If you have been paying attention recently, then you know that cryptocurrency is trading hot. Crypto prices have been growing steadily over the years thanks to new technology and platforms that make crypto trading easier and more accessible to the general public.

Coinbase is a US-based broker that specializes in digital cryptocurrencies. By using Coinbase, you can buy and trade cryptocurrencies with just a few clicks. Add in the ability to handle UK bank transfers and debit cards, and you have a crypto platform that seems very enticing.

In this article, we’ll discuss the types of cryptos you can buy/sell, how the interface works, and special features the platform has, and whether the platform is worth your time.

Coinbase Review: Verdict

So, is Coinbase worth using for UK citizens? We say yes. The platform is well-known, has high liquidity, and has one of the easiest, most streamlined UX for trading digital currencies. Despite the heavier fees compared to other crypto exchanges, Coinbase remains as one of the best cryptocurrency exchanges in the country and is a good choice for most people.

Coinbase: Overview

Coinbase is an online crypto broker based out of San Francisco in the United States Launched back in 2012. It is one of the first cryptocurrency brokers to gain a stronghold in the UK, as well as one of the most popular.

By 2013, the company had become the most funded bitcoin startup and the single largest cryptocurrency exchange in the world.

Coinbase currently boasts over 35 million users from over 100 countries worldwide and has more than £20 billion in assets under management.

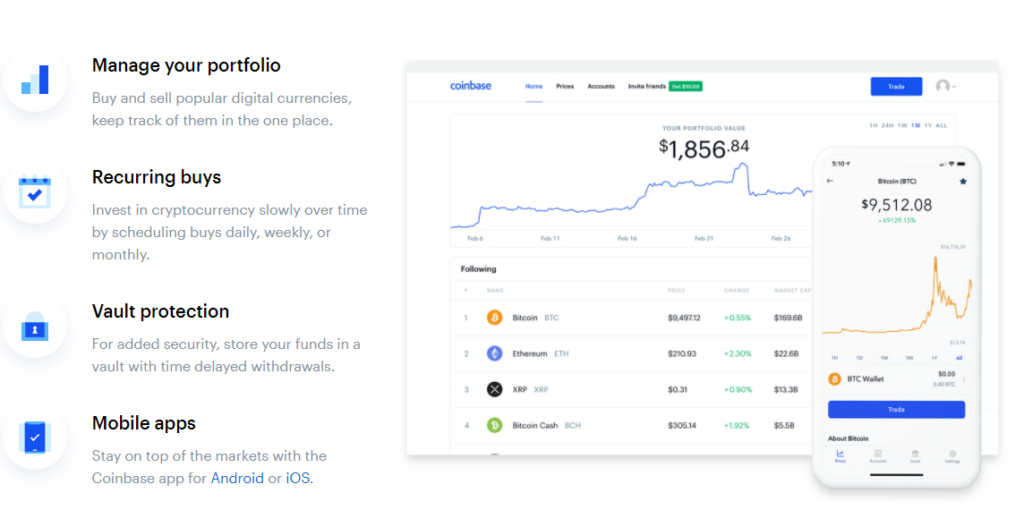

It can attribute this success to its simplified, streamlined interface that is meant to make crypto trading as easy as possible for those with little to no trading experience.

Coinbase is designed for accessibility. Creating an account takes just a few minutes and you can fund transactions with a regular UK bank account or debit card transfer.

Buying and selling crypto is as simple as making a few presses and swipes on your smartphone screen. Combined with low fees for crypto trading, it’s no surprise that Coinbase has become so popular.

The service also has a large library of resources and educational materials to help you navigate the cryptosphere.

How Does Coinbase Work?

It is easy to get started with a Coinbase account.

First, you download the app and will be prompted to make an account. Enter your first name, last name, email account, and set your password. The app will then send an email to verify your account, then you can set up a phone number for 2-factor authentication.

Once you have basic account details set up, you will be promoted to verify your identity. Coinbase requires you to upload a government-issued photo ID to show you are over 18 and to confirm your identity.

After that, you will fill out a short questionnaire with questions about your income, employment, and reasons for using Coinbase. The app uses answers to these questions to generate recommended investments that fit your preferences.

After you handle all verification, you can then link your payment method. For UK customers, you can link a standard UK bank account, SEPA transfer, 3D secure card, or a PayPal account.

Additionally, UK customers can store both GBP and EUR currency denominations in their Coinbase wallet, but the two folders have to be funded by different accounts.

It’s important to know that Coinbase does not accept physical checkers or bill pay for payment methods.

Once you have your payment method set up and authorized, you can start buying and selling cryptos. To make trades, select the “Buy/Sell” button in the top right-hand corner and you can browse various crypto denominations.

Coinbase currently supports most major forms of cryptocurrency, including Bitcoin, Ethereum, Litecoin, Atom Coin, and more.

When you find crypto that you like, you can select the Buy field under the asset listing and enter the amount of denomination that you want to purchase or select how much of your currency that you want to spend.

Select your payment method, click the Preview Buy button, then you can review and confirm your purchase. If everything looks in order, click on Buy and you are done.

You can also select whether you want the transaction to be a one-time purchase or a recurring purchase.

Coinbase partners with various payment services depending on your geographic location. In most cases, your funds will be immediately available after you sell, but you may have to wait a day or two depending on where you are, the time that you make the sale/purchase, and the amount you bought or sold.

Deposits from your bank transfer to your GBP wallet normally take about a single day to happen while EUR transfers from a UK bank account take 1-2 days.

Other Coinbase Features

Staking

Coinbase recently unveiled its Ethereum 2.0 staking feature which allows you to take part in the validation chain for a particular transaction.

Those who validate transactions on these blockchains can earn a staking reward. Users can earn anywhere between 3%-7.5% on ETH staking.

There is also no minimum transaction amount you must put up to stake on Coinbase. This staking function is currently in beta, but users can sign up on the waitlist on Coinbase’s website.

Coinbase Card

Users from the UK and Europe can also sign up for a Coinbase card that lets you spend money in your crypto wallet. Coinbase cards work much like normal debit cards and must be activated first when you receive the physical copy.

Coinbase cards are VISA and can be used anywhere VISA is accepted. There is also a monthly £200 withdrawal limit for free with a 1.00% fee for cash withdrawals after that. Typically, it takes about 5-7 days for Coinbase Cards to arrive in the mail.

Coinbase Pro

Coinbase also has Coinbase Pro, a special platform for trading cryptocurrency directly with other traders.

Whereas Coinbase pro is more like a traditional brokerage firm that lets you buy and sell crypto in fiat currency (i.e., government money), Coinbase Pro is specifically designed to let individuals trade crypto with each other.

Coinbase Pro is entirely free to use and does not require any subscription or monthly charges.

Coinbase Fees

Coinbase wants to make fees as unobtrusive as possible so typically, fees for things like miners fees and transaction fees will be determined based on how much the company plans to pay for each transaction.

Fees will always be different depending on specific factors like your location, payment method, and type of crypto purchase, but they will always be disclosed to you before completing a transaction.

In general, Coinbase charges one-half of a percent (0.5%) in spread fees for crypto purchase and sales. Actual spread rates may be higher or lower depending on specific market conditions.

They also charge a flat Coinbase Fee which depends on the total transaction amount.

For transactions less than £10, the fee is £0.99. For transactions between £10-£25, the fee is £1.49, for transactions between £25-£50, the fee is £1.99, and for transactions between £50-£200, the fee is £2.99. Coinbase charges either the flat fee or a variable percentage fee depending on which is greater.

So, here are some actual numbers to see how this would work out.

If you bought £100 worth of Ethereum, then you would have to pay a flat fee of £2.99 on the transaction or a variable fee. Variable fees can change depending on the day and specific market conditions. As of the time of writing, variable rates for UK customers are 1.49% for standard buying/selling and 3.99% for instant debit card buys.

- The good thing about this fee structure is that you can take advantage of lower variable rates to get a better deal.

- The downside is that fees are always changing so you are never actually sure how much you will have to pay in fees until you actually try to make the purchase or sale.

It can be a bit tricky to navigate if you like to be exceedingly mathematical and rigorous with planning your investments.

Coinbase also has a large article in their FAQ explaining exactly how its fee structure works, so they are very transparent about what you will have to pay.

Is Coinbase Legit? Is My Money Safe?

Yes, Coinbase is legitimate and they claim that your money will be safe with them.

Coinbase is authorized and regulated by the Financial Conduct Authority (FCA) and follows all relevant laws and regulations when trading cryptocurrencies.

The majority of Coinbase’s crypto reserves are held in “cold” storage with the rest in “hot” servers meaning that they are there to serve liquidity necessities for customers.

Coinbase says they insure all hot crypto so if this storage were breached, you would get your money back.

It’s important to realize that since crypto is not technically a currency (in that it’s not regulated by a federal government, it’s a digital currency), your investments are NOT covered under the Financial Services Compensation Scheme (FSCS).

However, we do need to talk about customer reviews.

We found a BBB page for Coinbase and here is what we found. They have a D- rating and a rating of 1.23 out of 5 from 120 customer reviews. Yeah, we know, that looks really bad.

Most negative reviews are about how Coinbase will lock people out of their accounts and not respond to queries to unlock the account. Other people report hackers getting into their account, stealing all of their money, and Coinbase not reimbursing them.

To be fair to Coinbase, they clearly state they cannot do anything if your account is compromised so they recommend customers take as many precautions as possible against account access.

It sounds like most people who are angry didn’t read the fine print and were not as secure with their account details as possible.

Coinbase Pros & Cons

Pros

- Simple interface. With Coinbase, it is very simple and easy to buy and sell cryptos. You can connect to a regular UK bank account or make transfers from a regular debit card. Transfers and purchases are completed quickly.

- A large number of support currencies. Coinbase supports most of the major cryptocurrencies and other not-as-common ones. You have a good selection of currencies to buy.

- Transparent fee structure. Coinbase’s fee structure is fairly complex but to their credit, they have a very detailed article explaining fees and giving specific examples on how fees are calculated. We understand that crypto fees can be complex because of the nature of the asset so it’s good they provide such an in-depth explanation.

Cons

- Customer service is bad. Coinbase’s customer service is hard to reach and takes a long time to respond to queries. Many customers also say that they just never hear back from customer support.

- Security issues. Many customers report Coinbase going back on their guarantee of insuring crypto funds. Others have reported their wallets have been hacked and they had money stolen from them with no response from Coinbase.

- Slightly high fees. Coinbase ends up having high fees compared to several other crypto exchanges. However, they do work to make sure you understand what fees you are paying.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

1 Comment