating from nearly 50 reviews. However, the vast majority of negative reviews were not about the actual investment picks, but dealing with billing and collections issues.

Many people claim that it is hard to get the company to honour the 14-day free trial. There were also several complaints about software and technical issues. Several people report having trouble getting the management and tracking tools to work correctly, especially the x-ray tools. There are also a few complaints about Morningstar’s customer service team.

That’s not the entire picture, though.

The few reviews that focus on the quality of the research content seem pleased. The consensus is that Morningstar provides pretty decent investment information all-around.

(Also, there was one person who seemed to have mistaken Morningstar for the vegetarian meat company of the same name, which was an entertaining read to say the least)

Overall, it appears that while Morningstar’s tools and research are good, the customer service and online application leave a lot to be desired.

Who is Morningstar Best For?

- Value investors. Morningstar gives a bunch of useful information for value investors who want to buy undervalued stocks.

- Those worried about asset allocation. Morningstar’s portfolio x-ray tool is extremely useful if you need to double-check your allocations to make sure things are balanced.

- Those who want expert advice. Even if you’re an experienced trader, it can be a good idea to get a second opinion from another expert.

Morningstar Premium Pros and Cons

Pros

- High-quality data. Morningstar has research tools and analytics that are some of the best in the business. The stocks and funds screening tool offer a wide range of search options for finding good picks.

- Top picks are good for value investors. Morningstar’s star system lets you identify undervalued stocks that are poised to take off.

- Free version. If you do not want to commit immediately, Morningstar has a free 14-day trial that you can sign up for. Apparently, though, it’s a bit hard to cancel this plan and not still get charged.

Cons

- Expensive. $199 a year is not exactly cheap. Although, $199 a year is cheaper than paying $29.95 a month.

- Questionable customer service. From what we can tell, customer service leaves a lot to be desired.

Wrapping Up

So, what do we make of our Morningstar review? This premium investing service is perfect when you need a good eye in your portfolio. with Morningstar Premium, you get access to the best fund screener and cost analyser tools on the market. If you need premium stock information to make your money work for you, then Morningstar and its rating system is a good stock advisor service.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024