Trading stocks in the UK and Europe has proven to be a bit of a hassle for decades. Clunky user interfaces, high trade fee costs and just a general lack of education have all resulted in low stock ownership among EU and UK citizens compared to its US counterparts.

Fortunately, a few tech startup companies have come into the space to try and make regular trading easier and more accessible to European citizens.

Freetrade boasts that it can make investing “simple, beautiful, and free.” Are they telling the truth or laying it on thick? Let’s dive into Freetrade and discuss their pros, cons and whether it’s a wise choice for you.

P.S. Check out our full review of Freetrade Plus here.

What Is Freetrade?

Freetrade launched in 2018 with the singular purpose to make stock trading easy and more affordable. Freetrade is a mobile platform that allows users to buy and sell stock, simple as that. Users can deposit funds and start trading common stock on the same day in markets all over the world. The platform has proven to be pretty popular and has amassed a user base of 150,000 strong and crowdfunding has raised more than £25 million in funding since 2015.

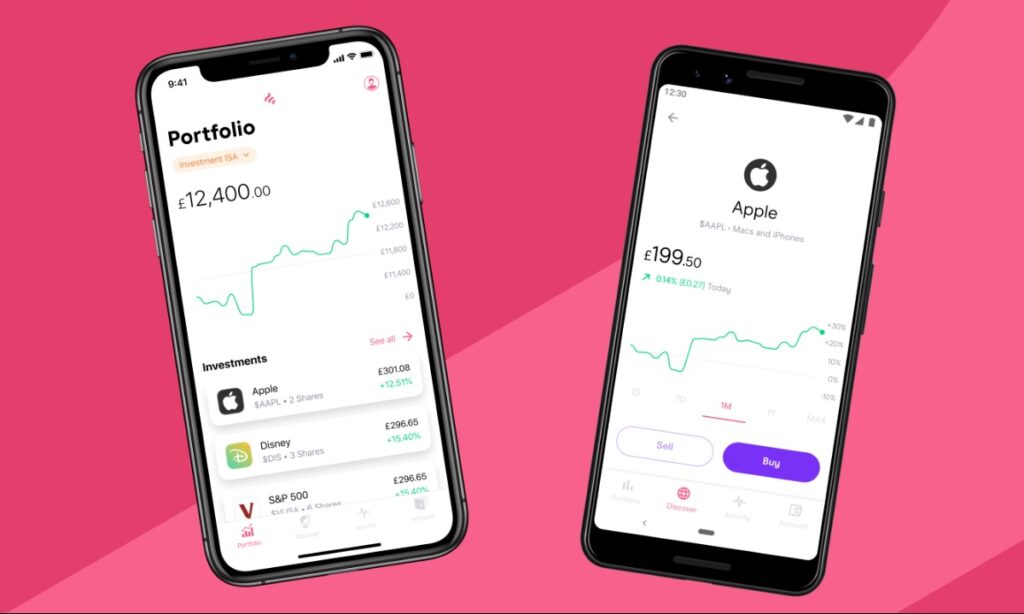

Freetrade offers commission-free trades on over 1,000 stocks and ETFs. The trick is that it puts all the tools you need for investing all in one simple app interface. Freetrade has selections from popular ETFs in US and UK exchanges. Freetrade is aimed at younger users who want an intuitive and simplified approach to building wealth.

How Does Freetrade Work?

After downloading the app, the next thing you have to do is set up an account. Setting up an account is straightforward and involves the basic identity checks like name, address, and some proof of identity. Keep in mind that Freetrade does not have a website with a trading platform; it is all app-based. So if you want to trade it will have to be from the mobile app.

Freetrade currently offers only standard trading accounts but plans to introduce new subscription plans in the near future. The standard account has 0 subscription fees and gives access to the catalog of stock and ETFs. Customers can set up ISAs as well.

Once your account is up, you need to fund it. Freetrade can handle most payment options including cards, bank transfers, and Google/Apple Pay. There is no minimum account balance so you can start investing with as little as £2 if you want. Freetrade allows for fractional share trading for both US/UK stock and ETFs.

Freetrade is focused solely on shares and ETFs, so you cannot invest in bonds or mutual funds.

This means that the value of pledged assets can change before you actually get them.

Freetrade has been well received for its intuitive app interface. The app actually went through a pretty thorough early access testing process so they have done a good job of working out the kinks based on user feedback.

Selling a share takes literally 4-5 taps on your screen. Withdrawing money is also pretty simple. You can actually withdraw into the same account from which you deposited funds and transfers are free. A standard bank transfer takes about 3-5 days but you can request a same-day transfer. Same-day withdrawals cost £5 a pop and you have to make the request before 2 pm for it to go through. You also have to wait for 2 days to withdraw any cash you get from a trade. So if you make £100 of a trade one day, you have to wait 2 days before you can get that money.

Freetrade also lets you invest in ISAs. ISAs grow tax-free and are a good way to start saving for retirement. Freetrade does charge a monthly £3 fee on ISAs. There is a useful option to transfer your existing ISA over the Freetrade.

As of February 2020, Freetrade made an exciting announcement that orders became commission-free for everyone

Additionally, they intend to roll out more features, including:

- Fractional shares. They were in the very first crowdfunding pitch deck in 2016, and they are launching in weeks.

- A LOT more stocks. From thousands of US stocks, to even more UK, as well as European and Asian ones, they are all on their way. We are prioritising the first batch of US stocks that have been the highest voted by the community.

- A premium account. We’ll only be a sustainable business by developing our revenue streams. Basic Accounts will remain free, forever, and in the next few months, we will offer you an advanced account that you’ll find too good not to pay for.

Is Freetrade Legit?

Absolutely, Freetrade is a legitimate organization and is registered and regulated by the Financial Conduct Authority (FCA), the UL’s highest authority on financial and stock-related matters. Freetrade must follow FCA rules about segregating client money and up to £85,000 of your investments are protected by the Financial Services Compensation Scheme (FSCS) in the case that Freetrade goes belly up (this won’t insure you from losses due to bad investments though).

It is actually interesting how Freetrade is set up to protect customer investments. When you invest with Freetrade, any stock or ETF you buy is actually held by a company Freetrade Nominees Limited with you listed as the beneficial owner. FNL is not a trading company meaning that it cannot create liabilities of its own. So this means that if in the unlikely event Freetrade fails, creditors cannot come after customer assets.

The story is similar when you invest in US stock using the platform. US shares are held at a third-party broker registered by the SEC (the FCA of the US) that likewise is a non-trading entity. It’s an interesting take on company structure that allows Freetrade to pull off the bulk trades it does and protect client money.

What Fees & Charges Does Freetrade Have?

Freetrade does not charge annual account fees so any money they get comes from fees on ISAs, and fees from instant withdrawals. Here is a quick rundown of what exactly you get charged for:

- Basic trades: free

- Basic account: free

- ISA: £3 monthly fee

- Same-day transfer: £5

- Bank transfers: free

- Forex rate: Spot rate plus 0.45%

So you don’t have to pay anything to set up a basic Freetrade account and start trading. You do have to pay a monthly £3 if you want to set up an ISA and enjoy some tax-free growth. When you buy US stock the exchange rate gets reflected in the price.

So far, Freetrade only has its basic account. They plan to unveil “Freetrade Alpha” in the near future which will serve as their ‘premium’ account service. The service plans to include free ISA accounts and unlimited instant trading for £10/mo or £100/yr if billed annually.

So whenever Alpha hits the shelves, it will likely be more suited to people who want to maintain a higher trading volume.

What Else Does Freetrade Do?

At this point, Freetrade only focuses on stock and ETFs. There are no options to purchase bonds, options, futures, or any other securities. Freetrade hopes to expand its catalogue of available investments in the near future as the app grows.

Frankly speaking, Freetrade does not do much else. There are no real analytics tools so you are kind of on your own when it comes to finding and picking investments. Freetrade has a few sections that show you graph data of a company’s historical share performance, but not enough real information to sink your teeth into. This is disappointing because a lot of these investment apps pride themselves on their rich libraries of research. Hopefully, this is something the platform works on in the future.

It is important to realise that Freetrade is not a financial advisory service, so they don’t give investment advice. You will basically be on your own. This is a dual-edged sword because on the one hand, you have a lot of freedom. But if you get too overzealous, it’s easy to pull the trigger on bad stocks, especially considering how user-friendly the Freetrade app is.

What Are People Saying About Freetrade?

Freetrade has been well received by the broader investing community. We checked out their Trustpilot page and they have a 4.1/5 average rating out of 257 reviews. Most reviewers praise the simplified interface and the free commissions on trades. Many people draw parallels between Freetrade and Robinhood in the US (which recently made its way here to the UK). Both apps specialise in fast, easy investments.

What Are the Benefits of Freetrade?

- No account minimum and free regular trades

- No annual account fee

- Instant trades available

- Trading is as easy as a few clicks

- Intuitive app is well-designed and straightforward

- The developers plan to add a lot of features in the near future

- Your funds are well protected and insured by the FSCS

What Are the Drawbacks of Freetrade?

- Currently only allows stock and ETF trades

- Relatively limited selection of investments

- No information/resources for education

Our Verdict: Is Freetrade Worth It?

Freetrade is a cool new app that actually makes owning stock accessible and fun. The investment selection is still limited, but the company has a good track record and has big plans for the future with the release of their Alpha premium accounts.

In the meantime, the ability to trade stock commission-free is a huge reason to at least give the platform a try.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024