Best Budgeting App UK

What is budgeting?

Budgeting can seem daunting and tedious at first, but when you get down to it, it’s truly a simple process. By anticipating your fixed expenses and setting limits on your more variable spending, you can create a budget and be well on your way to financial health.

Many are looking for more automated ways to make and track their budget with easy reminders and a user-friendly experience. Luckily, there are several great budgeting apps on the market and available to UK users. The hardest part might be deciding between all the options!

What are budgeting apps?

What makes a budgeting app so unique and helpful for your personal finances? Within each budgeting app lies the ability for the user to connect their banking, credit, and investing information to truly see it all in one place. Some offer more features to control your accounts, split up money, and freeze cards, but the goal is the same: to help the user plan and enact an effective budget within their full financial picture in view.

Are budgeting apps safe?

Because there are so many budgeting apps available, it’s important to understand if you’re looking at a safe and secure app in which to input your personal and banking information. Like any other sensitive information you decide to input online, entering your banking information into a budgeting app is a risky choice if you haven’t vetted the host of the app.

Before you ever allow access to your banking, investing, or credit card information, you’ll need to make sure that the budgeting app in question has the following features to make it as secure as possible (these were the qualities we looked for when rating the security of all the recommended budgeting apps below):

- TLS 256-bit encryption

This type of highly secure encryption is typically used for allapplications that use open banking, which is when a bank opens up their user information to be accessed by the client on other apps.

- 2 factor identification

This type of identification involves two methods of verifying the identity of the user. This could include text, face, email, or an authenticator application.

- Face and/or touch ID

Face and touch ID are both secure ways to verify that you are really you when logging into an app. This can help you feel more peace of mind when you login to your applications.

We’ve broken down the best apps currently available, and their unique features below.

Best Budgeting Apps in The UK

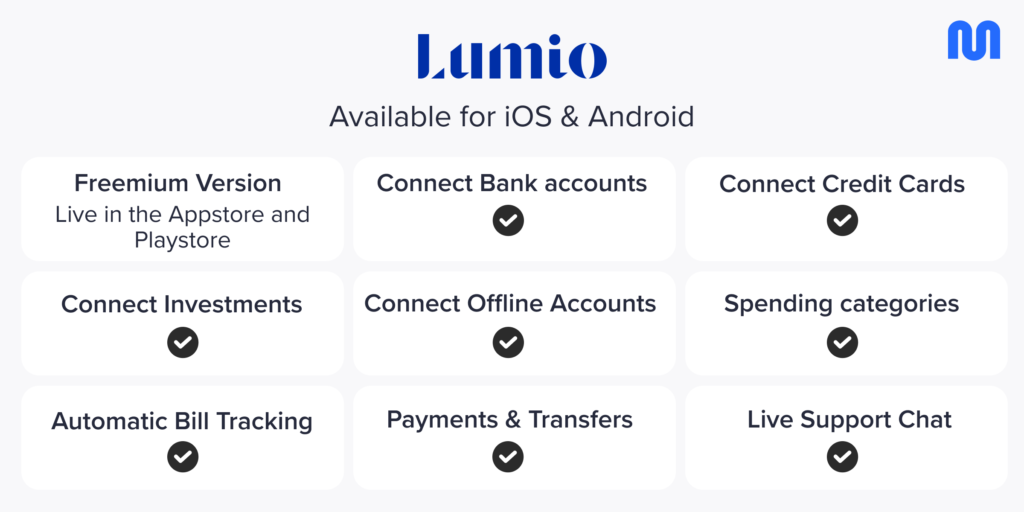

Lumio – Best App for Saving Time and Money

Lumio is a free app that provides a coherent dashboard for all things personal finance. If you’re looking for a one-stop-shop to maintain and grow your wealth, this is the app for you. It boasts the ability to connect your accounts to its real-time dashboard, so it’s customisable to your specific situation. The Lumio app even provides suggestions for your future finances by suggesting helpful financial products that could take your finances to the next level, all accessed on their app.

Track your spending to avoid any surprise charges, grow your savings and investments, and view your checking accounts all from the same page.

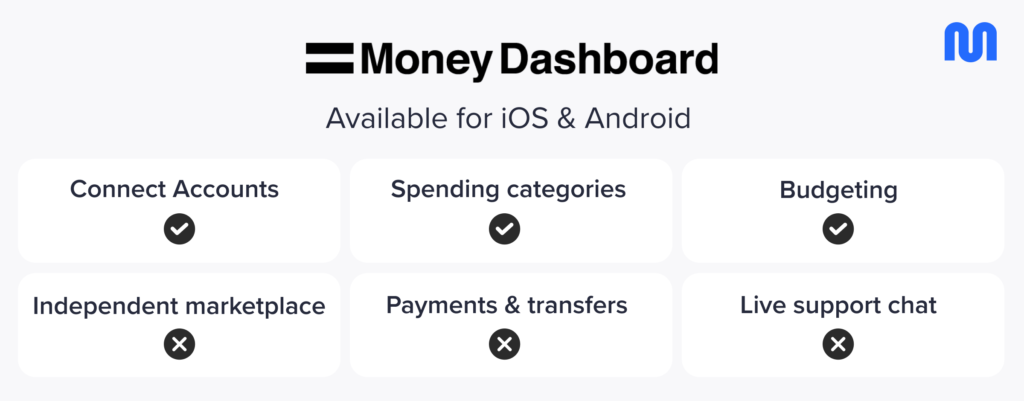

Money Dashboard – Best App for Customising Your Budget

Money Dashboard is another user-friendly (and free) budgeting app that connects your accounts in one place to show you a full financial picture. You can even split your transactions into customised line items and categorise them for easy budget tracking.

The app will even forecast your upcoming bills that are set to be withdrawn before your next payday, so you don’t overdraft when those bills come around. Talk about seeing the future! Some users have been a bit disappointed when they decide to change to a different type of money dashboard account (since there are several versions available on the app) and are prompted to enter all of their information once more.

- App Rating (8.2/10)

- Ease Of Use (6.8/10) – customers say that Money Dashboard is difficult when switching types of accounts.

- FCA Regulated – yes

- Security (10/10)

- Price – free

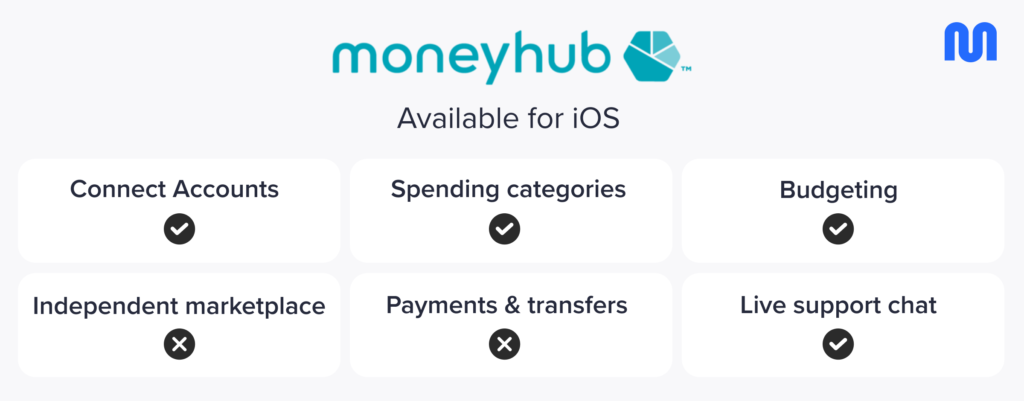

Moneyhub – Best App for Making and Meeting Financial Goals

Moneyhub is another UK based money management app that costs users just £0.99 per month after a free 6 month trial. It’s geared toward the planner – so if you’re interested in setting and crushing your financial goals, this is the budgeting app for you.

One of the features that users love includes an option to connect to financial advisors. If you have questions about your financial future and how to get where you want to go, this feature can be incredibly helpful.

- App Rating (8.6/10)

- Ease Of Use (8.2/10) – Customers say that Moneyhub is extremely helpful, but it’s user experience has some issues.

- FCA Regulated – yes

- Security (10/10)

- Price – £0.99/month

Monese – Best App for Saving Strategically

Monese is another popular, free budgeting app that allows UK users to use “savings pots” to automatically round up and save on their day to day purchases. If you need an easy way to see all your finances in one place and start saving on auto-pilot, this is the app for you.

Monese even recommends tips for improving your credit score depending on your current situation, helping users reach new financial heights. The main drawback users find when utilising this app is the slow or unaccommodating Monese ustomer service.

- App Rating (9.4/10)

- Ease Of Use (7.8/10)Customers say that Monese is a super helpful interface, but their customer service has come up lacking in some cases.

- FCA Regulated – yes

- Security (10/10)

- Price – free

Snoop – Best App for Cutting Spending And Bills

Snoop is yet another free budgeting app for the everyday person to see their cards, accounts and investments in one place. The app came on the market more recently in 2020.

The unique thing about Snoop is that it can find ways for you to save in places you’re already spending. Along the same lines, the app will also alert you when bills are looking too high, and recommend ways you can cut down on these costs that really might add up.

- App Rating (9.2/10)

- Ease Of Use (8/10)Customers say that Snoop is incredibly helpful. There aren’t many reviews yet because of the newness of the app.

- FCA Regulated – yes

- Security (10/10)

- Price – free

Plum – Best App for Saving And Investing More

Plum comes on the scene as a helpful free app to automate your savings with each deposit you make. Users can automatically indicate the portion of earnings from their paycheck they’d like to save, and voila! Automatic savings begin.

Another unique feature here is Plum’s ability to compare suppliers (think phone bills or Netflix subscriptions) and prompt you to sign on to a lower priced supplier to lessen your expenses when possible.

- App Rating (9.4/10)

- Ease Of Use (9/10)Customers say that Plum is incredibly user friendly and easy to navigate.

- FCA Regulated – yes

- Security (10/10)

- Price – free

Emma – Best App for Cutting out Wasteful Spending

Emma is another free option for those trying to consolidate their financial apps, and it boasts the ability to track subscriptions to eliminate wasteful spending. We could all use some help monitoring our subscriptions and accountability in this arena.

Another helpful feature Emma offers is the tracking and automatic categorisation of each expenditure. Leave the details to Emma. Customers have overall been very happy with the performance of the app, but there are some complaints of less-than-helpful customer service.

- App Rating (7/10)

- Ease Of Use (7.6/10)Customers say that Emma is an excellent platform, but the application support has been found lacking.

- FCA Regulated – yes

- Security (10/10)

- Price – free

Monzo – Best Banking App for the Controlling Type

Monzo is a free app that provides a hub for your finances, and more control over your accounts. This app also offers money “pots” to separate your money into saving categories. Saving for an upcoming holiday? You can strategically separate these funds.

Monzo also boasts card freezing abilities, so if you begin to become worried about the location or activity on one of your cards, Monzo can instantly freeze it for you.

- App Rating (7/10)

- Ease Of Use (9/10) Customers say that Monzo is an incredibly useful app.

- FCA Regulated – yes

- Security (10/10)

- Price – free

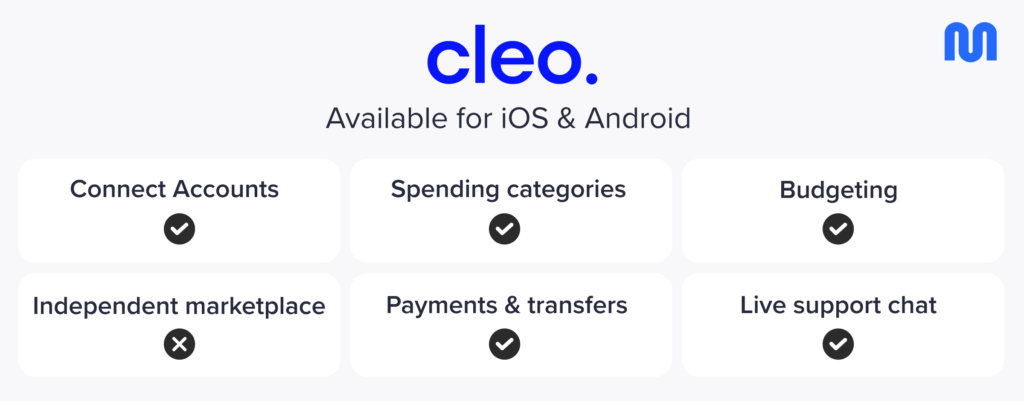

Cleo – Best App for Beginner Budgeters

Cleo is a popular free budgeting app that boasts a fun, relevant and helpful user experience. Some of their more unique features include the ability to lend money to users in a bind, and help users set and meet budgeting goals. If you’re just getting started with managing your accounts and sticking to a budget, Cleo is a great place to start.

Unfortunately, Cleo has recently announced that they will be unavailable for download in the UK, as they are focusing on building up a US customer base. Their current users can keep using the app with no upcoming updates, but new downloads in the UK are unavailable.

- App Rating (7/10)

- Ease Of Use (8.2/10)Customers say that Cleo is easy to use, and the only complaints have to do with payroll advances that didn’t seem high enough to users.

- FCA Regulated – yes

- Security (10/10)

- Price – free

Cleo and Yolt have shut down in the UK- what are the alternatives?

With all of these great options for UK budgeters, Cleo is the only option that isn’t currently available, but the first 8 are still great alternatives to the Cleo app for those who want a user-friendly budgeting app. Yolt is another honourable mention that has recently shut down in the UK to expand their other operations, but the good news is that UK users have many choices when it comes to budgeting apps. And, all the apps mentioned above are secure as they can be.

When you’re looking to put together a great plan for your finances, stick to it, and succeed in your saving, investing, and spending endeavours, a budgeting app can make all the difference. Drawing up a spreadsheet and manually inputting your expenses and incomes is a thing of the past. Depending on your personality and your goals, one of these 9 options could be just the right budgeting app for you. Take it from us, these are the best of the best!

FAQs

Why should I use a budgeting app?

Everyone is different when it comes to their financial and budgeting needs. Some have more controlling personalities, and need to check up on their budgeting app throughout the day, and connect all of their accounts in one place. Some are more trusting, and check their budgeting app from time to time. As you try out new apps and make budgeting goals for yourself, you’ll know what a healthy frequency looks like for you.

As far as the actual utilisation of the apps, it’s important to connect all your accounts when you sign on to a new and trusted app, to set a reasonable budget for yourself before tracking begins, and to adjust the budgeting categories as-needed as you go along your budgeting journey.

How do you create a budget?

Speaking of setting and adjusting a budget, many wonder how to even begin setting one up for themselves. Here are several easy steps to setting a budget:

- Start with looking at your historical earnings and expenses. Check out your average monthly paycheque, and get an average of how much you’ll normally spend on line items such as toiletries, bills, eating out, groceries and the like (per month as well).

- Now, make a projection for the next month as to how much you’ll spend and make sure to allow a buffer so your spending doesn’t go over your earnings.

- Track the expenses you’re accruing (here’s where a budgeting app comes in handy!) and adjust each line item as-needed if you find you’re spending more, or adjust your spending to limit a category that you might go over in.

Why do budgets fail?

Along the same lines, many wonder why even when they set their budget, its tough to keep track of and they fail. The key to success here is sticking to your budget and staying on top of your budget.

As far as sticking to it, this will take time and practice. Becoming more disciplined with your money is a process, accountability from a spouse, financial professional, or even an app can help.

Staying on top of your budget typically has to do with convenience. It will involve devising a method that will work for you, that you’ll check up on often. An app is a huge way to make your budgeting more convenient so you’ll be more likely to stay on top of it, instead of spending and making money without purpose and intention.

How do you stop living paycheque to paycheque?

As we’re trying to build and save wealth, many of us ask this question. For most of us, the problem isn’t making more money. The more we make, the more we spend. Living below or within your means is a strategy that will assist us with the attempt to stop breaking even each month and start saving and investing. How does one go about this? There are a few simple principles to start:

- Buy items that will hold or make value

- Manage your expenses and subscriptions

- Keep a close eye on your bills

- Don’t be tempted by the latest “upgrades”

FAQs for budgeting and money management apps

Why should I use a budgeting app?

Everyone is different when it comes to their financial and budgeting needs. Some have more controlling personalities, and need to check up on their budgeting app throughout the day, and connect all of their accounts in one place. Some are more trusting, and check their budgeting app from time to time. As you try out new apps and make budgeting goals for yourself, you’ll know what a healthy frequency looks like for you.

As far as the actual utilisation of the apps, it’s important to connect all your accounts when you sign on to a new and trusted app, to set a reasonable budget for yourself before tracking begins, and to adjust the budgeting categories as-needed as you go along your budgeting journey.

How do you create a budget?

Speaking of setting and adjusting a budget, many wonder how to even begin setting one up for themselves. Here are several easy steps to setting a budget:

- Start with looking at your historical earnings and expenses. Check out your average monthly paycheque, and get an average of how much you’ll normally spend on line items such as toiletries, bills, eating out, groceries and the like (per month as well).

- Now, make a projection for the next month as to how much you’ll spend and make sure to allow a buffer so your spending doesn’t go over your earnings.

- Track the expenses you’re accruing (here’s where a budgeting app comes in handy!) and adjust each line item as-needed if you find you’re spending more, or adjust your spending to limit a category that you might go over in.

Why do budgets fail?

Along the same lines, many wonder why even when they set their budget, its tough to keep track of and they fail. The key to success here is sticking to your budget and staying on top of your budget.

As far as sticking to it, this will take time and practice. Becoming more disciplined with your money is a process, accountability from a spouse, financial professional, or even an app can help.

Staying on top of your budget typically has to do with convenience. It will involve devising a method that will work for you, that you’ll check up on often. An app is a huge way to make your budgeting more convenient so you’ll be more likely to stay on top of it, instead of spending and making money without purpose and intention.

How do you stop living paycheque to paycheque?

As we’re trying to build and save wealth, many of us ask this question. For most of us, the problem isn’t making more money. The more we make, the more we spend. Living below or within your means is a strategy that will assist us with the attempt to stop breaking even each month and start saving and investing. How does one go about this? There are a few simple principles to start:

- Buy items that will hold or make value

- Manage your expenses and subscriptions

- Keep a close eye on your bills

- Don’t be tempted by the latest “upgrades”

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024