In today’s fast-paced economy, people are always looking for efficient ways to store and save money. While our parents’ generation might have found comfort in traditional brick and mortar stores, millennials like to take full advantage of the internet.

Given that today’s workforce has to be incredibly mobile, it’s no surprise that they prefer online banks to older, physical branches.

An online bank provides several benefits. First, your money is available from virtually anywhere.

Second, online banks do not have to deal with the overhead of having a physical branch, so they can pass those savings on to you in the form of great savings rates and interests.

Third, online banks are usually a lot easier to open a bank account with. The registration process is quick and they have pretty much all the functionality of a traditional bank account

In this article, we are going to talk about Monese. Monese was one of the very first online-only banks in the UK and has experienced a lot of growth in the 7 years that it has been active. The main motivation behind Monese was to make it easier for customers to access their money wherever they need it, but have they succeeded? Let’s find out.

Expect a rundown of features, pros, and cons, plus our verdict on whether Monese is worth checking out. This is our Monese review.

Also, consider checking out:

Monese Overview

Monese is an online-only bank based out of the UK and was founded in 2014 by Norris Koppel. He founded the company due to his dissatisfaction with the traditional banking sector.

Koppel was frustrated by his inability to open a bank account without certain documents like a utility bill or UK credit history. Without a bank account, Koppel was unable to rent an apartment or get a job.

So, Koppel decided to launch Monese as an on-demand banking service. Since launching, Monese has expanded across the channel to mainland Europe, and in 2016, the company won the European Fintech Award Best Challenger Bank. By 2017, the company had facilitated over half a billion pounds in transactions.

The whole point of Monese is to offer an easy and accessible bank account. Anyone can make an account, regardless if they have a utility bill or credit score to check. Customers can open an account in either GBP or EUR and can keep money in two currency denominations at once.

So if you live in the UK or Europe and need a quick way to access your money, then Monese is a viable choice.

It is also a great bank account if you travel around a lot and do not have time to waste looking for physical bank branches to access your funds. To date, Monese has served over 1 million users and over 3,000 people make accounts every day.

Monese has also recently added a Mastercard debit card that is accepted in over 200 countries around the world.

How Does Monese Work?

Monese is designed for simplicity. On that front, anyone living in the European Economic Area (EEA) can open an account with Monese through their mobile app or via their desktop site.

You do not need to have proof of address to open and you don’t have to have proof of a UK account or credit score.

After downloading the app, follow the step-by-step instructions to make an account. You will have to take a selfie with your phone’s camera and take a picture of an ID document like a national ID card or passport from any country.

The requirement for legal documentation is to prevent money laundering activity on the platform. You also have to provide a unique valid email address and have a valid phone number so you can receive text messages.

In some cases, you might be required to do a video call to verify any information. Overall, opening an account is much easier than at a standard UK bank with a UK account.

Once your identity is verified, then you can get an account number and a sort code. From there, you can start making deposits and setting up your account details.

You can make payments, send payments and pay utility bills, but you will need to receive your contactless debit card., which the company will send to you. It should arrive in about 14 days internationally and then you can activate it using the special 4-digit code.

You can then use the debit card like you would normal debit card payments. You can make payments, ATM withdrawals, use it for online buying, and more.

All of Monese is handled through the companion app. The app is well organized and has clear tabs for all the features and sections.

Monese also supports Google Pay and Apple Pay non Monese accounts so you can make contactless payments through your Monese account. This streamlined approach is a great benefit and one of the best features of the platform.

Monese Account Features

Accounts

Monese offers a wide range of personal accounts, including instant accounts, joints accounts, and savings. They also have a business account option.

Instant

Instant accounts are the main account option with Monese. You can make an instant account for free and keep a multi-currency wallet for buying in different countries.

You can make withdrawals from this account anywhere in the world, but there are monthly limits on withdrawals depending on which plan you pick (more on that later). The instant account can be used like any other debit account; to make purchases, send payments, pay utility bills, etc.

It is compatible with contactless payment so you can use your Monese instant account for an instant bank transfer.

Savings

Monese also offers savings. You can set up different accounts for savings goals to help keep you on track.

You can set up new savings pots directly from your phone without any extra sign-up features and create up to 10 pots for each currency account. In other words, you get a very flexible method of saving and meeting several money goals.

Debit Card

One of Monese most well-known features is their contact-less payment card you get when you make an account.

You get this card no matter the kind of account you have and it will be sent to you within 14 days. If you have the free version of Monese, then you will have to pay a £4.95 delivery charge.

The debit card also lets you do cash top-ups and can be used as a normal bank card.

Money Transfers

Monese also has a built-in currency exchange function so you can request and send payments to people all over the world.

Currently, with Monese you can send money in three currencies (EUR, GBP, RON) and can receive money in 20 currencies, including AUS, BRL, CHF, DKK, BGN, SEK, TRY, and USD.

Monese charges different exchange rates depending on which level account you have, but the difference between the two is approximately paying an extra 2-3% per transaction in extra currency exchange fees.

In addition to Monese-to-Monese transfers, you can hook up your Apple Pay or Google Pay account to make contact-less payments with other individuals.

What Are Monese Fees?

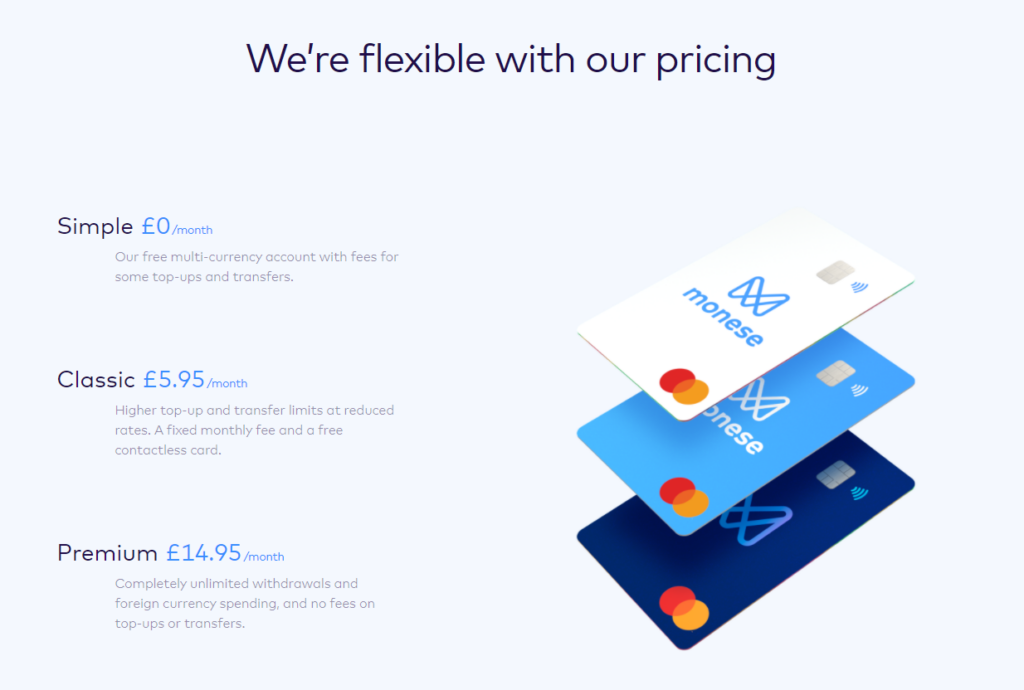

Monese offers three account tiers with different perks and benefits.: Simple, Classic, and Premium.

The Simple account is the lowest tier option and is free to use. You do not have to pay any monthly fee to open a basic account with Monese. With the Simple option, you get a free contactless debit card and have a £200 ATM withdrawal limit per month. (After £200 you have to pay a 2% ATM fee.)

You also get up to £2,000 in foreign currency transfers every money for free, with a 2% charge on further charges.

Also, the basic Monese account gives you free and instant currency bank transfers to Monese accounts.

The Classic account is the next tier and costs £5.95 per month. The Classic account comes with everything the Simple Monese account has but has higher monthly cash withdrawal limits.

You get up to £900 a month in free ATM withdrawals per month and up to £9,000 foreign currency card spending for free.

The Premium Account costs £14.95 per month and comes with free ATM cash top-ups and foreign currency card spending, no matter the amount. It also leverages a higher monthly price to eliminate bank card fees completely.

No matter which option you go for, you will get access to free virtual cards, Apple & Google Pay compatibility, multilingual support, instant bank transfers, and direct debits/standing orders.

Is Monese Legitimate? Is My Money Safe?

Yes, Monese is 100% legitimate and your money is safe with them.

The company is regulated by the Financial Conduct Authority (FCA) and the relevant financial authorities in other countries and they follow all relevant laws and regulations surrounding their activity.

Monese uses two-factor authentication to protect access to your account and you can also set up a face ID log-in and fingerprint lock. Monese also restricts your access to accounts to one phone at a time so nobody can take your credentials and log in on another device without you knowing about it.

There are also a few administrative features for security. If you lose your debit card you can lock it from the app so no one can use it and you can set things up to get instant push notifications about transactions on your phone.

Monese is also a member of Cifas, a not-for-profit membership organization that fights against identity theft and fraud.

So yes, your money is safe with Monese. Their security is state of the art and there are several levels to account access that prevent unauthorized access to protect you and your money.

Monese Pros & Cons

Pros

- Easy to make an account. You do not need proof of address or a UK credit score to open a Monese account. Instead, you just need proof of EEA residency or a passport.No paperwork or unnecessary meetings required.

- Instant access. Monese makes it easy to access your money whenever you want it. You can instantly make deposits or ATM withdrawals from anywhere on the globe and can send international money transfers to up to 20 different currencies.

- Free debit card. No matter the kind of Monese account you have, you will get a free contactless debit card for making in-store purchases. Monese also has a ‘virtual card” which is a unique 16-digit card you store on your phone via the app and can use as a physical card.

- Highly accessible. Monese’s app is available in over 20 languages and works in countries all over Europe. It is one of the most accessible money apps we have seen and that makes it very flexible. You can transfer free foreign currency through the app and connect to non Monese accounts.

- Savings accounts. Monese accounts make it easy to save for different goals. You can make different savings pots for different things and keep tabs on your progress towards saving goals.

Cons

- Minimal features. Monese is basically just for checking and savings accounts. It does not have all the fancy features that a full-scale banking institution has. It does not offer loans or credit cards and you don’t have access to special high-savings accounts like CDs and money market accounts.

- Free account is limited. The free Simple account is limited in its features. You basically only get access to the basic account, debit, and savings features, and the ability to transfer money.

- Limited cash withdrawals. Unless you have a Premium account, then you are limited in how many cash top-ups you can withdraw a month. On the free plan, you can only withdraw £200 per month.

Conclusions

So is Monese a good platform for free foreign currency transfers and money transfers? We say yes.

Even if you don’t have a credit history, you can open Monese accounts for free to transfer money and to use for currency transfers. Monese will not subject you to a credit check for an account opening and they give you a good interbank rate on currency exchange fee.

Monese can be used without an account fee to send money abroad in a much more efficient way than a standard bank transfer. The company also has good customer service and the app is well made.

Customer service is available 24/7 and customers get a nifty card. It’s a good option for sending money abroad.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024