Investors have a lot of options for where to put their money. It is important to weigh these options carefully and fully understand the financial risk. Not all types of investment vehicles have the same reward and not all have the same levels of risk in investments.

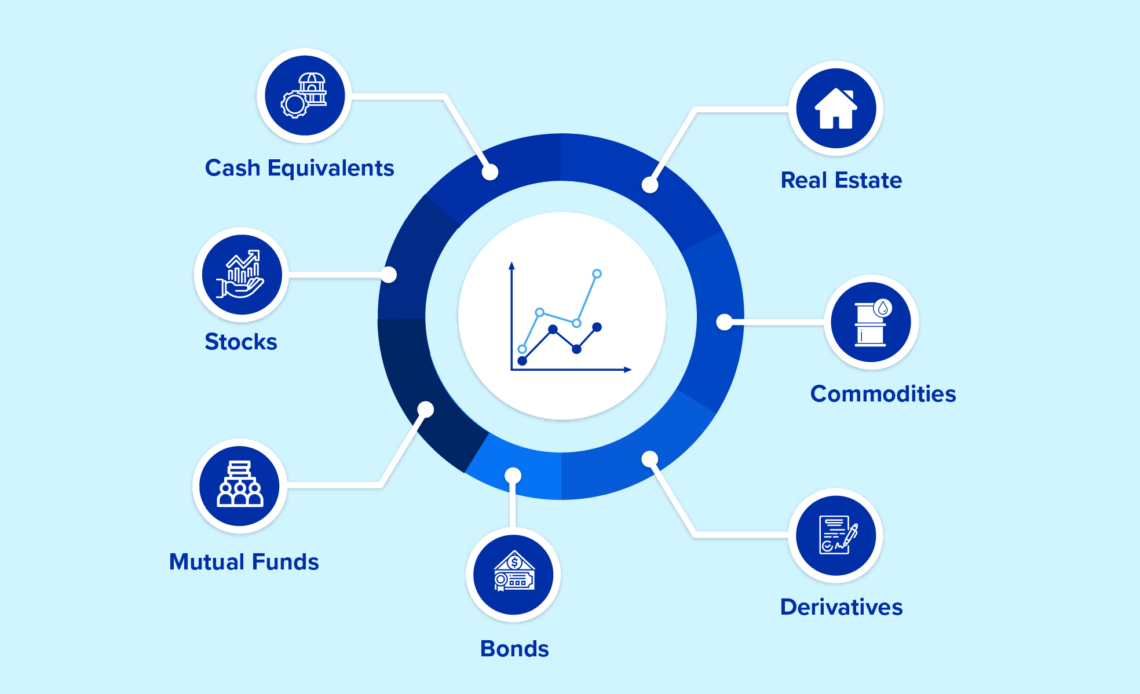

In general, there are 4 different types of investments, stocks, bonds, funds, and cash equivalents. Within these categories are sub types of investment classes. The key thing is that each type of investment presents a different level of risk, growth, and method of accumulation. A properly diversified portfolio should include assets from each major investment class, along with the various different types of investment vehicles.

So, today, we are going to cover the main types of investments and components of investment risk. We will also talk about the different types of investments, how they differ from each other, and the types of risk in finance.

Stocks

Stocks are one of the most common types of investment classes. When you buy stock, you are essentially buying a piece of ownership in a company, called shares. Investors purchase shares that increase in value as the company grows. Investors can then sell these shares down the road and make a profit. Stocks can appreciate or depreciate in value, so they carry some inherent risks.

When you buy shares from a company, you become a shareholder and share in the company’s profits. Companies sell their stock through a stock exchange, like the Nasdaq or the FTSE100. Investors buy shares through stockbrokers.

So how, exactly, do stocks increase in value? It is relatively simple: when you buy shares, you inject capital (money) into a company.

The company takes this capital and uses it to expand and grow. As the company grows, the overall value of the company increases, which in turn increases the value of your individual shares. This might sound like magic to a bunch of people, but it is how investing and the stock market work!

Since the growth of a company can fluctuate, the value of stocks can fluctuate too.

The goal of investing is to predict which shares will grow, invest, then make a profit after the share value has increased. By the same token though, investments can fall in value. This means that the share price can fall lower than what you paid for it, and you have functionally lost money. That is why investors should spread their stock investment over shares from several different companies. That way, if a couple of investments fail, other investments can insulate you from loss.

Stocks can generate money in two major ways:

- Buying some shares and selling them when they increase in price nets to profit from capital gains.

- You can also earn money through dividends. Companies regularly pay out part of their profits to shareholders in the form of quarterly dividend payments. Not all stocks pay dividends.

Historically, the stock market has had an average return of 10%. This figure is an average for the entire market, not individual stock. The average return for any given year can be more or less than 10%.

According to the Credit Suisse Global Investment Returns Yearbook 2020, global stock markets have net investors a real return of 7.6% over the past decade. Comparatively, bonds have yielded around 3.6% for investors.

There are two different types of stock, each with different types of investment risks.

- Common stock – Common stock is the most common kind of stock and the type that is traded the most. Buying common stock represents a claim of ownership in a company and provides voting rights. Investors get one vote per share and can vote on the board members who oversee management. Common stock has the most potential for gain out of the traditional investment classes.

- Preferred stock – Preferred stock does not confer voting rights, but preferred stockholders are entitled to priority for dividend payments. Preferred stock normally has a static dividend yield, whereas with common stock, dividend payouts can vary based on the board of directors. Many companies allow shareholders to convert preferred shares into common stock, but not vice versa.

Stocks are one of the most popular investment categories and for good reasons. Stocks compound in value over time, which means that the longer that you hold on to some share, the more they will grow with each period. That means owning a diversified portfolio of stock over the long-term is the best option for growth.

But this also means that stocks are a high-risk investment. Companies can fail and shareholders lose their investments. The main kind of risks stocks face is market risk. Market risk refers to risks due to fluctuating market conditions. So it is important to do your research on stock picks and take a thorough look at company financials to find picks with low risk.

Bonds

Bonds are a fixed income investment between an investor and a borrower. Bonds are essentially a loan that you issue to some entity (corporate or government) with the promise of repayment by a fixed date. Bonds are used as a way to secure capital to finance projects. Those who own bonds are called debtholders or creditors of the issuer. Bond agreements include a principal amount that must be repaid by a specific date, as well as details about variable or fixed interest payments made to the creditor.

Bonds are basically an IOU that companies give debtholders. It is a promise to pay back money by a certain date. Corporations and governmental entities rely on bonds to fund projects because they often need much more money than they could secure from a traditional bank loan.

Additionally, public markets allow individuals to buy and sell bonds to one another, even after the money has been raised for the company or government entity. So, bonds exist in their own financial ecosystems distinct from other kinds of investment asset classes.

Here is how bonds work: When companies need money for projects, they issue bonds to investors. Bon agreements contain information about the terms of the loan, amount of interest payments, and maturation date by which the funds need to be repaid. Debtholders get paid regular interest payments over the life of the bond agreement.

Bonds have a face value which is the amount of the principal that must be paid back. They have a market value that is determined by:

- How trustworthy the issuer is

- The length of the terms

- And the interest rate compared to the average market interest rate.

The coupon rate is the interest rate that the issuer pays over the lifetime of the bond and is normally a percentage of the face value. Coupon dates when interest is paid on the bond. Normally, bonds are paid on a semiannual basis.

Debtholders do not have to hold the bond for the entire period, so many sell off bonds when the rate of interest declines and repurchase them when the rate of interest increases.

Bonds have significantly fewer risks than stocks, but they also have a lower rate of return. The average bond has a maturation date of about 15 years, so bonds are meant to be long term investments.

Bonds generally have low risks, but they have some risks. The risk of a bond is generally determined by the issuer’s credit rating. The lower a company’s credit rating, the more likely it is that the company will default before the maturation date. Thus, investors demand higher interest payments for compensation. So, risk and interest for bonds share a roughly inverse relationship.

Bond value is also tied to duration. The duration refers to how much a given bond’s price changes in response to changing interest rates.

There are 4 different types of bonds, differentiated by the kind of organization that issues them.

- Corporate bonds are given by companies. Instead of going to a bank, companies issue bonds to cover things like refinancing debt and scaling production. Bonds usually offer better interest rates than traditional bank loans. Corporate bonds tend to have the highest risk of the different bond types because companies can default on debtholders.

- Municipal bonds are given by local municipal and state governments. The funds generated from municipal bonds are typically used for local projects, like airports, sewer systems, highways, etc. Municipal bonds tend to be very stable and low risk because they are issued by government agencies that are less likely to default on payments than corporations.

- Government bonds are issued by the UK government, and often referred to as gilts. They offer a fixed rate of return until their expiry, and are basically a loan from the bondholder to the government. The issuer pays a fixed interest rate up until the bond reaches its maturity date, upon which the government pays the bondholder the face value of the bond. As far as risk goes, they can be seen as somewhere between shares and cash.

- Agency bonds are a final category and refer to bonds issued by government departments other than the US treasury, or from government-sponsored enterprises. In that sense, agency bonds can function kind of like a government/corporate bond hybrid. Agency bonds are also very low risk but do encounter interest rate risk when the average interest rates rise.

Mutual Funds

Mutual funds are a third category of investment vehicles. Mutual funds pool money from multiple investors to buy a wide range of assets, including stocks, bonds, and other assets. You can think of mutual funds as collective investments. A large group of people all invest their money in a pool of securities and get a piece proportional to how much they put in. Mutual funds are managed by professional money managers who determine how to distribute the fund’s capital. The expense ratio of a fund determines how much money in the fund is used for operating and administrative expenses.

The benefit of mutual funds is that they give regular “average Joe” investors a way to invest in professionally managed funds. Mutual funds cover a wide range of investment securities and people share proportionally in the losses and gains of the fund. Whether or not a mutual fund does well depends on the performance and risk of the securities it is invested in.

Mutual funds are different from stocks and bonds because, unlike stocks, they do not give owners voting rights, and unlike bonds, returns track market performance instead of interest rates. The value of a mutual fund is called the net asset value (NAV) per share and is calculated by dividing the value of the portfolio by the total number of shares in the fund.

Another way you can think of mutual funds is investing in a company that invests in securities. Individuals investors own portions of the shares of the funds through their investments in the company that manages the funds. This dual-tiered structure makes mutual funds a very flexible type of investment vehicle that manages risk well.

The risk of a particular mutual fund depends primarily on the different types of securities the fund is invested in.

Funds that invest primarily in stock therefore have a higher risk than funds that equally allocate money between stocks, bonds, and other low-risk fixed-income assets, for example.

Mutual funds are also subject to all the risks that specific security types are subject to. With mutual funds, risk and returns generally share an inverse relationship. You can gauge the risk level of a fund by looking at how its returns have changed year-to-year. If it fluctuates a lot, that could be an indicator that it is a high-risk fund.

There are several types of mutual funds, but two are the most common.

- Index funds are mutual funds that track some specific segment of the market. For example, many index funds track the indices of large stock exchanges, like the Nasdaq or FTSE 100. Index funds are a type of passive investment and only track certain market indexes. As such, they have a low risk. They do not try to beat the market and they are only priced at the end of each trading day.

- Exchange-traded funds (ETFs) are similar to index funds but with one major difference. ETFs can be traded throughout the day, just like regular stocks. ETFs also tend to have lower taxation and management fees than index funds but have more risks.

Cash Equivalents

Cash equivalents are the third of the major types of investment and the least widespread. Cash equivalent are low-risk securities that are highly liquid and meant for short-term investing. Common cash equivalent investments include bank CDs, corporate commercial papers and money-market instruments. Basically, cash equivalents are assets that are either cash themselves or can be converted to cash immediately.

Cash equivalents tend to be the most stable kinds of investments because the underlying investment asset is cash, which does not fluctuate in value as stocks or bonds do. Cash equivalent assets also have short maturation dates, usually less than 90 days.

Whether or not a company offers cash equivalents is usually taken as a sign of its health. Companies that have lots of cash on reserve have a high ability to pay off short-term debts and liabilities. Other kinds of investment assets that have a maturation date of fewer than 3 months are often considered cash equivalent investments.

Other Types of Investment Vehicles

There are other types of investment vehicles that are more specialized and unique. The risk of these different types of investment vehicles can vary greatly from high risk to low risk.

Derivatives

Derivatives are investment vehicles that derive their value from some underlying asset or group of assets. The price of derivatives is based on price fluctuations of the underlying asset. Normally, derivatives are bought and sold to hedge positions and speculate on the movement of markets. Futures contracts and options contracts are two common types of derivatives whose value derives from the speculated price movement of some underlying asset class.

Although some derivatives can be used for investment risk management, the investment risk of derivatives tends to be highs because the underlying assets can fluctuate widely in price. Derivatives allow for large risk while putting little money down, which can generate huge losses if things go poorly. Derivatives are subject to market risk, interest rate risk, and liquidity risk. Liquidity risk is probably the most important kind of risk derivatives face.

Commodities

Commodities are physical goods that people buy and sell. Common commodities for investment include agricultural products such as wheat and barley, energy products such as oil and coal, or precious metals like gold and silver. The purposes of investing in commodities is to store money in the form of some physical good that is predicted to rise in price. This means there is a risk that the invested commodities will go down in price.

The exact investment risks depend on the specific commodity, but commodities, in general, tend to be riskier investments. This is because the price of commodities can fluctuate widely. Some commodities, such as gold and silver, seem to be relatively stable. Crude oil, on the other hand, is a very volatile commodity.

One benefit of commodities is that they can hedge against inflation risk. Commodities tend to increase in price with inflation so your investments still have the same buying power. Commodities can be held for the long term or the short term.

Real Estate

Real estate is another popular kind of investment. Property investments technically count as fixed-income investments but have some unique features that set them apart from other kinds of fixed-income investments. Property tends to be resistant to inflation risk because physical properties retain their intrinsic value. Also, many countries offer excellent tax benefits for property owners.

Physical property has an excellent long term track record of growth too. Even when accounting for the mortgage crisis during the 2008 recession, property prices, on average, have increased every year since the 60s. There are many ways to invest in real estate as well, either through rental properties, real estate investment trusts, and mutual funds.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024