In the past, investing was something of a rich man’s game. Unless you had a lot of startup capital and knew the right people, it was very hard to get in on the ground floor of early-stage businesses.

That meant that only a relatively small group of investors and venture capitalists could take advantage of when a new company exploded in popularity as they had the capital and networking contacts to invest beforehand.

Crowdfunding is designed to flip this traditional business funding model on its head. With crowdfunding platforms, now the average person can get involved in early-stage investing and stake out some equity in a potentially successful future business.

In the UK, there have been several platforms dedicated to crowdfunding operations that have popped up in the last 5-10 years.

Most people are probably new to crowdfunding and don’t even know where to get started. So we put together this guide to the 6 best UK crowdfunding sites and which ones are worth trying out.

Also consider checking out…

What Is Crowdfunding?

In many ways, crowdfunding is exactly what the name makes it sound like. Instead of offering investment opportunities to rich investors and those who have the proper network contacts, crowdfunding is the process of opening up early-stage investing to friends, family, individual investors, and all other normal people.

Crowdfunding takes advantage of the connectedness of the internet and social media to find backers for a company to gain capital. Crowdfunding is meant to increase entrepreneurship by expanding the pool of available investors and not rely on the good graces of a handful of angel investors and startup investors.

Crowdfunding platforms are basically a massive forum where business owners can pitch their ideas to the public. If the public likes the idea, then they can invest their money if in.

So for companies, instead of trying to get money from a handful of already wealthy investors, you can get your capital from thousands of people in the general public.

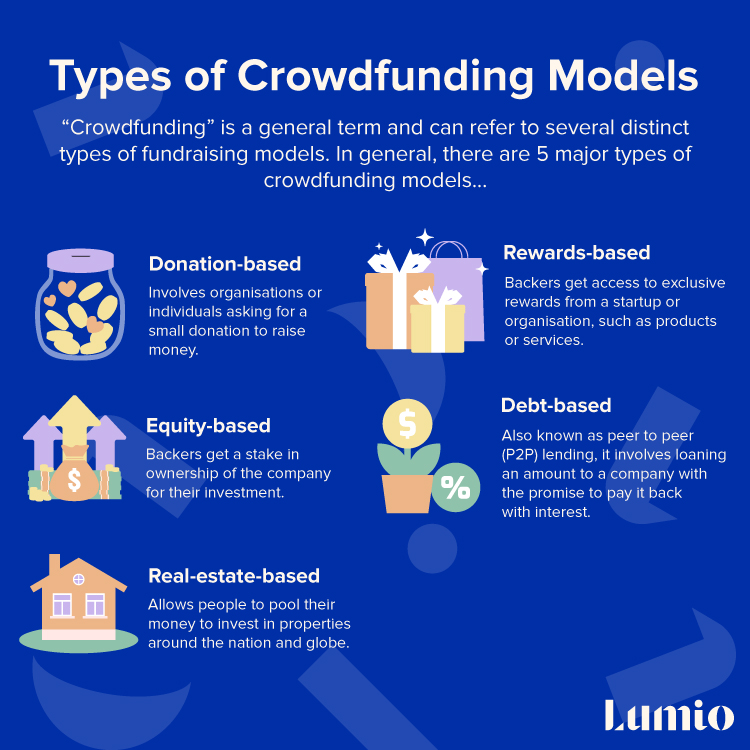

There are two major types of crowdfunding: regular crowdfunding and equity crowdfunding. With the regular model of crowdfunding, those who give money to the project might receive special discounts or rewards, but they do not own any equity in the company.

Donation and reward-based crowdfunding platforms are popular for creative projects. With equity crowdfunding, on the other hand, investors earn some equity in the project that they invest in.

Equity crowdfunding, also called peer-to-peer (P2P) lending, is more akin to the traditional model of equity trading on the stock market, just distributed over a larger network of people.

Within equity crowdfunding schemes, you have profit-sharing models and debt-based models. With profit-sharing joint revenues models, you are basically investing and getting a stake of equity (shares) in the company.

With debt-based models, you are loaning money to a company with the promise of them paying it back plus interest. This distinction essentially mirrors the distinction between investing in shares and investing in bonds in the traditional stock market.

Is Crowdfunding Legal?

Yes, in the UK, both donation-based and equity crowdfunding are legal and regulated by the Financial Conduct Authority (FCA). You can invest in a project on a crowdfunded platform and receive some equity in a company for your investment.

The UK was actually one of the first countries in Europe to pioneer equity crowdfunding and bring it under a legal scope. The FCA divides crowdfunding into two major types: Pre-payment and Investment-based crowdfunding and both have specific rules about the platforms that can facilitate them.

Even better, many equity-based crowdfunding platforms will give investors access to tax advantages such as deductions from income tax bills and reductions in capital gains taxes. You can read more about the specific crowdfunding regulations in the UK on the FCA’s website here.

Is Crowdfunding a Good Way to Invest?

Equity-based crowdfunding is inherently risky, as investing in a new startup is always risky. The benefit of equity-based crowdfunding is that you do not have to put in a ton of money. Most crowdfunding platforms let you invest as little as £10 in the project of your choosing.

Further, there is great potential for making large returns on your investment. Crowdfunding also tends to be a much cheaper method of getting equity in a company than traditional investment methods.

On the business owner side, crowdfunding is a fantastic way to put together the start-up capital for your venture.

Crowdfunding opens up a large pool of potential investors and crowdfunding platforms are excellent for marketing your projects to a wide audience, to build up brand recognition and momentum.

6 Best UK Crowdfunding Platforms

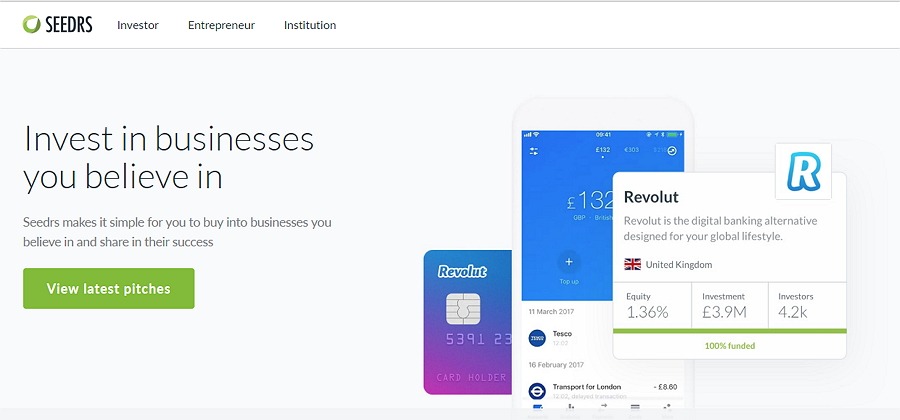

1. Seedrs

Seedrs is one of the most popular equity crowdfunding platforms in the UK and for good reason. Founded in 2011, the company has raised nearly £1 billion in funding for thousands of small and later-stage businesses.

The real draw of Seedr is how easy it makes crowdfunding. Once you make an account you can browse the marketplace for projects. When you find a project that interests you, you can invest the specified minimum amount and get a stake in the company.

The project owners determine their earnings goals, timeframe, and disbursed equity. If the project does not meet its earnings goal by the end of the time frame, then you get all your money back. That means that you only actually pay something if the project is successful.

Aside from the equity-based focus, Seedrs also gives investors some very nice tax advantages. Most Seedrs projects are eligible for the seed enterprise investment scheme (SEIS) which gives nice tax deductions for investments in start-up and early-stage businesses.

You can get up to 50% of your investment in a deduction from your income tax and there are also provisions to deduct from your capital gains burden.

Additionally, Seedrs offers a fully-fledged secondary market that lets you “offer investors in your business a chance to realise a return far earlier than traditionally possible”. This works by letting investors sell their shares to other Seedrs users. Not having to sit in your hands for an IPO or exit to sell your shares is a big incentive for investors, and could be an important feature to consider for your upcoming crowdfunding campaign.

They also recently announced full variable pricing, which lets you list shares at a premium (or discount) to their current valuation.

“As Seedrs is the shareholder in your company, as opposed to the underlying investor on the campaign (because of our nominee structure), they can sell their shares without causing any burden to the business at all. Seedrs provides the platform for them to list the shares, the documentation to sell and transfer beneficiary ownership to a new recipient, and a secure payment system.”

Seedrs

If that wasn’t enough, Seeders also goes the extra mile to handle all the legal/documentation aspects of your funding efforts, as well as give you a platform for marketing.

2. Crowdcube

Crowdcube is another equity crowdfunding platform in the UK that has received tremendous success in the past 10 years that it has been live. Crowdcube, like Seedrs, gives the average Joe the opportunity to invest in early-stage startups and get a stake of equity in return.

In fact, Crowdcube and Seedrs recently announced a merger/acquisition that is set to happen in early 2021 which will bring an even larger crowdfunding market to the UK public.

Crowdcube also makes sure to thoroughly vet all companies they feature on their platform to make sure that their claims and projects are fair and not misleading.

Crowdcube allows both joint-venture profit share models (equity-based models) and fixed-income models. The former is similar to investing in shares of the company while the latter model is like investing in corporate bonds.

As such, the fixed-income model has less risk but less chance of a big reward. But it’s nice that they offer an alternative funding option for those who want to minimize risk while guaranteeing a return plus interest on their money.

3. Zopa

Zopa is currently the UK’s largest debt-lending crowdfunding platform. Unlike equity-based crowdfunding, debt crowdfunding involves giving a loan to a company with the promise to pay it back plus interest.

As such, you won’t get equity when you invest through Zopa but you get a guaranteed payout plus some interest. Zopa’s model is unique in that it goes beyond traditional bank loans and matches lenders with borrowers directly online.

Borrowers get a low-interest loan and those who give money get a guaranteed payout. It’s a win-win for all parties involved and has the added benefit that you would be helping a local small business.

One of Zopa’s more enticing features is the lack of early repayment fees. Applying for loans on Zopa will also not affect your crest rating so business owners have a lot of good reasons to pitch their projects on Zopa. It is a popular platform for creative campaigns.

4. Syndicate Room

Syndicate Room is another equity crowdfunding platform but this one has a slight twist to its structure.

Syndicate Room only lists companies that are already backed by pro “angel investors” who have invested in the project and take an active role in gauging its viability.

The twist is that the public who invest in the project get the same economic terms for investing. This does two things: 1) it allows that you can be more confident in a company because it already has the backing of some of the best investors in the market, and 2) it allows for a more “sophisticated” selection of investment opportunities.

When you use Syndicate Room, you can be sure that you are investing in a company that has a fairly decent shot of succeeding because it has already been vetted by the pros and they have already made a commitment.

Syndicate Room currently has a portfolio of over 200 companies and over 30,000 members who have invested over £260 million since 2013. They estimate that you can get a target return of £3.50 for every £1 invested, which is an amazing return rate.

5. Funding Circle

Funding Circle is another P2P crowdfunding platform that allows businesses to receive microloans from the general public with the promise of paying them back with interest.

Funding Circle was built with the idea of putting businesses directly in touch with lenders so they would not have to go through the slog of applying for loans from traditional banks and lending institutions.

They are currently one of the world’s leading P2P platforms and have raised approximately £250 million in capital for businesses since their founding in 2011.

Funding Circle has received a lot of positive attention from the business community due to its very low-interest rates compared to federal small business loans and how it can make cash available very quickly.

The one caveat is that businesses need to have been in operation for at least 2 years before they can ask for money on Funding Circle. From the investor side, this is a good thing because it means you will be investing in qualified businesses that have a good track record of finances and are likely to pay off their loans in a timely and prompt manner.

6. Indiegogo

Indiegogo is a rewards-based crowdfunding platform that is based out of the US and has a solid foothold in the UK.

Indiegogo is not an equity-based or debt-based crowdfunding platform so backers do not get equity or guaranteed loan repayments. Instead, backers for a certain crowdfunding project are promised certain rewards for meeting a donation threshold.

Indiegogo is extremely popular in the creative industry, including tech, music, and gaming sphere so backers often get early and exclusive access to cool products along with merchandise.

So, you won’t be getting any equity if you back a project on Indiegogo but you might get exclusive access to a new video game, software package, or something similar.

On the small business side, Indiegogo is a good place to raise funds because it is very popular, has relatively loose restrictions and regulations on who can make a campaign, and offers a good platform for marketing your projects and keeping track of your campaign progress.

Indiegogo is also a good choice because you can get money for your projects without having to promise equity in your business.

Conclusions

When it comes to small business funding, crowdfunding fundraising is the way of the future. The decentralized and communal nature of crowdfunding has made it an extremely popular method of funding small businesses and a great way for the regular person to invest their hard-earned money in a successful enterprise.

UK crowdfunding sites are great for backing creative projects and are great for raising money for startups and other fundraising projects.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024