Looking for investment platforms? Luckily for you, there are a ton of great selections out there. The downside to this is the sheer amount of choices can make deciding on a service extremely difficult.

Hargreaves Lansdown is one of the largest UK stock firms in the country, and for good reason. The company is listed on the FTSE 100 stock index and has a good track record of investments. The company has a lot of investment tools for their clients and manages a lot of assets.

So you might be wondering: Is Hargreaves Lansdown the right platform for me?

In this article, we drill down into Hargreaves Lansdown and its investment platform, uncovering its pros, cons, fees, and features. We will then give our verdict over whether or not you should check them out.

What Is Hargreaves Lansdown?

Hargreaves Lansdown is the single largest UK investment platform. Since being founded in 1981, the company has grown to encompass over 1 million clients and manages over £100 billion in client assets. Hargreaves Lansdown is separated from other firms because they offer customers in-depth management, investment tools, prebuilt investment portfolios, and cash management services.

Hargreaves Lansdown was founded in 1981 by Peter Hargreaves and Stephen Lansdown. The company originally offered tax planning and unit trust advice to customers. In 1986, the company started offering discretionary investment services. In the 90s, the company expanded their operations and opened up their investment services to a wider pool of customers. By 2007, the company had amassed over £1 billion in assets and by 2011, the company had reached the FTSE 100 index.

What Services Does Hargreaves Lansdown Offer?

Hargreaves Lansdown is a comprehensive financial organization and offers a wide range of products and services to customers. We will cover some of the most relevant services they offer.

Fund and Share Account

The Fund and Share Account is Hargreaves Lansdown’s version of a GIA. The Funds and Share account can be set up in just 10 minutes and only requires an initial £ deposit to get started The Fund and Share account is primarily self-directed and you can choose your own investment allocations. You have to be a UK resident to open a Hargreaves Lansdown Fund and Share account.

ISAs

Among the most popular services offered by HL are ISAs. HL offers regular stocks and shares ISAs, Junior ISAs (JISAs), Lifetime ISAs, and investment trusts. The main features of all of these accounts are that they have special tax advantages status. More specifically, HL has the Hargreaves Lansdown Vantage Stocks & Shares ISA which allows you to choose from a variety of pre-built template portfolios that you can further customize. Hargreaves Lansdown ISA accounts have a £100 minimum deposit or a direct debit of £25 every month.

Pensions (SIPPs)

HL also offers pension products ranging from self-invested personal pensions (SIPPs) to pension drawdowns. The company’s Vantage SIPP has won several awards and is a pension fund that gives customers complete control over their investments. Hargreaves Lansdown also offers annuities and professional advice for comparing annuities.

Savings accounts

Hargreaves Lansdown also offers saving services. The Active Savings cash service maximised the savings rate on deposits held in cash. In fact, Hargreaves Lansdown is the only provider that offers this feature. The Active Savings option gives access to products with high savings rates. You can funnel your money from fixed savings account to fixed savings account without having to fill out forms.

How Do Investments Work With Hargreaves Lansdown?

Investments with Hargreaves Lansdown are one of the main advantages the platform offers. The platform has an extremely wide range of investment selections and gives access to over 2,500 funds. You can buy and hold shares directly on the broker’s platform. Available shares are listed on some of the largest stock exchanges in the world. Hargreaves Lansdown also has some investment types that are relatively uncommon on other platforms, such as investment trusts.

You get access to Hargreaves Lansdown’s investment services whenever you open an account. The platform’s trading website has a clean interface and has some good tools and guides to help you get started. Along with your investment accounts, you can open an Active Savings account. Keep in mind that this Active Savings account cannot be used with your other investment accounts.

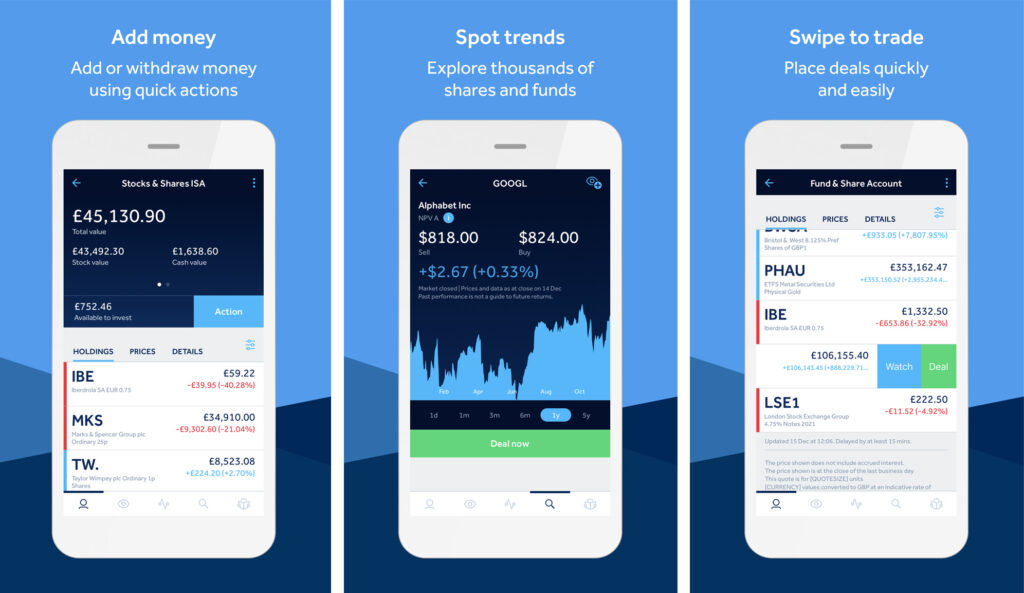

Hargreaves Lansdown also has a mobile app for both iOS and Android devices. The app is intuitively built and is responsively designed. In fact, virtually everything from your account can be managed from the app, so you don’t actually have to use the desktop webpage service.

What Fees Does Hargreaves Lansdown Charge?

Hargreaves Lansdown makes a sizable chunk of their money from management fees.

The company charges different management fees depending on which kind of account you hold. Given the range of services the company provides, the range of fees can vary quite considerably. They also charge fees for specific services.

For ISAs, there is a 0.46% management fee for the first £250k invested. Once you invest between £250k-£1 million that fee drops to 0.25%. Once you make it past £1 million, the fee drops again to 0.1%. After £2 million, there are no fees. They will charge additional fund manager charges and these can vary significantly.

SIPPs have a very similar fee structure to ISAs. SIPP accounts charge a 0.45% fee on the first £250k invested and 0.25% for accounts between £250,000-£1 million. Again, there is no fee for accounts totaling more than £2 million.

Hargreaves Lansdown also charges a ‘share-dealing’ service fee. These are fees you accrue from making trades. Share dealing charges begin at £11.95 for 0-9 deals, £8.95 for 10-19 deals, and £5.95 for 20 or more deals. Keep in mind that these rates are per deal. As you can see, this structure heavily favours active trading, which is one reason why Hargreaves Lansdown investment accounts appeal to high volume traders.

Also, all deals made by the phone have a 1% charge between £20-£50. This is an important feature as there are some investment classes that can only be traded over the phone. Hargreaves Lansdown also charges a 1% fee for dividend reinvestment and a £1.5 monthly charge for equity regular savings.

As you can see, Hargreaves Lansdown charges a lot of fees. This is one reason why the service may not appeal to investors who do not have a very high net-worth.

What Else Does Hargreaves Lansdown Do?

The list of services Hargreaves Lansdown is vast and are too numerous to list here. Suffice to say, they are a comprehensive financial institution that has a long history managing client funds and advising financial matters. Hargreaves Lansdown manages some of the biggest clients in the country and they offer financial services of virtually any kind you can think of. Pretty much the only thing Hargreaves Lansdown does not do is regular, run-of-the-mill banking services.

Is Hargreaves Lansdown Legit?

Absolutely 100%. The company’s activity is regulated by the Financial Conduct Authority and your money is insured by the Financial Services Compensation Scheme (FSCS). Up to £85,000 of your investments are insured and you can claim that money for free online in the case of insolvency.

Keep in mind that these protections will not insure losses from poorly performing investments.

Hargreaves Lansdown Benefits

Extensive services: Hargreaves Lansdown offers just about every financial service you could need, for both low and high net-worth clients. The only services they do not offer are banking services.

Expert advisory services: The advisors at Hargreaves Lansdown are the best of the best. These money managers have years of experience in managing client assets. You can also forgo advising services and invest on your own if you so desire.

Great for high net-worth individuals: Hargreaves Lansdown is a good investment choice for high net-worth individuals The pricing structure favors those with large account balances and those who engage in high volume trading behavior. If you are wealthy enough then the fees will not make much of a dent in your profit.

Extensive knowledge base: When you create an account and start investing, you get access to a selection of tools and guides to help you out. This includes things like a pension calendar and how-tos about GIAs, ISAs, and investing fundamentals.

Hargreaves Lansdown Drawbacks

Lots of fees: Virtually every action has some fee attached to it, whether its deals, trades, or advisory services. The presence of fees is compensation for the variety of services the company offers.

Designed for more experienced investors: A beginner can use Hargreaves Lansdown as their main investment platform just fine. But the service is tailored towards more experienced investors who know how to build and assess portfolios.

Our Verdict: Is Hargreaves Lansdown Worth It?

We say yes, Hargreaves Lansdown is worth it. The platform offers a huge range of services and has a wide amount of investment selections. Account-holders get access to an extensive knowledge base and advisor services. The only drawback is the high fees, which may be a turn off for some investors.

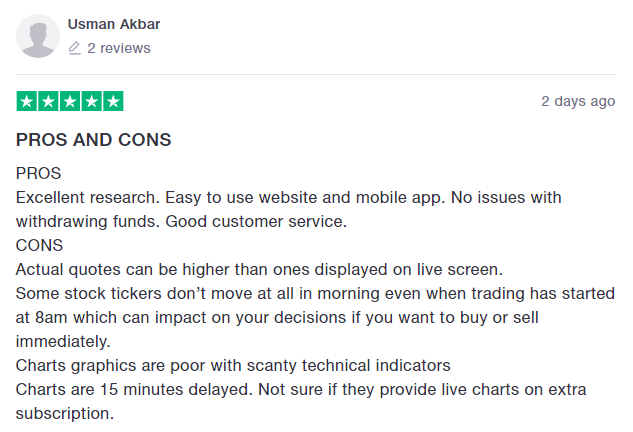

What Are Other People Saying About Hargreaves Lansdown?

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

1 Comment