Understanding what salary you should be making at your age can help you make informed career decisions and gauge your financial progress. This guide provides a detailed overview of average salaries across different age groups in the UK, taking into account various factors such as industry, location, and education. By the end of this article, you will have a clearer picture of where you stand financially and what steps you might need to take to achieve your salary goals.

Why Salary Benchmarks Matter

Knowing the average salary for your age group helps you:

- Set Realistic Career Goals: Understand what you can expect to earn and aim for higher benchmarks.

- Negotiate Better: Use salary data to negotiate your salary during job interviews or performance reviews.

- Plan Finances: Make informed decisions about savings, investments, and lifestyle choices.

Factors Influencing Salaries

Several factors can influence how much you earn, including:

- Industry: Some sectors, like finance and technology, tend to offer higher salaries.

- Location: Salaries can vary significantly between regions, with London typically offering higher wages.

- Education: Higher educational qualifications often lead to better-paying jobs.

- Experience: More years in the workforce generally correlate with higher earnings.

Average Salaries by Age Group

Ages 18-24

Young adults typically start their careers in this age range, often in entry-level positions or while still studying.

- Average Salary: £18,000 – £22,000

- Notable Factors: Many individuals in this group are part-time workers or apprentices, which can lower the average salary.

- Career Path: Jobs in retail, hospitality, and customer service are common.

For more details on starting salaries, visit the National Careers Service.

Ages 25-34

This age group often sees significant career progression, with many individuals advancing to mid-level positions.

- Average Salary: £25,000 – £35,000

- Notable Factors: Higher education degrees and certifications can greatly influence earning potential.

- Career Path: Roles in management, technical fields, and professional services become more prevalent.

Learn more about career progression in your 20s and 30s from the Prospects UK.

Ages 35-44

Professionals in this age group typically reach senior or managerial roles, resulting in higher salaries.

- Average Salary: £35,000 – £45,000

- Notable Factors: Experience and advanced degrees or certifications can significantly boost earnings.

- Career Path: Leadership roles, specialized technical positions, and higher-level management positions are common.

For insights on advancing to senior roles, check the Chartered Management Institute.

Ages 45-54

This age group often represents peak earning years, with individuals holding senior management or specialized expert roles.

- Average Salary: £40,000 – £55,000

- Notable Factors: Extensive experience and leadership roles contribute to higher earnings.

- Career Path: Executive positions, senior management, and highly specialized professional roles dominate.

For more information on salaries at this stage, refer to Glassdoor UK.

Ages 55-64

As individuals approach retirement, salaries can plateau or even decrease slightly, though many still hold high-paying positions.

- Average Salary: £38,000 – £50,000

- Notable Factors: Some may transition to part-time work or consultancy roles.

- Career Path: Senior advisory roles, consultancy, and part-time professional work are common.

Learn about transitioning to part-time work from Age UK.

Ages 65+

While many people retire, those who continue to work often do so part-time or in consultancy roles.

- Average Salary: £25,000 – £35,000

- Notable Factors: Income from pensions and investments often supplements salaries.

- Career Path: Consultancy, advisory roles, and part-time positions.

For retirement planning resources, visit the Money Advice Service.

How Industry Affects Salaries

Finance

Finance is one of the highest-paying sectors, with significant bonuses and salary growth opportunities.

- Entry-Level: £25,000 – £30,000

- Mid-Level: £40,000 – £60,000

- Senior-Level: £70,000+

Visit TheCityUK for more on careers in finance.

Technology

Tech roles are known for high salaries and rapid advancement.

- Entry-Level: £25,000 – £35,000

- Mid-Level: £45,000 – £65,000

- Senior-Level: £75,000+

For tech career insights, see Tech Nation.

Healthcare

Healthcare offers competitive salaries, especially for specialized roles.

- Entry-Level: £20,000 – £30,000

- Mid-Level: £35,000 – £50,000

- Senior-Level: £60,000+

Learn more from the NHS Careers.

Education

Salaries in education vary, with higher earnings for senior and specialized positions.

- Entry-Level: £22,000 – £30,000

- Mid-Level: £35,000 – £45,000

- Senior-Level: £50,000+

For more information, visit TES.

Engineering

Engineering offers robust salaries, particularly for experienced professionals.

- Entry-Level: £25,000 – £35,000

- Mid-Level: £40,000 – £60,000

- Senior-Level: £70,000+

Check Engineering UK for industry trends.

Legal

The legal profession is known for high earnings, especially in corporate law.

- Entry-Level: £30,000 – £45,000

- Mid-Level: £50,000 – £70,000

- Senior-Level: £90,000+

For legal career advice, visit the Law Society.

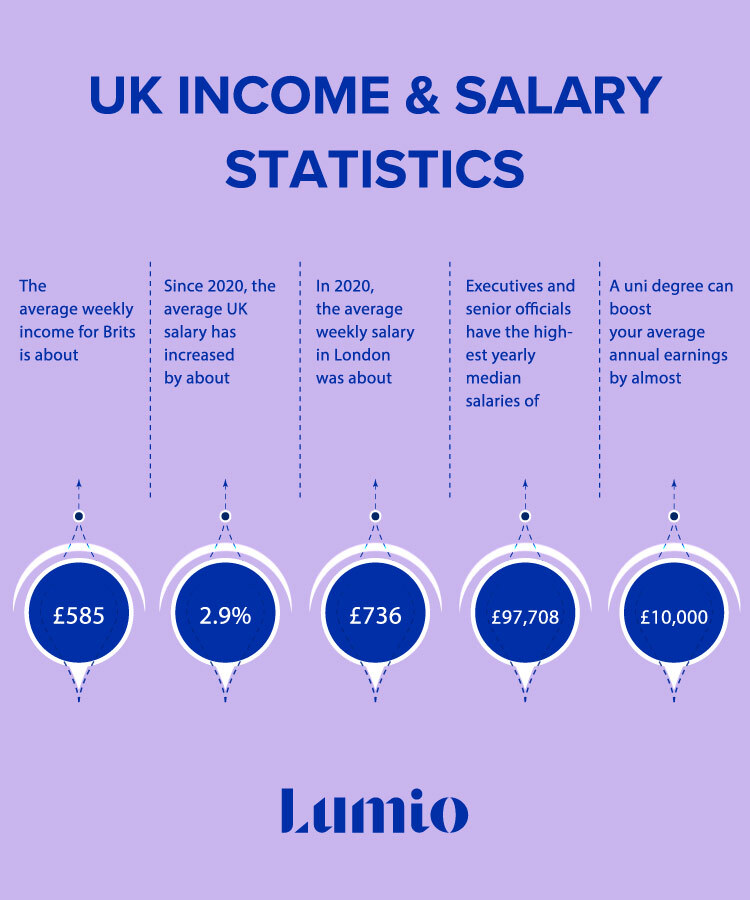

Regional Salary Differences

London

London offers the highest salaries in the UK, reflecting the cost of living and economic opportunities.

- Average Salary: £40,000 – £50,000

South East

The South East also provides high salaries, particularly in areas close to London.

- Average Salary: £35,000 – £45,000

Midlands

Salaries in the Midlands are moderate, reflecting its diverse economy.

- Average Salary: £30,000 – £40,000

North West

The North West offers competitive salaries, especially in major cities like Manchester.

- Average Salary: £28,000 – £38,000

Scotland

Scotland’s salaries are competitive, particularly in Edinburgh and Glasgow.

- Average Salary: £30,000 – £40,000

For more detailed regional salary data, visit the Office for National Statistics.

Educational Impact on Salaries

GCSEs and A-Levels

Basic qualifications can lead to entry-level roles with potential for growth.

- Average Salary: £18,000 – £25,000

Undergraduate Degree

A bachelor’s degree significantly boosts earning potential.

- Average Salary: £25,000 – £35,000

Postgraduate Degree

Advanced degrees open doors to higher-paying roles.

- Average Salary: £35,000 – £50,000

Professional Certifications

Certifications in fields like finance, IT, and engineering can further increase salaries.

- Average Salary: £40,000 – £60,000

For educational resources, visit UCAS.

How to Increase Your Salary

Continue Your Education

Investing in further education can significantly boost your earning potential. Consider pursuing advanced degrees or professional certifications in your field.

Gain Experience

Experience is a key factor in salary increases. Seek out opportunities for career progression, take on additional responsibilities, and strive for promotions.

Develop New Skills

Continuously upgrading your skill set makes you more valuable to employers. This could include learning new technologies, improving your leadership abilities, or acquiring specialized knowledge.

Network

Building a strong professional network can open up new opportunities. Attend industry events, join professional associations, and connect with colleagues and mentors.

Negotiate

Don’t be afraid to negotiate your salary. Use industry benchmarks and salary data to support your case during performance reviews or job interviews.

Consider Changing Jobs

Sometimes, the best way to increase your salary is to change employers. Be open to new opportunities and keep an eye on the job market.

Know what you’re worth

Before sitting your boss down, make sure you do some research about average salaries for your position/experience level.

Knowing where you stand compared to others like you can help figure out how much to ask for. If you find that you are already at the top of your market for your position, then you might have to settle for less than what you might initially want. Don’t treat average reported salaries as the final word, but as a starting range.

Generally, talking about salaries with coworkers is considered a bad idea. However, talking to coworkers about their salaries can be helpful if you feel like you are being severely underpaid. If everyone is being underpaid, then you might be able to come up with a plan to increase wages.

Be smart about when you ask

You are much less likely to get that raise if your boss is having a bad day or there is stress in the workplace. For example, asking for a raise on the tail end of impending budget cuts is generally a bad idea. On the other hand, if you have been performing particularly well recently and your boss seems pleased with your work, it may be a good time to pop the question.

Prepare to accept more responsibilities

You can’t get something for nothing. If you are expecting a pay raise then you should also be prepared to take on more responsibilities in the workplace. If your track record has been good, then your employer should feel comfortable giving you more responsibilities.

Figure out the salary structure

Take some time to figure out the salary structure of your company. For instance, some companies may have strict limits on how much or a raise they can give at once or they may never give raises above a certain percentage. The more you know about how your company handles salaries generally, then the better able you’ll be to handle the process.

Don’t feel bad asking

Lastly, you shouldn’t be afraid to ask for a raise. Asking for a raise does not mean you are greedy or entitled, and it’s a completely normal thing a reasonable supervisor will understand. Even if your boss says no, it won’t hurt your relationship as long as you are respectful and have a track record of good work. Raises are not a gift or a favor; they are a way to compensate you for the hard work you put into your company.

Summary

Understanding what salary you should be making at your age can help you set realistic career goals, negotiate better pay, and plan your finances effectively. The average salaries in the UK vary significantly based on age, industry, location, and education. By continuously improving your skills, gaining experience, and staying informed about salary trends, you can enhance your earning potential and achieve your financial goals.

For more detailed information and resources, consider visiting the following websites:

- National Careers Service

- Prospects UK

- Chartered Management Institute

- Glassdoor UK

- Age UK

- Money Advice Service

- TheCityUK

- Tech Nation

- NHS Careers

- TES

- Engineering UK

- Law Society

- Office for National Statistics

- UCAS

Final Thoughts

Salaries are influenced by a multitude of factors including age, industry, location, education, and experience. Understanding where you stand can help you make informed decisions and take strategic steps towards increasing your earnings. Whether you’re just starting your career, looking to advance, or planning for retirement, having a clear understanding of salary benchmarks can guide your financial and career planning.

To maximize your salary potential:

- Invest in further education and professional certifications.

- Gain relevant experience and seek out promotions.

- Continuously develop new skills to stay competitive.

- Network with professionals in your industry.

- Be prepared to negotiate your salary and consider job changes when necessary.

By leveraging these strategies, you can work towards achieving a salary that reflects your skills, experience, and the value you bring to your employer.

For additional insights and updates on salary trends, career development, and financial planning, follow reputable career and finance blogs, join professional networks, and consider consulting with career advisors.

Remember, knowledge is power when it comes to your career and financial wellbeing. Stay informed, stay proactive, and take control of your financial future.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

1 Comment