Back in 2017, the UK government unveiled new rules for Lifetime Individual Savings Accounts (LISAs). LISAs are a new kind of ISA that allows young people to save for retirement, buying a new home, or more. The main difference between a LISA and a regular ISA is that the UK government will contribute a percentage every year to your account.

In order to open a LISA, you have to be between the ages of 18-40. You can start making contributions immediately or wait, but you have to make some contributions before you turn 50. You can also only contribute £4,000 a year, which the government will match with a 25% bonus. So if you put in £500, then the government will add an extra £100. That means you can get up to a £1,000 bonus from the government every year, completely gratis.

There are some restrictions on a LISA though. You cannot withdraw the funds until you are of retirement age, or if you are buying a house. There are also provisions to allow for withdrawals if you are severely ill. If you do withdraw for any reason other than these, you will incur a heavy financial penalty.

There are 2 major types of LISAs: stocks & shares LISAs and cash LISAs. Stocks & shares LISAs allow you to put your money into the stock market so your investments can grow. Unfortunately, this opens you up to risk as investments can go poorly.

Cash LISAs, in contrast, allow you to save for retirement in cold hard cash. That cash collects interest and so grows every year. Since you are not investing in stock, there is less potential for growth, but there is no chance that you will lose money from volatile market conditions.

Since their unveiling in 2017, many providers and banks have started offering cash LISAs for their customers. In this article, we cover 5 of the most popular firms that offer cash LISAs to customers. We will cover each service and give a list of their pros and cons.

5 Best Cash LISA (Head To Head)

- Moneybox

- Paragon Bank

- Hargreaves Lansdown

- The Nottingham Building Society

- Newcastle Building Society

Moneybox

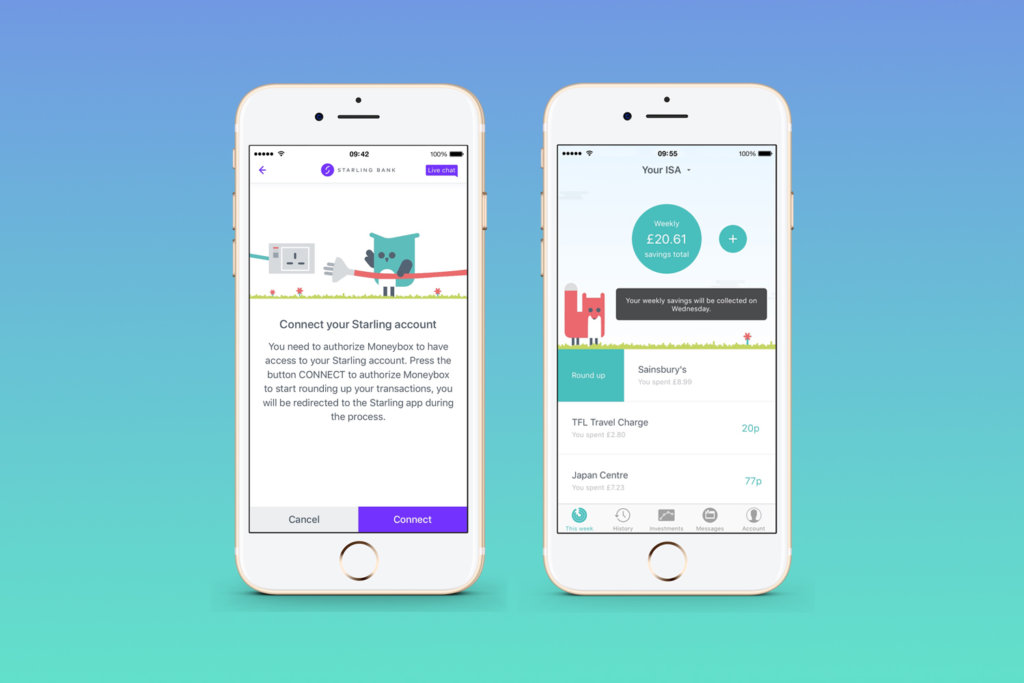

Moneybox is up first on our list and is a relatively new brokerage firm based out of the UK. Moneybox is based on a micro-investment philosophy and deals in smaller investment amounts. One of Moneybox’s unique features is the roundup purchases. Round-up purchases will round up any purchases you make with a verified payment method to the nearest dollar and invest that extra spare change. Moneybox is a good service that encourages mindless saving.

Moneybox’s Cash LISA is one of the best in the business. As is the case everywhere, you have to be between 18-40 to open a LISA and there is a £4,000 annual contribution limit. The cash LISA can be connected to round-up purchases Moneybox’s cash LISA offers a suitable 0.5% AER interest rate and a special 0.5% introductory bonus for the first year. Keep in mind that this 0.5% is stacked on top of the 25% that the government gives you.

Even better, there are no fees for opening an account and there are no account minimums. Moneybox cash LISAs are held through a company called Investec which is covered by the FSCS so your investments are insured up to £85,000. Moneybox will also allow you to transfer an existing LISA to Moneybox for a relatively small fee.

| Type of account | Account subscription | <£100,0000 | >£100,000 | Interest |

| Cash LISA | N/A | 0.45% | 0.15% | 1.5% |

Moneybox LISAs do not have any account subscription fees of minimum account amounts. They charge a standard 0.45% annual management fee which is fairly typical for most brokerage services. This fee drops when you have more than £1,000 invested in the platform. Fund fees also fall in the 0.12%-0.30% range.

Pros

- No account minimums

- Compatible with round-up purchases

- Relatively low annual fees

- Can transfer from existing LISA

- Special 0;5% introductory bonus for the first year

Cons

- You can lose the bonus if you cancel before 1st year

- Interest rates can fluctuate, which can be either good or bad

The bottom line is that Moneybox is a great service to start a cash LISA. You can transfer an existing LISA and they offer a special introductory bonus for the first year that you have an account.

Paragon Bank

Paragon Bank is a brokerage service that won “Best Online Cash ISA Provider” at last year’s Yourmoney.com Awards.

Paragon Bank was founded in 2005 and currently manages over £300 million in assets. Back in 2019, Paragon Bank launched a cash LISA service designed to help young people save for retirement. Paragon’s LISA can be set up solo or you can transfer over an existing LISA from another provider.

Paragon’s LISA offers a generous 1.15% AER per annum. This is a bit smaller than some services such as Moneybox’s 1.5%, but it is higher than Newcastle Building Society’s 1.1% annual rates. You can open a Paragon Bank LISA with just a £1 minimum deposit and you can open an account online. Paragon Bank is regulated by the FCS and insures all your funds through the FSCS and is protected for up to £85,000.

Paragon Bank also has a useful feature called ISA wallet, which helps spread out contributions over your different ISA account, including your LISA. This is a great feature if you are nearing the £20,000 annual ISA contribution limit and want a way to better allocate contributions each year. If you withdraw within the first 12 months then you will incur a 20% penalty fee, but if you withdraw after 12 months you can access that money penalty-free.

Paragon Bank offers a base 0.75% interest rate on their accounts. So if you have £1,000 deposited, then after a year that amount will rise to £1,007.50. (this example amount does not factor in the 25% government bonus). Like most LISA providers, the interest is subject to change. Paragon does not allow joint LISA accounts and you need to contribute at least one pound every contribution period.

Pros

- ISA wallet tool is very useful

- You can withdraw funds after 12 months with no penalty

- Easy to open an account online

- You can transfer an existing LISA

Cons

- Lower interest rates than some other providers

- No joint accounts available

Hargreaves Lansdown

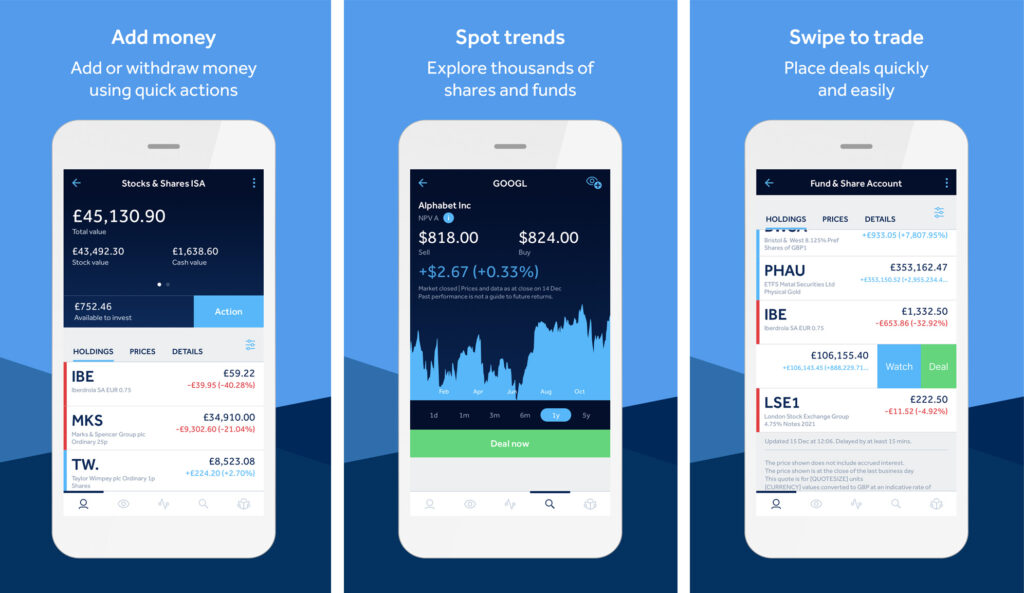

Hargreaves Lansdown is one of the larger financial services providers in the country and offers a wide range of financial services to the public. Hargreaves Lansdown can provide financial advising services, general investment accounts, and more. Hargreaves Lansdown is also one of the few providers that offer both a stocks & shares LISA and a cash LISA.

Hargreaves Lansdown LISAs are fairly standard. You can start a LISA in just a few minutes online and only need £100 to get started.

Hargreaves Lansdown is a bit different from other providers and requires you to contribute at least £25 a month to your account. All Hargreaves Lansdown accounts have a flat 0.45% account management fee and this includes cash LISAs.

| Type of Account | <£250,000 | £250,000-£1m | £1m-£2m | £2m+ |

| Cash LISA | 0.45% | 0.25% | 0.1% | 0 |

All Hargreaves Lansdown accounts have a base 0.10% interest rate and are variable up to 1.25% per annum. This is higher than Paragons Bank’s rates but still smaller than Moneybox’s 1.5% rate. There is also the option to transfer an existing LISA to a Hargreaves Lansdown account. Extra charges to your account may apply. For £3,000 in funds, normal fees come out to about £13 per year.

Pros

- Great reputation

- Fees decrease the more you save

- Variable interest rates

- Both cash and stocks & shares LISAs

Cons

- Extra charges besides management fees

The Nottingham Building Society

Back in 2017, The Nottingham Building Society launched its cash ISA service as the second cash LISA to be introduced in the UK. Nottingham Building Society allows any UK citizen between the ages of 18-40 to open a LISA for a £10 minimum deposit. Nottingham Building Society does not accept LISA transfers from other providers. So if you already have a stocks & shares LISA, then you cannot transfer any funds from one account to the other.

Nottingham Building Society also has some geographical restrictions. You can only open an account if you live in the bank’s branch network. This includes the towns of Nottinghamshire, Derbyshire, Lincolnshire, Staffordshire, Norfolk, Leicestershire, Cambridgeshire, Hertfordshire, South Yorkshire, Bedfordshire, and Northamptonshire.

Nottingham Building Society used to not offer online services, so you would have to open your LISA account in person. However, they recently added online services in 2019, so now you can manage your account online. But you still have to apply to a LISA account in person.

The Nottingham Building Society also offers special mortgage broker advice for account holders. Once you save up more than £500 in your account over a year-long period, you can get ‘free’ broker advice from the company’s mortgage services. Normally, this service is £299 per visit, so it’s a nice addition for account holders looking to buy a house.

| Type of account | Interest rates | Minimum account |

| Cash LISA | 1.25% | 10£ |

Nottingham Building Society has a 1.25% interest rate on all cash LISAs and has a minimum of £10 account balance. As we said earlier, Nottingham Building Society does not allow cash ISA transfers from other accounts so you have to open one from scratch.

Overall, Nottingham Building Society offers lower interest rates than a lot of other providers but has the added benefit that they provide mortgage services. The 1.25% interest rate is pretty decent but it is still smaller than Moneybox’s very generous 1.5% rate.

Pros

- Offers free mortgage advice

- Decent 1.25% interest rates

- Good advising services

Cons

- Cannot transfer an existing account

- £10 minimum account balance

Newcastle Building Society

Last on our round-up is Newcastle Building Society. Newcastle Building Society launched its LISA in 2018 and it has become one of their most popular financial products. Newcastle LISA must be opened online and you must be between 18-40 to open an account. Like many providers, Newcastle Building Society does not allow transfers from previously existing LISAs to a new LISA opened with them., They plan on introducing the features in the future but do not currently have a time-scale.

Newcastle LISA can be opened with a minimum deposit of £1. Every year interest is added to the account on the day that you opened it. You can actually open multiple LISAs but contribution restrictions will apply to all of them. You can fund your cash LISA with basically any method. Newcastle Building Society offers a base 0.35% AER on all accounts that is variable. As of 2020, the current interest rate is 1%, lower than some of the other competitors we have covered here.

| Type of account | Interest rates |

| Cash LISA | 1% |

Newcastle Building Society’s interest rates are fairly low, but the rate is variable and can be higher. Newcastle will notify you whenever the interest rate on your account changes.

Pros

- Easy to open an account online

- Variable interest rates

- They plan to allow for transfers in the future

Cons

- Low interest rates

Final Thoughts

LISAs are a great relatively new method to help young people save up for a house or retirement. The main benefit of a cash LISA is that you can park your funds and watch them grow with interest, without exposing them to any risk as you would with a stocks & shares LISA. This means that cash LISAs tend to grow more slowly, but they are more secure and reliable.

So if you are looking for a smart way to save for retirement or to buy a house, then opening a cash LISA can be a very smart investment. The government gives you a 25% bonus on all deposits that you make which can add up to quite a bit over time.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024

1 Comment