Fidelity Investments is one of the most well-known investment platforms in the country and operates internationally as well. Fidelity International is the foreign investment branch of this company and allows UK investors to invest their money through Fidelity’s large network.

So today we are going to talk about Fidelity Investments and give you the lowdown. We’ll cover the platform’s features, pros, and cons. Then we will give our verdict on whether the platform is worth using or not.

Fidelity: Overview

Fidelity Investments was first launched way back in 1946 in the US and launched its international branch in 1969. Fidelity International currently represents over 2.5 million clients and controls over £450 billion in assets under management. The UK is the single biggest country represented in Fidelity International’s client pool as over 1 million customers are from the UK.

Fidelity specializes in all aspects of wealth management, including SIPPs. ISA, and general investment accounts. Fidelity’s investment platform is called Fidelity Fundsnetwork. Compared to Hargreaves Lansdown (read our full review here), Fidelity has more clients in their investment platform and also controls more in assets.

Services Fidelity Offers

Investment ISA

One of the major services that Fidelity offers is its investment ISA. Fidelity ISAs let you invest up to £20,000 per tax year and have a minimum monthly deposit of £25. With the Fidelity ISA, you can invest your money in funds, unit trusts, and ETFs. You can also transfer in existing stocks and shares ISA from another provider, which is pretty handy. Fidelity ISAs also have very low fees to the tune of a 0.35% annual service fee or £45, whichever is more. If you invest more than £200,000 then you get a lower 0.20% service fee and if you invest more than £1 million then you do not have to pay any service fees at all.

Junior ISA

Fidelity also offers Junior ISAs that parents and guardians can start and control. Junior ISAs are in control of the parent until the beneficiary turns 18, after which they can take control of the funds and turn it into an adult ISA or withdraw the funds. Junior ISAs allow for up to £9,000 per tax year and require a £25 minimum investment per month. Like the adult ISA option. Junior ISAs let you invest in funds, ETFs, investment trusts, and transfers. Like a regular ISA, Junior ISAs get to experience tax-free growth.

SIPPs

Fidelity also offers Self Invested Personal Pensions (SIPPs) so you can open your own pension to plan for your future. Fidelity SIPPs let you contribute up to £40,000 per year and require a £25 minimum investment per month. Like all SIPPs, you get a 20% tax relief for any contribution that you make and you can get further relief if you pay a higher tax rate. The SIPP option lets you invest in ETFs, investment trusts, funds, shares, and more. You can start withdrawing from your SIPP when you hit 55 years old. You can also transfer in a pension from an external provider and manage it using Fidelity.

In addition to regular SIPPs, Fidelity also offers junior SIPPs that a parent or guardian can make on behalf of a child to help them get a head start on their retirement. Like with the regular SIPP, junior SIPPs have a 20% added tax benefit on all contributions up to an annual limit of £2,880.

International Trading Account

Fidelity also offers an international trading account so you can invest in all kinds of funds, including ETFs, and investment trusts from foreign sources. There is no upper limit to the amount you can invest internationally and you can start a savings plan for as little as £25 per month.

Research and Tools

Fidelity also stands out among companies because of its massive library of research tools for investments. Fidelity offers retirement planning calculators, videos and articles on basic and advanced topics in investing, and specific guides on how to run a SIPP or ISA.

There are also tools to help you identify which investments are the best choice for your needs and predictions about their performance in the future.

The best part of these kinds of tools is that they are designed for the non-expert so you do not need to have highly specialised knowledge to read the charts and use screening tools. Even if you aren’t a regular trader, you’ll pick up on how to use these tools very quickly.

Stand out tools included with the Fidelity platform include the Pathfinder tool which helps you choose funds based on your preferred risk and return. The Pathfinder tool also lets you choose between growth and income funds.

There is also the Investor Finder tool that gives you a roadmap of all the investments that you own. You can choose the investments that you want (ETFs, funds, trusts, or shares) and the screener tool can help you distil all important information about those securities that are relevant to your decisions.

Lastly, Fidelity has a daily market review that provides daily insights about the state of the market, investment ideas, personal finance tips, and more. The article database includes pieces written by experts in finance and financial reporting so you know that the advice is top-notch. In addition to the daily market view is an RSS feed that aggregates news related to investments all over the spectrum.

In other words, when you sign up for Fidelity you get access to a massive set of tools and resources for screening investments and performing market analysis. The research library and tools are probably one of the best and most unique features of the platform and are a great addition for both beginners and experts.

Other Fidelity UK Services

Retirement

Fidelity also offers comprehensive retirement planning services to help people with pension pots and taxation issues related to retirement. These services are useful if you have multiple streams of income for retirement and you need some extra help sorting through everything.

Wealth Management

Fidelity also has an entire suite of wealth management services for individuals with high net worths (£250,000+). These services include access to a personal financial manager, fund selection and portfolio administration, and much more. Individuals who meet the net worth criteria pay lower fees. If you have more than £1 million invested with them, then you only pay a total of £2,000 a year.

How Does Fidelity Work?

Fidelity works like most other investment platforms. You can go to the desktop site and start to make an account. To register an account with Fidelity you need to provide your National Insurance number and either a bank account or debit card to fund your investments. Once you enter that information, you can pick the kind of account you want to make, whether it’s an ISA, SIPP, Junior SIPP, or a general investment account.

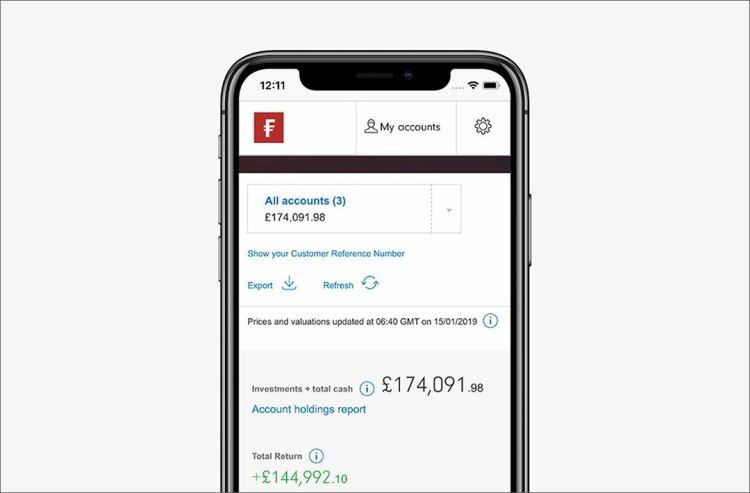

If you are having trouble deciding, then you can use the Pathfinder tool to make investment selections. Fidelity also recently updated their user interface, so the tools for selecting and screening stocks are much more intuitive and streamlined compared to a few years ago. The company also has a mobile app but we prefer the desktop version as it is cleaner and just works better.

How Much Does Fidelity Cost?

Like many online investment platforms, Fidelity charges a percentage fee based on the total assets you have under management. The annual services fee starts at 0.35% for any amounts under £7,000. Any higher than that, the annual fee is reduced to 0.2%. If you have more than £1 million invested in the platform, then you do not have to pay any service fees.

Also, Fidelity does not charge any fees for regular day trades. So you can buy, sell, and switch investments without incurring an extra charge. However, Fidelity does impose a £10 charge for inline deals, shares, ETFs, and investment trusts.

Most people end up paying around £45 a year for Fidelity services, which is very cheap for low account value. Obviously, the more money you have in your account the more you will pay in fees, but we feel that the 0.35%-0.2% fee is very agreeable.

Fidelity also has managing funds that cost as little as 0.06% in fees. Actual fund fees can differ based on the bid-offer spread, how well the security performs, and how much the individual fund manager charges.

So, while Fidelity does have a relatively low-cost fee structure, there are a handful of small fees that, while not very large themselves, can add up. So it is in your best interest to handle investments to minimise all these small fees.

Compared to Hargreaves Lansdown, Fidelity has lower annual account fees and lower trading fees. Also, Fidelity does not have a minimum account balance for regular trading accounts so you can get started with as little money as you want. Just make sure you have enough to cover any small fees you might incur from specific funds.

Is Fidelity Safe? Is My Money Protected?

Fidelity has excellent reviews from customers. They currently have a 4.0 out of 5 rating from over 1,830 reviews. The vast majority of reviews claim that the platform is very easy to use and that it is easy to buy and sell investments.

Many praise just how much the platform can do, including access to the analysis and screening tools. Some people say that the interface might be a bit intimidating at first because there is so much you can do, but once you get used to it everything flows smoothly. Several reviewers also highly praise the customer services.

As far as security and protection goes, Fidelity is regulated by the Financial Conduct Authority (FCA) and all accounts are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 in cash.

Also, Fidelity encrypts all your personal information on the platform using standard bank-level encryptions. So there is very little chance of your account being hacked unless you accidentally give your password or other login credentials away.

Fidelity Pros and Cons

Pros

- Easy to use. The Fidelity platform is highly streamlined and intuitive to use, even if you are not used to investing online.

- Low fees. Fidelity charges a 0.35% account fee but you can get a lower 0.2% rate if you invest more than £250,000. If you invest more than £1 million, then you do not have to pay an annual service fee.

- Lots of research. One of Fidelity’s best features is the massive research library. They have articles, videos, and information pieces on pretty much every topic related to investing.

- Great reputation. Fidelity has been around for a long time and they have a great public reputation and longevity.

- No Fidelity minimum deposit. You do not need to have a minimum deposit to open an account and trade stocks.

Cons

- Small fees. A Fidelity account for active traders has several smaller fees and trading costs.

- Limited investments. Fidelity has a decent range of funds and investments for a brokerage account, but they are limited compared to other third party providers.

Final Thoughts

Fidelity accounts and Fidelity funds are a great choice when you want to be an active trader pro.

You can invest your own funds using the platform for stock trading and stock research. The trade tools are great and you can use them to cultivate an investment strategy.

Fidelity also has experts to help you get investment advice and other wealth management and investment services. Fidelity is a great platform to manage investments and the tools they offer are among some of the best in the business.

So if you’re looking for new trading opportunities and trading ideas, then Fidelity investment is a good trading platform for the interactive investor.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024