Budgeting can be tricky. While internet banking makes it quick and convenient to access your finances, it can be challenging to track your expenditure and set a budget for your monthly outgoings.

Essentially the task of budgeting is easy – calculate your bills, decide how much you want to put into savings and then calculate a monthly, weekly or daily budget for your disposable income.

Despite meticulous planning, it’s not unusual to find the odd payment you can’t identify (those pesky PayPal purchases!) or get hit with a huge bill that impacts your monthly budgeting. Luckily, there are some fantastic options out there for budgeting apps which can really help you organise your finances each month.

Here we’ve picked our ten favourite budget planner apps for keeping track of your finances.

Rounding Up The Top 7 UK Budget Planner Apps

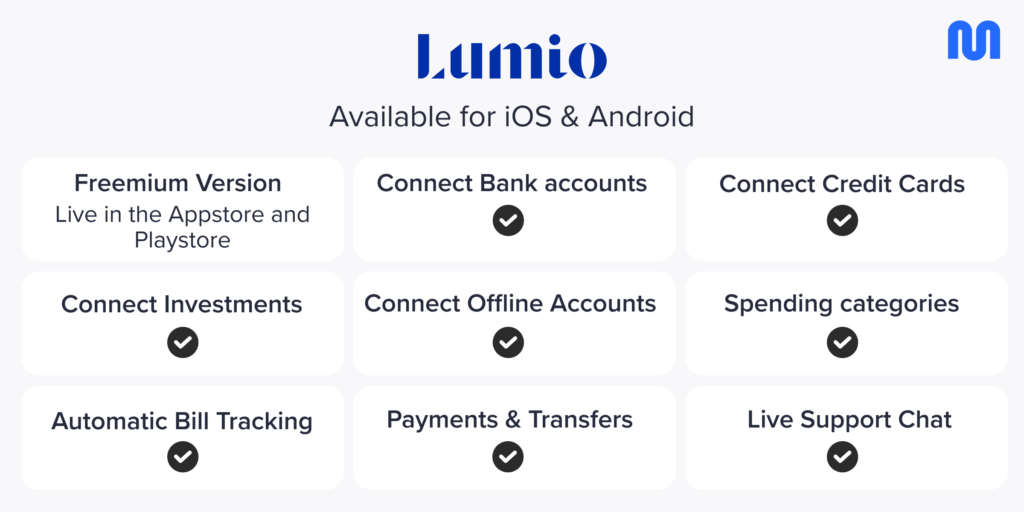

Lumio

Lumio is much more than just a simple “budget planner” tool. It lets you connect, track and grow your financial life in one app, in seconds. Get matched with the right financial products for you and start growing your money on autopilot.

The great thing about Lumio is it’s dedicated to hosting the widest range of account connections in the market, and is aimed particularly at UK users.

If you’re looking to take control of your financial life, give Lumio a whirl. It’s free!

Wallet

Wallet is a free to download app for iOS, Android and desktop. Like many apps you can download it for free or subscribe to the Premium version to access added features.

The free option comes with plenty of really helpful features such as planned regular payments (meaning you can input your monthly bills such as rent or car insurance to repeat each month) and financial reports to track exactly what you’re spending on.

You’ll also have the ability to categorise your spending by inputting your payments. This will break down into areas such as food and drink, shopping, transport and entertainment.

While the free version is a convenient tool for keeping track of your finances, it does require you to manually enter your payments (which can be time-consuming). The premium version syncs to your account but will cost you around £5.49 per month should you want to upgrade.

Head to the App Store, Google Play to download, or you can access their web app via your desktop browser.

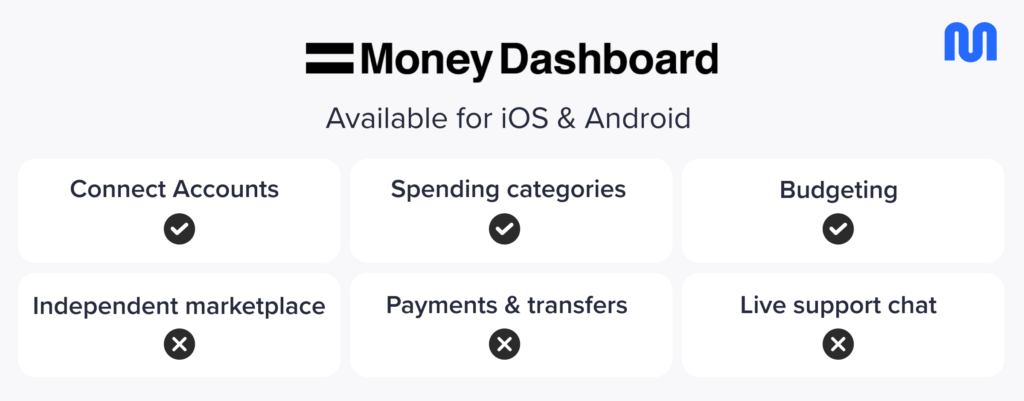

Money Dashboard

Money Dashboard is a great option if you have several accounts you want to group together. The app will not only link your accounts and analyse your spending, but will also help you with savings goals.

It connects to every major UK bank but also challenger banks like Monzo.

You’ll also have access to some really useful budgeting tools such as payday reminders, letting you know how much you have until your next wage is paid, spending history reviews and the ability to transfer between your bank account apps.

The app is free to sign up for and can be accessed via the Money Dashboard website or through your smartphone.

It’s worth mentioning that Money Dashboard won ‘Best Personal Finance App’ in 2017, 2018, 2020 and 2021 so you can be reassured that it comes highly recommended.

Find out more on Money Dashboard at the iOS App Store, Google Play or their website.

Wally

Wally is a free to use budgeting app that helps reach your spending and saving goals faster.

The app utilises flexible budget periods to help you achieve your aims and uses a straightforward, easy-to-use calendar to keep track of your regular payments.

The app will allow you to scan and upload bills, warranties and receipts. This can be a huge help to keep track of official documents (we’re all guilty of shoving important printouts into drawers and boxes never to be seen again!).

Wally can connect to joint accounts, so if you’re budgeting with a partner or housemate it can really help keep joint bills, rent and savings goals organised. Similarly, you’ll be able to use the document function to keep track of your lease agreements or joint bill reminders.

The one downside with Wally is it’s currently only available on iOS, however if you are an Apple user this is a great choice if you’re searching for an easy to use app that has the ability to budget with others.

Download Wally for free on iOS store or head to their official website.

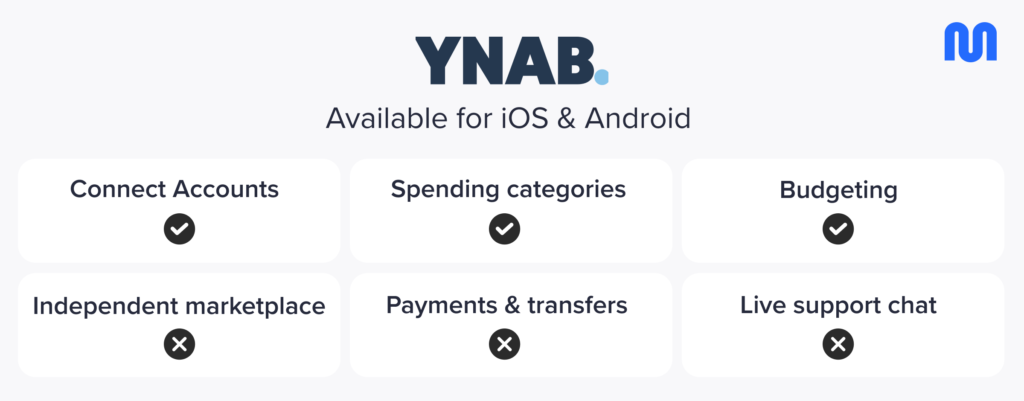

YNAB

YNAB (or ‘You Need A Budget’) is an award-winning software that is designed to take the stress out of budgeting and put you in control of your finances.

Unfortunately, much of the UK is living paycheck to paycheck, with very little or no money left over at the end of the month. YNAB aims to give you total budget control claims that users can save up to $600 (around £430) in their first two months using the app.

The service allows you access to benefits such as workshops and video courses on budgeting and aims to change your mindset when it comes to your finances. It’s a noble cause and one we’re all about — helping people feel more confident about their financial future.

While the app isn’t free (it’ll cost you £11 per month), there is a free trial available to use. The difference with YNAB is that, rather than simply giving you insights into your spending, it will help adapt your mindset to how you prioritise your money.

Head to the YNAB website for details on how their plan works and get a tour of their courses.

Monzo

Monzo has quickly become a household name in personal finance. Their service allows you to see all your incomings and outgoings in a highly visual and intuitive interface.

Their accounts come with other benefits as well such as bill splitting and the ability to use your card abroad for free.

Using Monzo is not only a great way to budget as you can top up your card with a certain amount each week or month and keep on top of that figure, but you can also use your card to track purchases and differentiate and track your spending.

If you’ve calculated what you need to set aside for savings and bills, it can be beneficial to use Monzo as a way of monitoring your disposable income and evaluating whether you are overspending on certain areas such as shopping or dining out.

You can also use their ‘Pots’ feature to keep in control of your saving aims. Maybe there’s some new tech you want, or you’re saving for a new car — using Pots lets you divide your money up into your chosen areas and work towards your goal.

While there aren’t as many features as other budgeting apps, if you’re looking to manage your disposable income, then a Monzo card can really help.

To apply for a Monzo card head to their website or download the app from iOS App Store or Google Play.

Also, consider checking out our Revolut vs Monzo vs Starling shootout!

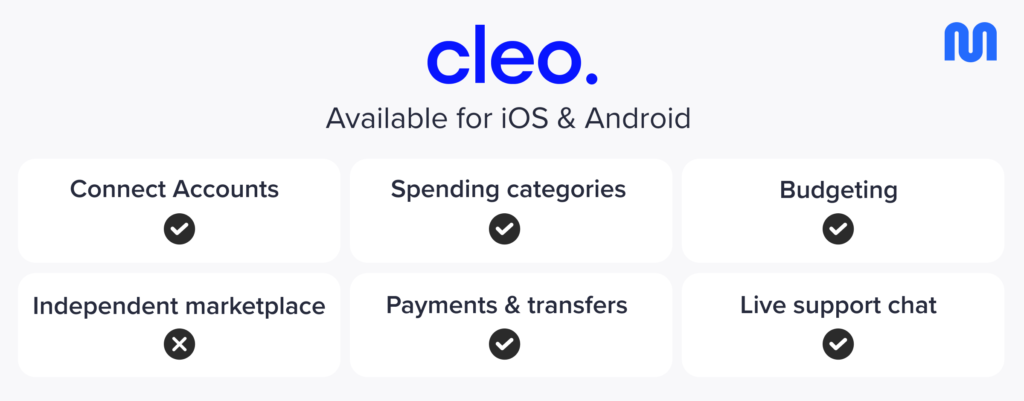

Cleo

The last in our list is Cleo, a budgeting app that might not be for everyone but certainly is unique.

The app utilises all the budgeting tips and help you’d expect from bill management to monthly spending targets. Cleo has an added smart chat bot that works with you in a real-time conversation to help with your spending goals.

Cleo will break your spends down into updates and advice and even has a ‘roast’ mode which injects some dry humour into the conversation and will poke fun at you for overspending.

What we love about Cleo is how it makes budgeting fun. If you’re looking for investment advice and a more clerical look, then this probably isn’t for you. However, Cleo has taken a unique approach to the often mundane task of financial management which can be a breath of fresh air.

For more information on Cleo (we’d recommend checking out the roast function before you download!) head to their website or get the app via iOS App Store or Google Play.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024