Interactive Investor is an online investment service based out of the UK. With Interactive Investor, you get access to DIY tools to help you make winning investment picks. Interactive Investor has also become popular due to the in-house recommendations and research they offer.

In this article, we take a look at Interactive Investor and break it down into bite-sized chunks. We’ll talk about its features, pricing, pros, and cons. We’ll then give you our verdict on whether Interactive Investor is worth your time (and money).

Who/What is Interactive Investor?

Interactive Investor is an online investment and research platform based out of the UK. Interactive Investor was created back in 1995 and has since served over 300,000 customers. They also recently acquired rival investment platform TD Direct, meaning that Interactive Investor has one of the most engaged communities in the UK investment sphere.

They also acquired Alliance Trust Savings (ATS) back in 2019, which merged the two largest retail investment platforms in the country, Interactive Investor currently has over £36 billion in assets under management and is the second biggest investment platform in the country.

Interactive Investor has also won several awards for its low-cost investing model, including:

- ADVFN – Best Stockbroker for International Dealing

- ADVFN – Best Low-Cost Stockbroker 2020

- Shares Awards 2020 – Best Stocks & Shares ISA provider

What Services Does Interactive Investor Offer?

Interactive Investor Account

Interactive Investor is an execution trading platform, meaning the trading accounts are the main attraction. Interactive Investor trading accounts give you access to a huge range of individual shares, ETFs, funds, and investment trusts. You can hold up to 9 currencies in your trading wallet, which reduces the need for annoying forex fees. When you open a new account with Interactive Investor, you get £100 in free trades which you can use to buy any kind of investment the platform offers. The ability to store up to 9 currencies in the same wallet is a great feature and is one reason why Interactive Investor is so highly rated for international trading.

Stocks & Shares ISA

Interactive Investor also offers a very favourable Stocks & Shares ISA. With the ISA account, you can make up to £20,000 per year in tax-free investments in a wide range of securities, including funds, ETFs, individual shares, and ETFs. The Interactive ISA has a minimum contribution of £25 per month, which is very low compared to some of the other major brokerages that offer ISA accounts. You can have an ISA account up and running in just 10 minutes and control your ISA from the same place you control your general investment account.

Junior ISA

Interactive Investor also offers Junior ISAs for saving for your child’s future. Parents can open a Junior ISA from their account and keep control over it. Junior ISAs have a maximum contribution of £9,000 for the current tax year. Like the regular ISAs, Junior ISAs have a £25 minimum monthly deposit. When your child turns 18, all the proceeds in the Junior ISA can be transferred to an adult ISA or withdrawn.

SIPPs

Interactive Investor also started offering self-investment pension plans to those saving for retirement. SIPP investments qualify for tax relief for up to £40,000 per year or up to 100% of your annual income, whichever is higher. Anyone who pays the basic tax rate will also get a 20% match to any of their investments. So for example, if you invest £8,000 then you will get an extra 20% to make it £10,000.

Higher rate taxpayers can also qualify for additional relief through their annual tax return. SIPPS have a minimum deposit of £25 and when you sign up for a SIPP account, you get £100 in free trades for your investment of choice.

Company Accounts

Interactive Investor also offers company accounts, a feature that isn’t often seen on other investment platforms. With a company trading account, you can trade under the name of a UK Limited Company. Like regular trading accounts, you have a wide range of investment choices including funds, trusts, shares, and more. Up to 4 individuals can be placed in control of a company account, so you can use the platform to become a funded trader with some larger company.

Pension Trading Accounts

Lastly, Interactive investor offers pension trading accounts which allow investing in assets like property. These accounts allow you to invest in assets that you cannot invest in with the regular SIPP account.

You can also connect a pension trading account with a SIPP or SSAS that is held by a preferred provider, not just Interactive Investor.

Model Portfolios

In the past, Interactive Investor had a selection of 12 pre-built portfolios that were created by their research team. They have since shaved their model portfolios down to 4:

- Active Growth

- Active Income

- Low-cost Growth

- Low-cost Income

So, what’s the lowdown? Well, growth-oriented portfolios put an emphasis on foreign and domestic shares that are poised for growth, while the income portfolios are meant for generating passive income through things like dividends and bonds. The two active profiles involve more risk but also have a greater potential return.

One interesting thing about these portfolios is their composition. They are made out of ETFs, unit trusts, investment trusts, and a mix of other passive tracker funds and active funds. This setup gives each portfolio a highly diversified composition and an advantage when it comes to performance.

In fact, you can actually just look at the portfolios, then take the info and build your own portfolio on a different platform. In other words, you don’t even need to sign up with Interactive Investor to benefit from their investment selections.

II Super 60

The Interactive Investor Super 60 is the company’s version of the Hargreaves Lansdown Wealth 50 (read our full Hargreaves Lansdown review here), a measure of some of the best-performing investments on the market.

The II Super 60 contains a mixture of both passive and active funds, so it can appeal to any type of investor. Investors can use the II Super 60 to vet potential investments for their portfolio and see which ones are a good choice. The II Super 60 is chosen by the company’s in-house team of experts and is vetted purely for quality and performance.

The II Super 60 was created in response to the claim that the Hargreaves Lansdown Wealth 50 is not necessarily chosen for potential returns but for the interest of fund supermarket’s profits. As such, the II Super 60 tries to be very transparent with their selection criteria and claim that their selections are based purely on helping you outperform the market.

Ethical Investing

Interactive Investor also has ethical investing as a major focus. To that end, they have a huge curated list of over 140 ethical investments that span a wide range of asset types.

These investments include companies that traffic in renewable energy, affordable housing, gender equality, and social governance.

Interactive Investor promises that these funds are not ‘greenwashed’ and that all funds are genuinely ethically managed.

If you consider yourself an ethical investor, check out these other articles we’ve written:

How Does Interactive Investor Work?

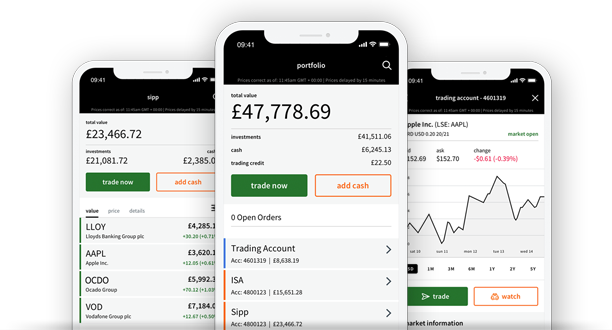

Interactive Investor has a simple, streamlined setup meant to make investing as easy as possible. When you sign up for an account. You choose whether you want to open a general investment account, ISA or a SIPP. Once you make your account and provide details, you can connect a bank account and start funding your own investments.

On the main account dashboard, you have a lot of options. You can view all your previous trades with the transaction history tab and look at all your documents in the document history tab. You can also take a look at the research account tab to look at investment research and news.

Also, from the main dashboard, you can make a Virtual Portfolio where you can select shares and other investments to make a watchlist.

The virtual portfolio is basically a faux portfolio you can use to keep track of investments and project what your earnings might be for a particular portfolio.

All of these features are wrapped up into a single, streamlined interface that works for both desktop and mobile. Interactive Investor also has an app for smartphones and tablets that has full functionality.

Interactive Investor Pricing

Interactive Investor has a simple and transparent pricing structure. They charge a flat fee of £9.99 per month for a regular investment account, which comes with 1 free trade a month.

They don’t charge anything for regular investment trades but they do charge a £7.99 fee for ETF trades, investment trust trades, and US share trades. They also charge a £0.99 fee for dividend reinvestments.

The next plan level is called Funds Fan and costs £13.99 a month and comes with 2 free fund trades per month.

The highest plan is the Super Investor plan and costs £19.99 per month and comes with 2 UK, ETF, or fund trades for free. The Super Investor plan also reduces fees for ETF, funds, US shares, and international trades to £3,99, £3.99, £4.99, and £9.99, respectively.

The way this plan works it is in your best interest to use your free trades each month. Either way, if you only stick with regular trades, then you do not have to pay a fee on those transactions.

These three service plans are available for each major kind of investment account they offer: trading accounts, ISAs, and SIPPs. So, if you want to have both an ISA and SIPP trading account, then you would have to pay £19.98 per month (or about £239 per year) for both.

Is Interactive Investor Safe?

All accounts held by Interactive Investor are covered under the Financial Services Compensation Scheme (FSCS) and are protected up to £85,000 in cash. Also, Interactive Investor has cash help in a pool with other customers to reimburse customers in case of financial impropriety or some other problem.

Who Is Interactive Investor Best For?

Interactive Investor is probably best for DIY investors who want to manage their own portfolios. The platform gives access to a broad range of investments that you don’t normally see in an online platform such as unit trusts and investments trusts. The fixed fee platform and free trades per month are also a good idea for active investors. If you use your free trades every month, you are getting your full money’s worth with the monthly subscription prices.

Also, the fixed fee nature means that Interactive Investor can be the cheapest platform, depending on how much money you have held with them. Once you have about £50,000 with them, the flat fee structure is cheaper than paying a percentage of assets under management.

Of course, this also means that the £9.99 fee can be a large chunk of your assets if you have a small portfolio.

Interactive Investor Pros and Cons

Pros

- Large investment selection

- Streamlined interface

- Flat, fixed monthly fee structure is easy to understand and transparent

- Large database of research articles and stock recommendations

- II Super 60 is a great resource for vetting selections

Cons

- Fees can be a lot if you have a small portfolio

- Must pay for each kind of account

- Fee for dividend reinvestment

Final Thoughts

So, is Interactive Investor worth it? We say yes, the platform is a great idea for DIY investors that want to actively manage their funds.

With Interactive Investor, you can take control over your personal finance journey, with minimal trading fees and an interactive investor forum.

Whether you want a stocks and shares ISA, free research account, or invested personal pension, this online investment service is one of the best interactive investor platforms with low trading fees and stellar features.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024