If you live in the UK, chances are you don’t need much of an introduction to Barclays. They’ve been a financial mainstay in the UK for as long as many of us have been alive.

But what about Barclays Smart Investor? This particular product prides itself as a good option for entry-level investors looking to enter the world of the stock market, but are they worth your time? In this article, we break down the service piece by piece, and help you decide whether Barclays Smart Investor is right for you.

Let’s dive in.

Barclays Smart Investor: Verdict

No minimum investment fee, trustworthy, and easy to use. What more could you ask for in a brokerage service? As long as you don’t have plans to invest outside of the UK, Barclays Smart Investor is sure to serve you well. And to top it all off, you have a wealth of top-tier tools at your disposal.

Perhaps best of all, you don’t have to pay expensive fees to get your foot in the door with Barclays investment solutions. It’s an affordable starting point for beginners who are serious about learning to invest but don’t have a lot of capital.

Pros & Cons

| Pros | Cons |

| Extensive stock history | Questionable customer service |

| Affordable fund fees | UK trading only |

| No withdrawal fees | No mobile app |

| Minimal bond fees | |

| No inactivity fees | |

| Low stock fees |

How Does Barclays Smart Investor Work?

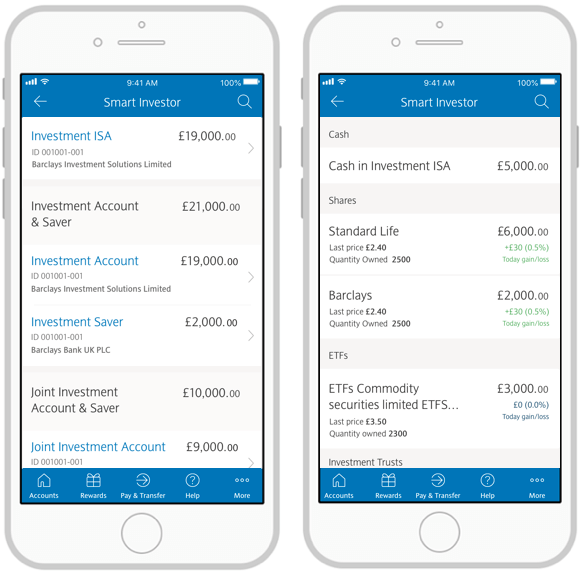

Barclays Smart Investor is a web-based application that allows you to trade on the stock market. Its ease of use and user-friendly interface make it an excellent fit for beginners with a limited understanding of stocks, trading, and investments.

As an investment arm of Barclays, the Smart Investor tool is one of the most trusted in all of the UK. And among all the banking services that provide investment products and services, Barclays Smart Investor is most similar to other high-end professional investment platforms.

You’ll find many of the features and options that are typical of those speciality investment platforms. From the website, you can invest in London Stock Exchange (LSE) companies.

If you wish to branch out to international trades, you’ll need to establish a separate Saxo Capital Markets account. This is because Barclays Smart Investor is limited to UK-based trading.

Full Review

Given the fact that Barclays Smart Investor is UK-only, you’re limited to UK products and services. However, Barclays Smart Investor gives you 34 handpicked funds to choose from right from the start.

Normally, we might say to do your homework on these initial funding options.. but the Barclays Smart Investor Funds List is a trusted resource, as the company has technically been around for centuries. Yes, centuries.

Barclays’ roots can be traced back to the late 1600s. With that kind of experience behind them, you know this banking giant must be doing something right.

Moreover, the Barclays funds list features some of the most promising options. In fact, they were handpicked by Barclays due to their likelihood of producing secure profits in as little as five years. If you still can’t decide which funds are right for you, we suggest you first seek independent investment advice to familiarise yourself with the field.

Registration (8/10)

The Barclays account is completely online and easy to use, which means you can easily complete the registration process directly from your computer or smart device. Compared to Barclays’ primary competitors, the Smart Investor account opening time is reasonable.

Registration Completion

Whereas Charles Stanley direct may take as little as one day or as much as three, Barclays has an average of fewer than three days. For comparison, Hargreaves Lansdown averages one day to complete registration.

So, depending on whether it takes one to three days to complete registration with Barclays, it’s basically within the same timeframe as the competition.

Registration Requirements

Now, an online broker’s account like Smart Investor is very similar to a regular bank account. Opening it is an online process, at least to some extent. Some brokers only need you to provide or open a new Gmail account. Others, however, require a few days to complete the process.

Not only can you deposit funds in it, but you can also keep your financial assets, like stocks or foreign exchange (forex) positions. And best of all, opening a Barclays Smart Investor account is entirely free.

With that said, there are a couple of factors you want to keep in mind. As we’ve already touched on, Barclays deals in only one currency. If you want to branch out into other currencies and sectors, you’ll need to register with Saxo Capital Markets.

Maybe not the biggest deal in the world, but for beginners who are new to the world of investing, carrying more than one account might prove frustrating and too convoluted for some.

So while it’s true that you are limited to a single base currency, there’s no minimum deposit required. This means anyone can begin trading without the need for a considerable investment starting out. What’s more, the Barclays Smart Investor platform is incredibly user-friendly.

Account Requirements

In order for you to open a Barclays Smart Investor account, you’ll usually need to provide proof of identity and residence. In an ideal world, this process should be completely digital. However, the most challenging aspect is that some brokers will eventually want you to provide physical documentation (or physical copies).

Let’s take a moment to examine the documentation requirements and what you’ll need to provide to Barclays when registering. The following are acceptable documents:

Proof of Identification:

• Driver’s license

• Passport

Proof of Residency:

• Utility bill (electric, water, etc.)

• Bank statement

Opening a Barclays Smart Investor account is completely digital. Therefore, you can complete the entire identity verification process on the company’s online web trading platform. When you have finished the open Barclays Smart Investor account process, you must first transfer your starting deposit from your bank account to your Smart Investor account.

And you must do this before you can start trading. Remember, Barclays does not require a minimum deposit. Therefore, if you want to invest or trade a small amount of money, Barclays is the perfect broker with which to do so.

Even if Barclays required a minimum deposit amount, we’d still agree that it is a good broker for beginner investors to introduce themselves to the world of investing. Keep in mind that you can always start out investing a small amount.

And as you become more acclimated to managing investment decisions, you can always put additional funds into your investment account at a later date.

Ease of Use (7/10)

Admittedly, Barclays’ fee structure may be complex to some users. But if you’re able to familiarize yourself with them, you may just find that they are more than reasonable — especially when compared to the fees and costs of other investment companies.

Trading Funds and Shares

For example, investors who choose to invest £100,000+ will likely find Barclays Smart Investor significantly cheaper when trading funds.

But what about share trading?

Even there, we found Barclays to be an affordable option for those with portfolios valued below £50,000.

If your portfolio is larger than that, we recommend checking out some of the other trading platform options designed to complement them. Plus, you’ll save money in doing so.

To that point, Barclays Smart Investor might not be the best web trading platform for people looking to strictly trade funds and who have smaller bank accounts.

Clients with Larger Portfolios

If your portfolio is greater than £250,000, share trading can get expensive rather quickly. Moreover, Barclays Smart Investor’s regular customer service platform is unsuitable for investors who don’t want to get their hands dirty.

Instead, you can choose to put your savings into the market while maintaining your investment decisions and investment portfolio. A list of platform funds and five standard investment portfolios are essential for novices. And the simple fee structure allows beginners to invest confidently, without the unwanted stress of hidden fees.

Features (7/10)

Research Tools

Search for stocks, ETFs, structured products, and more in the comprehensive Barclays Smart Investor Research Centre. The Advanced search tools makes it easy to navigate the system.

Barclays Smart Investor also lets you choose stock notifications to keep you informed of the latest market trends. If you want to look around at what’s available, the Research Centre has a list of the lowest and highest funds among various industries.

You’ll also find fund tools such as industry performance tables, giving you plenty to play around with as you learn the ins-and-outs of the platform.

Customer Support (6/10)

Barclays Smart Investor features an extensive FAQ (Frequently Asked Questions) list. Each section takes you to the appropriate page based on your enquiry. They also have an operational video library that can help you with various aspects of the investment platform.

Smart Investor Research Centre

For example, you can quickly and easily learn how to manage your investment account settings, use the Research Centre, and more. Beginners will especially appreciate the comprehensive nature of this support feature.

Email, Chat, and Direct Line

And if you can’t find what you’re looking for, Barclays Smart Investor offers a direct customer service line that you can reach between the hours of 7:30 am and 7:00 pm, Monday through Thursday. Or, you can reach the direct line on Fridays between the hours of 7:30 am and 6:00 pm.

Alternatively, you can always reach out to Barclays Smart Investor online service via email. If you prefer slightly more direct virtual contact, a chat feature is also available through the company’s website.

Pricing Structure (7/10)

When compared with savings accounts, the various costs associated with investment can seem daunting. Barclays attempts to use a straightforward pricing structure to help you understand the value of your investment.

The fees you are charged depend on a few different things, such as:

- The frequency of your investment

- The value of your investment

- What you’re investing in

Barclays charges a daily management fee based on the end-of-day value of your investment account. Cash isn’t included in the calculation, but the minimum fees listed below apply from the moment you transfer existing investments to your account or transfer money for the first time.

Moreover, your fees get calculated every month on the anniversary day of your first investment account opening. Barclays will notify you when due, which is 15 after being notified.

How the Fees Work: Examples

Below are some of the maximum fee and minimum fee options you’ll across in your investment journey.

Customer Fees

Funds: 0.2% p.a. (Funds refer to Unit Trusts & OEICs only)

Other Investments: 0.1% p.a. (Other investments refer to all asset classes other than funds and cash)

Minimum Monthly Fee: £4 (The minimum monthly fees apply only when you add cash or investment to your account)

Maximum Monthly Fee: £125

Transaction Fees

Funds (Online): £3

Other Investments (Online): £6

All Automated Regular Investments: £1

All Investments (Telephone Transactions): £25

Cost to Invest up to £24,000 (If Making 2 Transactions per Year)

Customer Fee: 0.2% p.a. (Minimum £48 p.a.). You pay £48 p.a.

Transaction Fee: £3 trading fees. You pay £6

Total: You pay £54

Cost to Invest up to £48,000 (If Making 4 Transactions per Year)

Customer Fee: 0.1% p.a. (Minimum £48 p.a.). You pay £48 p.a.

Transaction Fee: £6 transaction fees. You pay £24

Total: You pay £72

What Other People Are Saying…

Most users agree that Barclays is a solid choice for first-time investors. Its pricing structure can feel convoluted at times, but Barclays tried to make it as straightforward as possible. The curated Barclays funds list is ideal, as it provides newcomers with a simple setup for getting started.

The lack of international equities is a bit of a letdown. But for learning to trade in the UK, Barclays Smart Investor will serve you well.

FAQ

Is Barclays Smart Investor safe?

Yes, especially considering Barclays’ reputation and extensive history.

Is Barclays Smart Investor expensive?

Since there isn’t a universal cost to using Barclays Smart Investor, its fees depend on your investment habits. Thankfully, there’s a cap on fees, so you don’t have to worry about getting overcharged.

How do I withdraw money from my Barclays Smart Investor?

Simply log into your Smart Investor account in My Hub and select Portfolio. Then, click Manage and select Withdraw.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

Hello everyone it is possible to retrieve your stolen bitcoins. I never believed in bitcoin recovery because I was made to understand that it is not possible. But sometime in February I fell for a binary options scam which promised a higher return and I lost close to $75,000. I read an article on (reddit) as regards to a recovery expert and genius so I reached out to Mr. Adam Wilson, and to my surprise I got all bitcoins recovered within 42hours frame. I don’t know if I’m allowed to share the links on here but you can contact him if you are finding it very difficult to withdraw your funds at, adamwilson. trading AT consultant. com All Thanks To Him