Even though they come around at the same time every month, it’s far too easy to slip up on bills. Thankfully, there are plenty of options on how to be reminded. You can use the age-old solution, a pen and a calendar. However, there are more modern options available — many of which do a whole load more than simply remind you that it’s time to pay up.

If you’re looking for a way to set reminders for yourself rather than relying on someone else, check out the best bill reminder apps available for Android and iOS users!

Why Use a Bill Reminder App?

Bill reminder apps are just one of many types of personal finance apps available. They’re able to be set to remind you when your bills are coming due, and will prompt you to pay them. Some more advanced personal finance apps include bill reminder apps, and there are standalone reminder apps available, as well.

Depending on how involved you want the app to be, you can choose just to use simple reminder apps or dive deeper into the capabilities of those advanced personal finance apps.

Additionally, some bills are on cycles that don’t follow the typical monthly payments. When bills only need to be paid every few months or annually, it can be challenging to remember them.

Missing Bill Payments Can Be Costly

When you’re late on bill payments, costly late fees can add up. Over time, these can make an impact on your finances. Additionally, if you miss a payment on your utilities or entertainment services, you risk losing access, which can be a pain.

The last major impact that missing bill payments can have is on your credit. A lower credit score can make your life a lot harder in the long run. Your credit has to be preserved so that you can finance a house or a car. Paying voluntary bills can help you stay on top of your credit and your finances.

The Best Bill Reminder Apps for Android and iOS

We’re covering the best bill reminder apps for both Android and iOS users. Not all apps are available on each platform, but we’ll be sure to specify who they’re available for! Get started below!

Lumio

Available on: Google Play Store and the App Store.

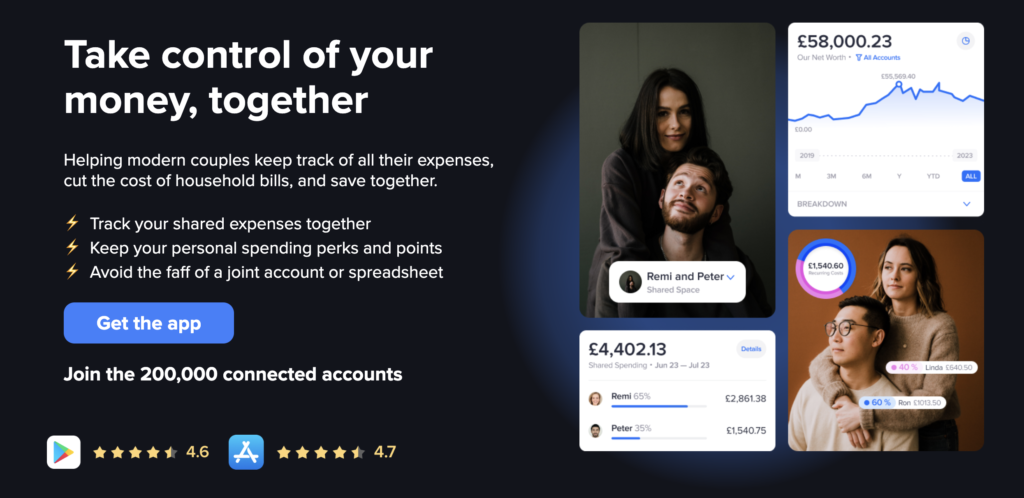

1. Lumio: Couples Finances

Lumio is the simplest way for anyone in a relationship to manage their money. With a secure private and shared space, Lumio makes it easy for couples to track, share and save together as a couple – without giving up their financial independence.

Lumio allows you to connect your bank accounts, savings, credit card, pension, and investment accounts in one place and you can share any bill, expense or a whole account into your Shared Space with your partner.

What Is Lumio?

Lumio helps modern couples keep track of all their expenses, cut the cost of household bills, and save together.

It’s not a traditional budgeting or bill management app as it does so much more than simply tracking your spending and finances.

Lumio’s main feature is called Spaces. Spaces allow you to switch between your personal finances and your shared finances. So, whether you are in an early relationship and splitting the occasional meal out or living together, Lumio gives you all the flexibility to manage money together as a couple.

Lumio already has more than 200,000 connected accounts and was recently shortlisted for Personal Finance App of the Year at the British Bank Awards. Lumio is a registered Agent of Moneyhub – which is authorised and regulated by the Financial Conduct Authority – so you know you’re in safe hands.

Lumio Key Features

Private Space and Shared Space

- A single source of truth for your personal and shared finances. Effortlessly switch between a secure view of your personal and shared finances.

Track all your accounts and balances in one place

- Connect any bank, savings account, credit card, investments and pension, and you can share any balance, transaction or information you want to share with your partner. You are always in control of what you share.

- Lumio has a list of more than 200 Financial accounts to connect from. Want to add an offline account or asset? You can create a manual account to track your account balances and net worth.

Track & cancel wasteful household bills & subscriptions

- Once you securely connect your account, Lumio automatically identifies any bills, subscriptions or direct debits, and picks out all your recurring payments.

- You can share any bill with your partner, and Lumio will keep track of all your bills as a couple, so you always know where you stand.

- Lumio lets you know when your bills go up, so you can deal with it on the spot.

Real-time expense tracker

- You can share any bill, expense, or an entire list of transactions from your account into your Shared Space.

- Lumio keeps track of any shared expenses with a live breakdown of who paid for what – and a real-time I Owe You tracker so you always know where you stand.

- Full list of automatically categorised spending.

Wallet

Available on: Google Play Store and the App Store

Wallet is one of the more popular bill reminder and finance apps available currently. It helps you track your expenses in addition to allowing you to set reminders for your bills. Wallet has many different features and settings not available on the other bill reminder apps listed here, like allowing you to see all of your money in real time. Like Evernote, it also allows you to keep track of all of your statements, invoices, and various financial documents. Wallet helps you keep everything in one place.

Fudget

Available on: The App Store

Fudget is more than just a bill reminder app, it’s an involved personal finance app. Fudget makes budget planning easy, and lets you set reminders for your bills, all in one application. Because it’s designed to be a full circle personal finance app, Fudget can be used to track income, expenses and schedule bill reminders.

Fudget is only available to iOS users through the App Store.

Evernote

Available on: Google Play Store, the App Store, and PC

Evernote is a great note taking app that can be used on your smartphone as well as your personal computer! While it gives you all the tools to keep your life organised, you can use it as a bill tracking app with enhanced documentation features. It lets you upload receipts, bills, and invoices, so that you can track your spending and track your bills. Reminders can be set to notify you on your smartphone and your computer, so you never have to be without the application. Evernote is one of the old guards of life optimising apps — we highly recommend it!

Reminder With Alarm

Available on: Google Play Store

Reminder With Alarm is the simplest bill reminder app available to Android users. It’s not specifically developed for bill reminder purposes, however. Its main function is as a general reminder app, meaning that it can be used for reminders of all kinds. One of the uses suggested is as a medication reminder app. However, that doesn’t mean it can’t be used for bills as well! If you want to make paying bills easier, this tracker app can do that.

Easy Bills Reminder

Available on: Google Play Store

Another reminder app that’s exclusive to Android users is Easy Bills Reminder. This application is meant to be your personal assistant, and can help you schedule weekly, monthly, and yearly reminders. Because the cycle can be customised, it makes paying bills on your time easy! The application will also send you notifications ahead of time at intervals that you choose. Easy Bills really does make paying bills easy.

Mobills

Available on: Google Play Store and the App Store

Mobills is a particularly popular finance app for both Android and iOS users. It lets you track expenses and bills in one place, making keeping track of your finances easy. One of the most unique features of Mobills is the ability to manage multiple accounts on the same device. This means that you can separate your personal expenses and your business expenses, or you can run accounts for multiple family members. If you need more versatility than what a standard bill reminder app would give you, check out Mobills.

Spendee

Available on: Google Play Store and the App Store

Spendee is an app that lets you manage all of your money tracking needs in one place. This app is useful for more than just setting bill reminders, it also lets you track spending and income. It allows for connection with your other financial applications, so all of your bank information and bills are up to date within the app. One of the best parts about the app is that the synchronisation is automatic, and categories are created based on your purchases. You can also add in cash expenses manually so that all of your spending is accounted for.

Home Budget Manager

Available on: Google Play Store and the App Store

Home Budget Manager gives you more than most of the other applications on our list. In some cases, the tools that it provides are too much. However, if you like the ability to track expenses, set bill reminders, and create reports, then Home Budget Manager is an excellent option. Bill reminders can be created on individual cycles, and can also be removed or edited at any point in time. Home Budget Manager keeps all of your home’s expenses and income in one place.

Money Lover

Available on: Google Play Store and the App Store

Money Lover lets you create bill reminders as well as track all of your spending. Additionally, it comes with a notepad app so that you can keep track of any discrepancies. Money Lover is an excellent option for people who need to manage their finances on the go.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024