It used to be the norm that you could go to college, get a degree in virtually anything, and be able to find good job prospects after you’d graduated.

However, with more people pursuing higher education, it is now more competitive for those jobs that used to require just any old college degree.

The increase in hyper-specialisation and technical skills in the workforce means that employers are often looking for very specific skill sets that some degrees may not provide.

While it is still true that having any kind of college degree will make you better off in the job market, the connection is not as strong as it used to be.

As such, those who pursue higher education have to be a bit more judicious in what they deduce to study in college.

The UK has some of the best schools in the world and education in the UK has a rich tradition of assembling some of the brightest minds. Approximately half of the working population has a higher education degree, and about one-tenth holds an advanced degree.

Finance degrees have been a popular choice in English schools for a long time, but are they really worth it? Is it worth taking out loans to pursue a finance degree?

Let’s talk about the commitments and opportunities of getting a finance major and whether or not it’s worth it.

How Much Can You Make With a Finance Degree?

Average Finance Graduate Starting Salary

As of 2020, the average starting salary of finance and accounting majors directly out of university was £23,818. Considering that the average salary across all university graduates was about £22,200, that means that finance majors do a little bit higher than the median salary for recent graduates.

The average salary of £22,818 is just for students who recently just graduated. The average amount goes up with time and experience. The average finance major has a mid-career salary of about £45,000-£60,000.

That is pretty decent considering the average mid-career salary across all industries is between £39,000 and £43,000.

All of this data is good news for those seeking finance majors. The financial industry is massive and makes up a large percentage of the nation’s GDP, so job openings for those with finance or accounting skills are numerous and well-rounded. Finance majors typical work at places like:

- Banks

- Insurance companies

- Financial planning

- International finance

- Financial analyst

- Consultancy agencies

- Personal financial management

- Financial services

- Investment banking

- Investment management

- Public sector

- Business owners

- And more

The job outlook available is large too. Major firms and agencies will recruit competitive applicants right out of college or finance majors who can work for a local agency with a specialized focus.

Accounting kind of gets a bad reputation for being boring and not very exciting, but the skills an accounting and finance degree will give you can be used virtually anywhere.

Managing money is important, and that applies to most industries. As such, there are many finance jobs to work in a wide range of industries.

Examples of careers you can do with an accounting degree or a finance degree include a financial analyst, financial planning or financial planner, risk management, chief financial officer, and more.

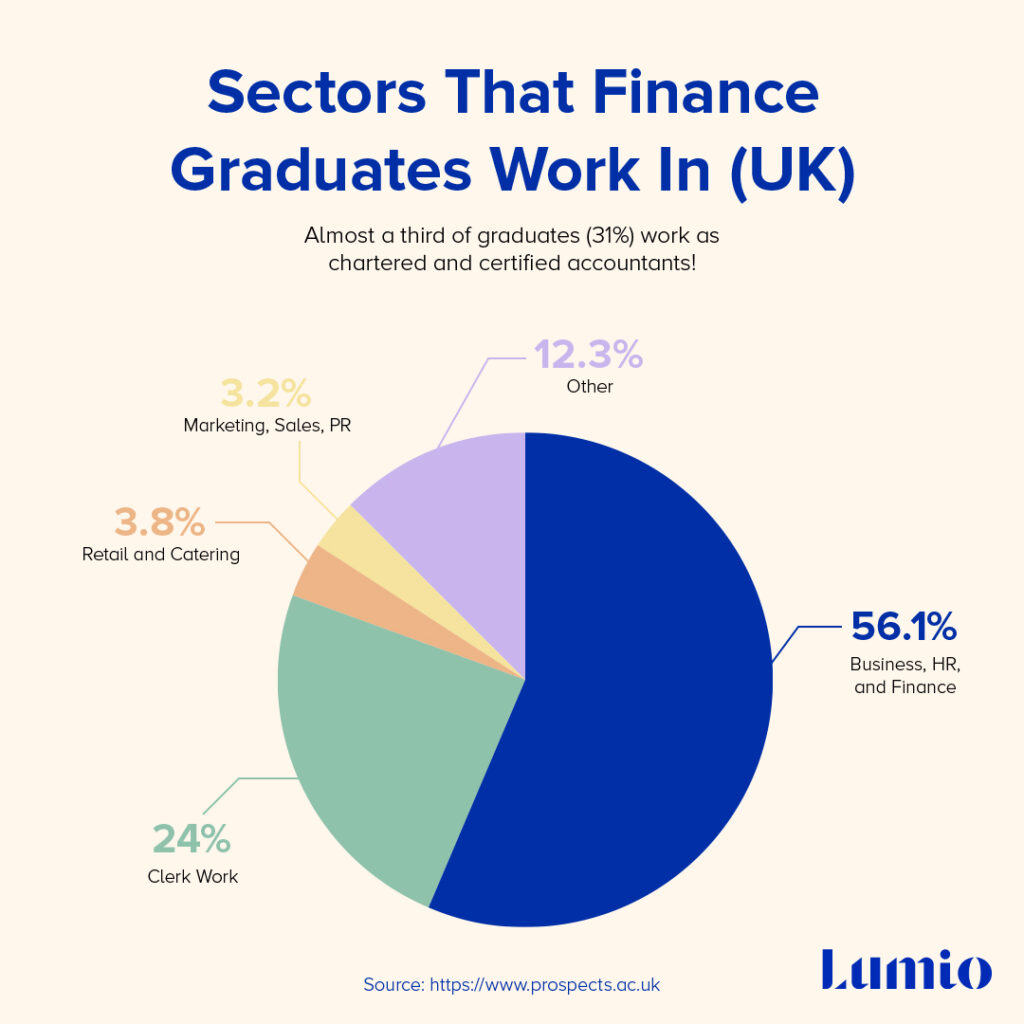

If you want a more specific breakdown of industries in which finance majors work here are some figures:

- Business, HR, and Finance – 56.1%

- Clerk Work – 24%

- Retail and catering – 3.8%

- Marketing, Sales, PR – 3.2%

- Other 12.3%

As you can see, the majority of finance and accounting students end up working at businesses or some other function in the financial industry. That may sound homogenous, but that includes a lot of different industries.

What Kind of Skills Will You Learn In A Finance Degree Path?

Finance degrees are all about training student’s analytical and financial skills in a practical context.

Students in finance degree programs will learn knowledge of business administration, organization, financial concepts and terminology, problem-solving ability, analytical and quantitative reasoning skills, and effective entrepreneurial practices.

Many finance majors go on to start their own business ventures and combine the theoretical and practical knowledge that they learn in school.

Also, finance majors will learn important professional skills like time management, project planning, networking, and language skills.

A finance program can provide a good place to make connections and find business opportunities as well. Many people form a tight network with their peers that continues well into their professional careers.

All of this is to say that a finance degree affords a lot of employment options. You would get the option of working in a lot of different environments and have a relatively stable career.

Finance majors see some of the best mid-career growths out of the most popular degree options in the UK.

What Kind of Courses & Units Will You Take?

Finance and Accounting courses cover a range of general theoretical and practical courses. The point of the majority of the courses is to cover the fundamentals of working in finance in a post-financial crisis England.

Generally speaking, Finance programs in the UK are either BA (Honors) degrees or BSc (Honors) degrees and take 3 years.

The main difference between the two is that a BA program has a slightly more broad, liberal arts focus while a BSc is more focused and has a more technical orientation. Both types of degrees are useful and can be adapted to suit many career paths.

The exact course you take will differ depending on your specific area of focus and intended career paths. That being said, here is a rundown of some courses and qualifications that are offered at institutions around the UK.

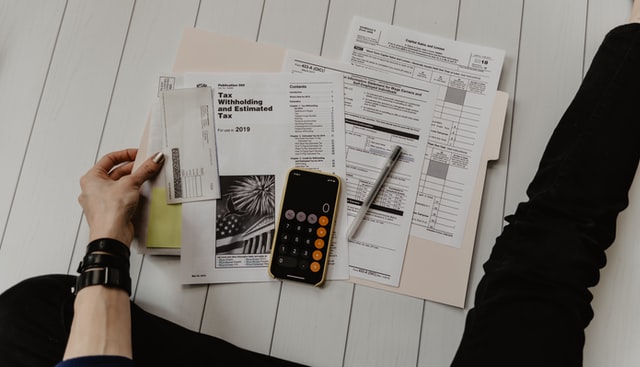

ACCA (Association of Chartered Certified Accountants). Courses under this qualification include both theoretical and practical courses. Most are focused on the fundamentals of business accounting, tax law, corporate finance law, and financial practices in a business context. Graduating with these qualifications will allow you to get a job in many areas of the finance industry and business.

AAT (Association of Accounting Technicians). Courses in the AAT qualification track include fundamentals and coursework focused on a specific industry for specialization.

ICAEW (Institute of Chartered Accountants in England and Wales). This qualification consists of 3-5 years of both coursework and practical work experience in a work setting. This qualification path is a good route to a career in finance as a personal financial manager and corporate finance accountant.

In most cases, students will have to receive one of the following qualifications to work in an official capacity in a business or financial institutions. In some cases, a completed degree in finance may not be necessary but completion of prerequisite courses is.

Courses are split into modules. Consisting of core/fundamental courses and electives.

Core courses cover what you would expect. In this case of finance, this means topics like debt, equity, derivatives, markets, etc.

Electives allow for a more broad selection and include more specialized topics or tops that may not fall strictly under traditional finance categories.

In addition to these courses and qualification paths, most bachelor’s degrees will give you the opportunity to pursue partner programs to get some real-world experience.

These kinds of internships in a bachelor’s degree are invaluable for learning practical skills on the job while also giving you connections when seeking jobs in the financial sector or financial institutions.

Postgraduate Finance Degree Options

Finance and accounting students also have the opportunity to pursue post-graduate education to receive higher degree credentials.

One of the most popular postgraduate options for finance and accounting students in the UK is the MSc Master of Finance. These types of master’s degree usually take an extra year of coursework and specialized education.

Most postgraduate finance programs also give you more opportunities to get work experience in the field of finance through partner programs.

In order to apply for a postgraduate finance degree, you must have completed an undergraduate degree in finance, accounting, or a related area. You may also be required to take an entrance exam.

The course breakdown for MSc Finance programs is usually broken down into 4 major groups:

- Foundation modules: These courses are focused on the basics of finance and cover core concepts like debt, equity, capital, efficiency, etc. In general, these modules also contain courses related to statistics and the mathematics necessary to deal with finance.

- Core modules: Core modules include most of the professional courses included in the curriculum, things like ethics and professional standards, econometrics, investment banking, and portfolio management.

- Electives: Electives are more flexible and like in undergraduate, they allow for more specific and interest-related subjects. In a master of finance program, common electives might include financial management, trading strategies, regulations & monetary policy, financial planning, Macroeconomics, and quantitative investing.

- Projects: Most postgraduate degrees also generally include a practical component in the form of projects or internships with businesses.

Another popular graduate degree in the field of finance is an MBA program.

A master’s of business administration program gives a broad overview of business management, including things like risk management, financial analysts, and other useful skills for management in finance careers.

P.S. If you’re considering getting a degree, check out our guide all about student finance in the UK.

How Much Does A Bachelor’s Degree in Finance Cost In The UK?

Tuition in England is different for each student in the UK. What you pay will depend on where you are from and where you will be studying.

That being said. schools in the UK can only charge up to £9,250 for English students per year. If you live in Scotland, then you can go to schools for free if you go north of the border. So for most students, tuition fees are substantially lower than £9,250 per year.

Keep in mind that this figure only covers tuition costs. You also need to take into account living costs like rent, food, transportation, equipment, and the like.

The average university student spends approximately £795 per month on living costs. AS you might expect, rent is the most expensive living cost, followed by food. These costs can be reduced substantially if you live at home while at university.

We have an entire post breaking down UK rental prices, in case you’re interested!

How Much Does a Master of Finance Degree Cost?

Masters degrees are usually more expensive than university programs. As of 2020, the average MSc in Finance program in the UK was between $23,000-£47,000. That is notably more expensive than undergraduate education.

But at the same time, a masters degree opens up better job opportunities with more pay.

The average salary of those who hold MSc degrees in the UL is £115,000, much higher than the average annual salary than for someone who only has an Honors degree.

Is Getting a Finance Degree Worth It?

Overall, a degree in finance is one of the most popular options and an excellent choice of degree for university.

Finance degrees will teach you the fundamentals of how money works, which is a useful set of skills to have in virtually every niche of the business and finance economy.

Business degrees like finance and accounting are usually considered good generalist business degrees because they provide technical skills that are useful no matter what kind of sector or industry you end up working in.

Also, finance students generally see higher starting and mid-career salaries than other degree holders.

All in all, it’s a good degree option that has a fair return on investment. If you are looking for a degree that would make up for the cost of schooling, then a degree in finance is one of the better options that you could pick.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024