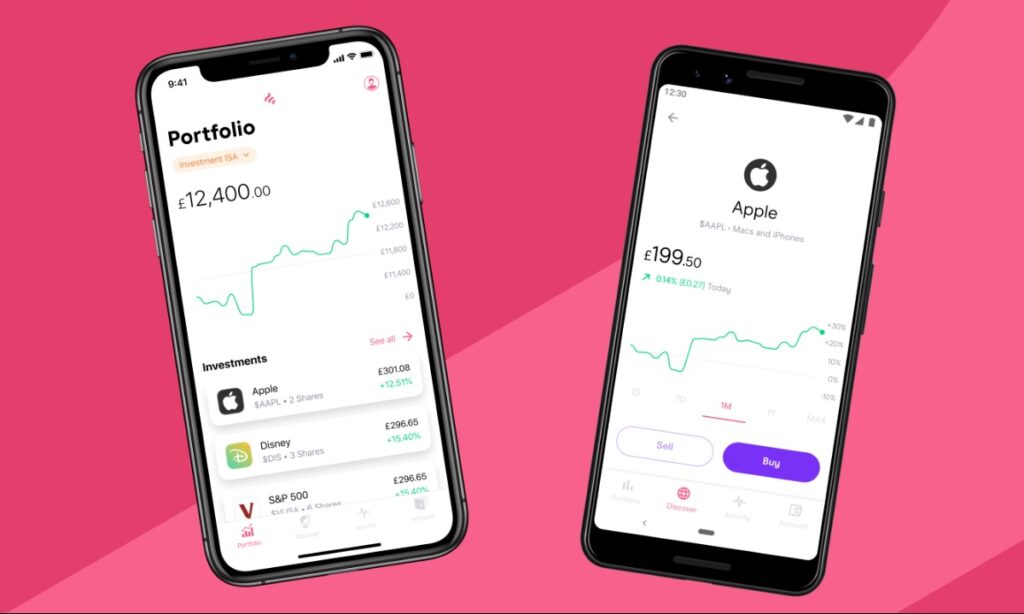

Freetrade Plus is here! For those who have not been following this exciting young company, we are pleased to announce that Freetrade has launched its premium paid platform (which was originally going to be called “Freetrade Alpha”). In Autumn of 2020, the new interface was rolled out to investors, Freetrade customers, and new users.

As we spend our time covering the forefront of UK fintech, we felt as if it were necessary to break down Freetrade Plus for our readers as soon as possible. Does it live up to the hype? Is it worth It? All of these answers and more can be found below in our in depth Freetrade Plus review.

Verdict

Although some may say that it is too early to tell, we feel very strongly that Freetrade Plus may be worth it for new investors looking to become more involved with their trading. The platform is full of user-friendly features that are designed to make investing easy and profitable for users of any experience level.

Who is Freetrade?

Before diving into Freetrade Plus, let’s talk a brief look at the company behind the platform. Freetrade is a young company that has crowdfunded over £25 million in investments since 2015. Officially, Freetrade launched its first mobile platform in 2018.

Since its inception, Freetrade has accumulated a large number of users taking advantage of the easy to use platform’s commission free trading. Although the investment portfolio is somewhat limited, Freetrade has generally received positive feedback as the company continues to grow and evolve. For more information on Freetrade, feel free to check out our in-depth Freetrade Review.

What is Freetrade Plus?

On August 6, 2020, Freetrade VP, Duncan Leslie, announced the launch of Freetrade Plus, a premium platform designed to provide users with easy access to advanced investment tools. Freetrade Plus was originally developed under the alias “Freetrade Alpha,” however that name has since been scrapped.

What Are The Fees & Charges when Investing with Freetrade Plus?

Despite containing the word “free” in its name, Freetrade plus is a paid platform. Freetrade Plus access starts at £9.99 per month. Upon activation, there is a 14-day trial period in which users can cancel their subscription completely free of charge.

Aside from that, users are still entitled to Freetrade’s commission free trading with no annual account fees or minimum balances required. If requested, users may be charged a small fee for same-day bank transfers.

How Does Freetrade Plus Work? What are the Extra Features?

With fee-free trading, many existing Freetrade users may not be motivated to upgrade to a platform that adds a monthly cost to their operation. Whereas the company was founded on the principle to make it easy to trade stocks, paying for Freetrade Plus offers users a chance to take the next step to enjoy a tonne of bonus features.

Priority Customer Support

More than anything, Freetrade touts priority customer service as one of the best reasons to upgrade to the Plus platform. Using the in-app chat feature, Plus investors will head to the front of the customer support queue among the company’s growing community.

Freetrade Plus users will also be able to contact the company during an expanded time window from 6 AM to midnight from Monday thru Friday (usually 9 AM to 5 PM). This is especially helpful for those who like to check their investments before and after normal working hours.

Expanded Portfolio Options

A limited amount of available stocks was one of the criticisms that early adopters of Freetrade had previously pointed out.

However, they have done extremely well to meet customer expectations, and have consistently been adding to their ever-growing range of small and micro-cap stocks. At the time of writing this article, there are over 2000 securities available to invest in for free, and about 700 (so far) in Plus that users can invest in.

The team are also promising to “roll out literally thousands more for Free and Plus members in the coming weeks“.

Upon announcing the launch of Freetrade Plus, the company has stated that the number of available stocks will continue to grow in both the free and paid platforms. Importantly, Plus members will be able to access the most companies, including risky investments with small market capitalisation for savvy traders.

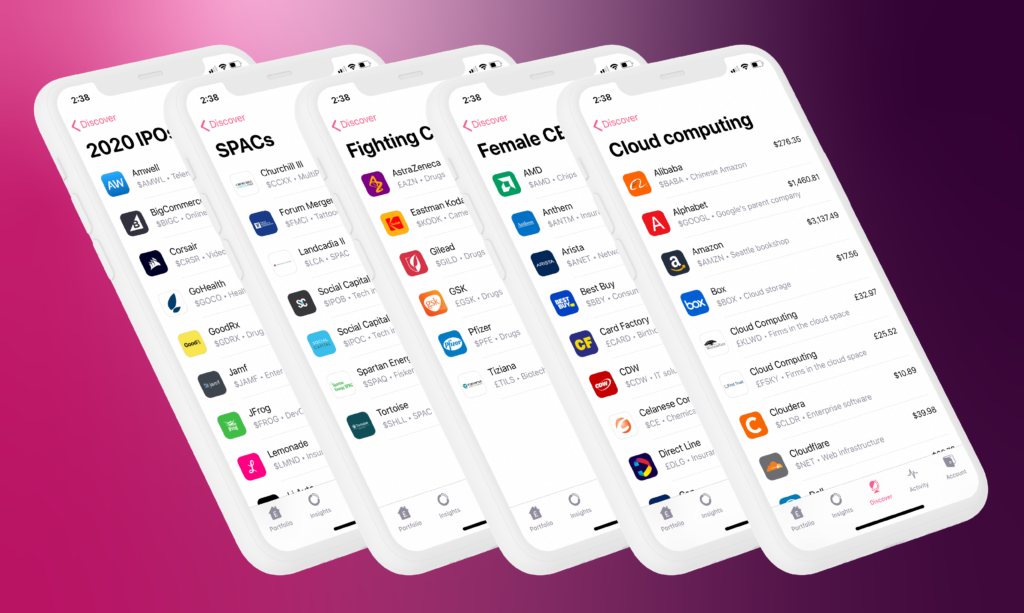

Curated Stock Collections

Beyond simply having a large number of stocks available to invest in, Freetrade also makes it incredibly easy to adopt stocks to fit personal user preference. With an upgrade to Freetrade Plus, users get quick access to specifically curated collections such as “Fighting Climate Change” and “Fighting COVID-19,” which help create a flow of investments for companies helping global causes.

Beyond this, there are also a variety of stock collections that are specific to certain industries or ongoing performance trends. As more stocks are added, a growing number of curated stock collections are certain to arise.

Limit Orders

In terms of day to day user experience, limit orders are one of the handiest features of Freetrade Plus. With a limit order, premium users can set stock prices to automatically buy and sell shares when they hit a predetermined price. Optimizing limit orders is one of the best ways to leverage new technology to easily make strong stock decisions.

In a “Buy Limit,” an affordable price is set so that a stock is purchased automatically when a stock dips to that level. Conversely, a “Sell Limit,” is set so that a stock is automatically sold at a price that will result in a profit. As most investors know, buying low and selling high will forever be the key to great investing.

Stop Losses

Much like limit orders, “stop losses” are an automatic way to optimize your portfolio with Freetrade Plus. A “stop loss” is a set amount for a stock price (below the current value), that will automatically initiate a sale if it is reached. If a company’s stock value is trending down, a stop loss will prevent you from losing too much before it’s too late, providing a nice safety net for risky portfolios.

Free Stocks and Shares ISA

Lastly, Freetrade Plus offers a completely free ISA account with its premium monthly payment. Although Freetrade’s basic platform offers ISA accounts at rates (£3 fee per month) well below the market average, free is a hard price to beat. Like in all ISA accounts, Freetrade Plus offers profits free of capital gains tax on investments up to £20,000 a year.

If you are an active investor that also holds an ISA account, Freetrade Plus’s price of £9.99/mo may be somewhat similar to what you are already paying. Adopting Freetrade Plus will give you access to all of the bonus investment features on top of a completely free ISA account.

Who Can Use Freetrade Plus?

Today, early access to Freetrade Plus is currently limited to crowdfunding investors who have earned lifetime access to the platform as a pledge reward. Freetrade Plus is scheduled to be launched to the public in Autumn of 2020, slowly rolling out to more and more users. To request an invitation to the platform, you can visit the Freetrade Plus registration page.

Freetrade Plus is limited to the same user base as the company’s ordinary services. Freetrade is limited to UK residents that are at least 18 years of age. Beyond that, Freetrade is also hoping to expand further into the European market.

What Are People Saying About Freetrade Plus?

Upon its initial launch to its own community of invested users, Freetrade Plus has received positive feedback as another forward step for the promising young company. To keep up to date with Freetrade Plus’s reception and rollout, you can visit the company’s Fireside Chat community message board.

What Are The Benefits Of Investing with Freetrade Plus?

- Commission Free Trading

- Expanded Stock Options (Beyond Regular Platform)

- Curated Stock Collections

- Priority Customer Support

- Advanced Bonus Features

What Are The Disadvantages Of Freetrade Plus?

- Still Working With A Limited Stock Portfolio

- £9.99 Per month may be too much for passive users

- Fairly New Platform

Freetrade Plus Alternatives

Of course, if you are looking for premium software to make the most out of your investments, Freetrade Plus is not your only option. For UK investors interested in a paid digital subscription, the following alternatives can be considered:

- Revolut

- DEGIRO

- Stake

- Robinhood UK

- Hargreaves Lansdown

Beyond these options, there are always going to be new and old methods for investing and saving money. If you’re not interested in public UK and US stocks and ETFs, perhaps you would be more interested in real estate or private investing.

Final Thoughts

For those who have not adopted the Freetrade platform already, we recommend trying it out before upgrading to Freetrade Plus. As the company continues to grow its enthusiastic user base, Freetrade Plus is likely to become one of the most popular premium stock trading platforms in the UK.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024