In the past, investing used to be a huge ordeal. You would have to go through a physical exchange or buy the services of an expensive brokerage manager. Stock trading was something that most only wealthier people of means engaged in.

Thanks to the internet though, now you can invest from anywhere on the globe. The best part of online brokerages is that they streamline the process of trading and are often much cheaper than using a traditional brokerage.

AJ Bell Youinvest is an investment platform in the UK and is one of the leading wealth management companies. AJ Bell Youinvest offers a wide range of investment options for the average person, all wrapped up in an elegant and user-friendly online platform.

So, today we are going to take a look at AJ Bell Youinvest and discuss whether it’s a good option for low-cost trading. We will talk about the investment products they offer, whether they offer financial advice and any other features that make managing and trading your investments simpler.

We will then give an overall rating and say whether AJ Bell Youinvest is a good value for investors.

This is our AJ Bell review.

AJ Bell Youinvest: Overview

AJ Bell is one of the largest and most well-known online investment platforms in the UK. The company was founded in 1995 and first launched its online platform in 2000.

AJ Bell Youinvest was one of the first online SIPP providers in the UK and currently serves over 1 million customers and manages nearly £90 billion in assets.

AJ Bell’s online investment platform is called Youinvest and is a member of the London stock exchange. The purpose of the online platform was to give average people a quick and simple method to save for retirement.

AJ Bell Youinvest was acquired by Interactive Investors in 2017, but the company has still managed to maintain a strong foothold in the investment sector with its flagship Youinvest SIPP products and growing list of investment products.

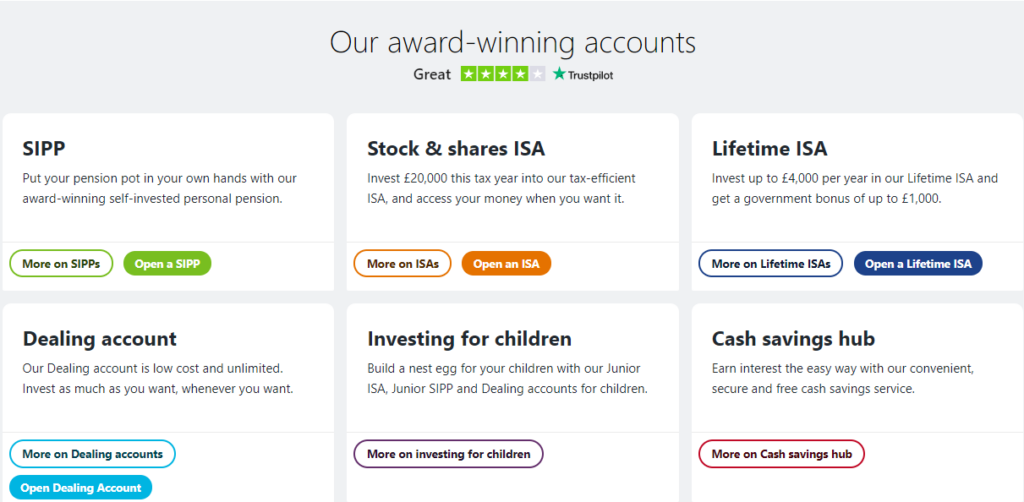

What Services Does AJ Bell Youinvest Offer?

Here is a detailed rundown of the different products and services AJ Bell Youinvet offers.

SIPP

The flagship product from AJ Bell is their self invested personal pension (SIPP). These pensions are DIY retirement accounts and let you save money until the age of 55.

Like all kinds of SIPPs, AJ Bell’s SIPPs give you tax benefits. It works on the standard 80/20 allowance meaning that the government will match you £20 for every £80 you put in.

AJ Bell SIPPs also have some good features. For example, you can roll-over other pensions to your AJ Bell SIPPs. It is free to make SIPP accounts and buying investments starts at as little as £1.50.

In addition to regular SIPPs, AJ Bell Youinvest also offers Junior SIPPS for minors. Junior SIPPS are a tax-efficient way for you to save for your child’s future. Junior SIPPS get tax relief at a 20% rate and so the maximum annual contribution is £3,800.

Stocks and Shares ISA

As you might expect, AJ Bell Youinvest also offers standard stocks and shares Individual Savings accounts (ISAs). AJ Bells’ stocks and shares ISA is low cost and give you a wide range of control over your investment selection.

AJ Bell’s marketplace allows stocks and shares as well as over 2,000 funds, investments trusts, and ETFs. AJ Bell’s investment platform accounts have won several awards for best self-managed retirement accounts.

AJ Bell Youinvest also has a special feature for those who invest a lot with the platform. Customers with more than £4,000 get access to the free Shares magazine (more on that later).

You can also transfer your shares from a different ISA provider. The annual contribution limit for ISAs is £20,000.

In addition to the standard stocks & shares ISA, AJ Bell offers Lifetime ISAs for younger people who are looking to boost their savings for retirement.

With regular savings, it costs around £1.50 per deal for £25 per month of investments. That is the same rate as Hargreaves Lansdown.

The Lifetime ISA has a 25% contribution, meaning that for every £4 you put in, the government will match an extra £1.

That’s pretty darn generous, and for a person who saves £4,000 a year, that is nearly £30,000 extra in savings by the time retirement draws near. Lifetime ISAs have a maximum contribution limit of £4,000 per year.

One last feature of the ISA is the Junior ISA. The Junior ISA is a method for you to save money for your children’s retirement. Contributions for Junior ISAs are capped at £9,000 per year and they safeguard the money until the recipient on the account turns 18 years old.

Dealing Account

AJ Bell Youinvest also has what they call a “Dealings Account,” which is a special version of their investment service accounts.

Dealings accounts are designed to give you even more flexibility with your investment options and include shares, funds, investment trusts, bonds, and more.

The best part about Dealings accounts is that you can pay into them as much as you want and there is no extra penalty for accessing your money.

With the Dealing account, you get overseas share trading in over 24 international markets and can invest as little as £25 per month. AJ Bell also allows you to open joint Dealing accounts with a spouse to get even more utility.

Cash Savings Hub

Lastly, AJ Bell Youinvest offers what they call a “Cash Savings Hub”, which is essentially a platform to help you find the best savings accounts and rates.

The Cash Savings Hub hooks you up with AJ Bell’s network of partner banks and you can apply for their high-yield and instant savings accounts quickly through the platform.

The cash savings hub is a good way for you to try out several different financial arrangements so you can find the best one that works for you.

You also do not have to go through the hassle of filling out paperwork and forms for the different accounts. All you need is an existing AJ Bell Youinvest investor account.

Here are some quick examples of the kinds of rates you can get with the Cash Savings Hub.

- Interest rates at partner banks hover between 0.5%-1.1%, which are all fairly decent APY rates for savings accounts.

- Terms on high-yield savings account range from less than a year to over 4 years as well.

AJ Bell Funds

One of AJ Bells’ most popular features is its selection of passive funds to invest in. The passive funds are portfolios managed by AJ Bell Youinvest and can be split into three types of growth:

- Cautious: Cautious portfolios focus on stable long-term growth and mostly consist of fixed income assets like bonds.

- Balanced: A balanced portfolio is focused on a decent mixture of growth and risk. It consists of a more equal blend of lower-risk assets like cash and bonds and higher-risk assets like equities.

- Adventurous. The adventurous portfolio is meant to be focused on high-risk high-growth and consists mostly of equities and investment trusts with low exposure to cash and fixed-income investments.

As the name implies, passive funds are meant to be left alone to accrue wealth over time. You can sort of just “buy and forget” passive funds.

In a lot of ways, AJ Bell’s passive funds are kind of like roboadvisors that another provider like Betterment offers.

AJ Bell also has what they call an “income portfolio” that is focused on generating consistent income through things like dividend shares and bond interest payments.

According to AJ Bell Youinvest, the income investor portfolio can generate a consistent income of 4% a year, which is exactly the sweet spot for retirees.

Investment Tools

One last major feature AJ Bell offers is its library of financial research and investment screening tools offered. AJ Bell Youinvest includes market news, investment articles, alerts, videos on various topics, and a list of the top buys and sells, compiled by AJ Bell’s in-house team of analysts and researchers.

Educational articles range in complexity from beginner to advanced topics but most seem to be focused on first-time investors.

How Much Does it Cost to Use AJ Bell Youinvest?

Unfortunately, AJ Bell Youinvest is not free to use and has some charges and fees. As far as the annual platform fee goes, the company charges a different percentage depending on the number of assets you have under management:

- <£250,000 – 0.25%

- £250,000-£1 million – 0.10%

- £1 million – £2 million – 0.05%

- >£2 million – no charge

As you can see, the more money you have invested through AJ Bell, the less in annual fees you have to pay. Also, at the lowest rate of 0.25%, fees are capped at £42 a year.

AJ Bell also charges a one-time fee for various services on the platform.

- Funds – £1.50 per deal

- Shares – £9.95 per deal

- Online investment – £1.50 per deal

- Transfer assets – £9.95 per holding

- Shares (10 or more per month) – -£4.95 per deal

In general, the Junior ISA and Junior SIPP accounts have the same money charges as their normal variants but have different annual contribution limits.

Is AJ Bell Safe?

Yes, AJ Bell is a legitimate banking institution and financial brokerage firm.

They are regulated by the Financial Conduct Authority (FCA) and all your money is covered by the Financial Services Compensation Scheme, up to a certain cash limit.

AJ Bell actually puts your funds in a third-party holding institution separate from the company’s funds so your money is protected if the company goes under and creditors cannot seize your assets.

AJ Bell also claims that in the unlikely event that the company is wound down, they have the cash reserves to meet all associated costs.

As far as security goes, AJ Bell uses 256-bit encryption on the mobile deal app that also automatically logs you out after 15 minutes of inactivity.

If you save your login details to the app, it creates an encrypted key that gets stored on your phone that only they can decrypt. So, AJ Bell is about as secure as any other online trading or banking institution.

Also, AJ Bell has a good reputation with customers. They have a 4.1 out of 5 rating from over 1,000 reviews on TrustPilot.

The majority of investors praise the platform for being efficient and easy to use and a number of reviewers praise the layout of the mobile app as being intuitive and responsive, with even more claiming that the customer service is responsive and genuinely helpful.

So, it’s safe to say they have great word-of-mouth endorsement.

AJ Bell Pros & Cons

Pros

- Easy to use. The best feature of AJ Bell is that it’s easy to use. Even if you have no previous experience with share investing, you can get started trading fast with an AJ Bell passively managed fund.

- Good customer service. The customer support team responds quickly to queries and is helpful at troubleshooting problems. Customer service is a big factor so kudos to AJ Bell.

- Good selection of investments. AJ Bell has a good investment selection ranging from bonds and fixed-income investments to shares, investment trusts, and ETFs. They do not seem to offer some derivative options though.

Cons

- Fees. Most of the fees are small but there are a lot of them including annual fees and per deal fees.

- Limited research. While AJ Bell does offer research and technical articles, they are somewhat limited compared to what you could get from some other trading institutions.

So, Is AJ Bell Any Good? Is It Worth It?

So, is AJ Bell worth it? We say yes.

It is a good trading platform that has a good per trade rate that is perfect for the interactive investor. Youinvest AJ Bell has good value for the price of share dealing and the trading fees are reasonable compared to other platform trading fees.

So, if you want to make your money work for you, then AJ Bell is a good choice of trading platform.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024