The money apps for UK couples looking to take the faff out of their shared finances.

When it comes to managing finances as a couple, having the right tools can make all the difference. Finding the right money management or budgeting app can help couples align their financial goals, track their spending, grow their savings and build a future together. So, we wanted to do a lot of the legwork for you, download, subscribe, and rigorously test all the leading money management apps in the UK market and strip it back to the top 5 money management and budgeting apps for UK couples. In this article, we’ll cover:

- Top 5 Budgeting and Money Management Apps for UK Couples in 2025

- How to Start Budgeting as a Couple

- The Benefits of Using a Budgeting App for Couples

In 2025, the money management market is brimming with innovative apps tailored to different financial needs of couples. Some of these apps are built off the bank of Open Banking while others have take their own route – learn more about Open Banking here (thanks to MoneySavingExpert). If you want a more personalised and insightful experience, then one of these innovative solutions below should be for you. Now, let’s take a look at the UK’s leading money management and budgeting apps for couples so you can find the best fit for your relationship.

Top 5 UK Budgeting and Money Management Apps for Couples in 2025

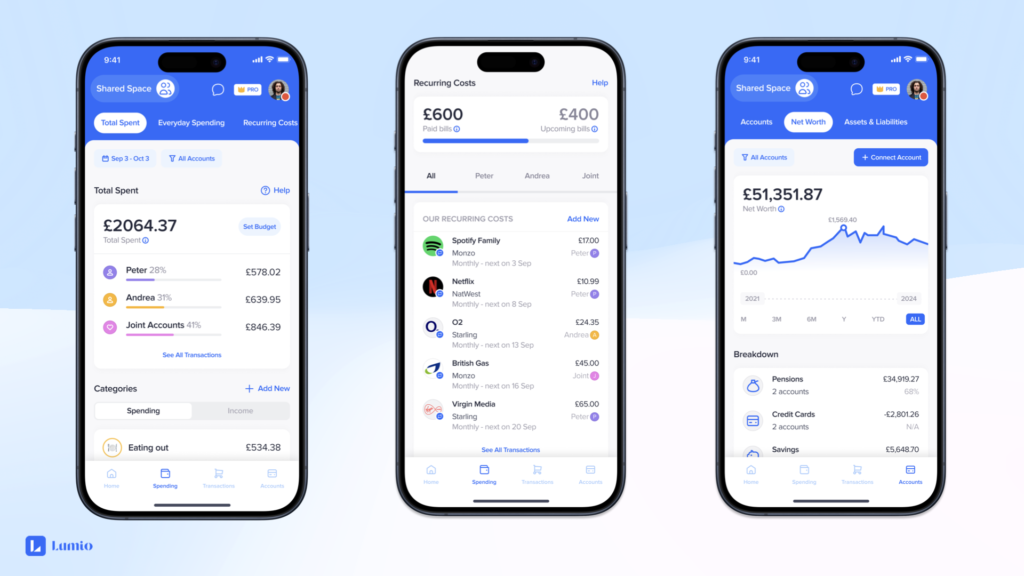

1. Lumio

Lumio is the only specialist money management app for couples in the UK. It has quickly become a popular choice for modern couples after being designed as a smart and flexible alternative to Joint bank accounts for couples. The app connects to all your bank accounts, credit cards, and investment platforms to give you a holistic view of your finances, both as a couple and an individual – and gets couples on the same page in minutes. Lumio has been created to work as the first financial app in your relationship. Your financial third wheel. So, let’s take a closer look.

Core Features

- Control what you share. Private Space for personal finances. Shared Space for Shared finances as a couple.

- See All Your Accounts in One place: Connect seamlessly with more than 90 UK banks and financial services. Connect any account, and only share the accounts you want your partner to view.

- Expense Sharing and Splitting: Share any expense to your Shared Space. Lumio easily tracks all shared expenses and calculates who owes what with it’s IOU Tracker.

- Bills and Subscription Tracking: Automatically detects any recurring bills or subscriptions and provides cancellation reminders. Helping couples co-ordinate bills, effortlessly.

- Net Worth & Debt Tracking: Helps users monitor all your assets, liabilities and debts in one place.

Pros and Top Features

- Budget Creation: Custom budgets based on categories such as food, entertainment, and travel.

- Data Security: High-level encryption ensures sensitive financial data stays secure.

- Clean and Elegant Design: Modern interface that appeals to modern couples

- Expense Categorisation: Automatically categorises transactions for easier budgeting, while customers can create their own custom categories themselves.

- Sync Spending Cycles to Pay day: Set a custom day to analyse and view your finances. 1st of the month, payday or a specific day. e.g. 28th.

Cons and Potential Drawbacks

- Subscription Cost: Lumio requires a monthly fee for premium features (although there is a Freemium option).

Best For

Couples who frequently split day-to-day bills and expenses – whether for household costs, groceries or travel. If you want a simple way to track shared expenses, set a budget and start saving together, Lumio is an excellent choice. Whether you are not ready for a Joint Bank account or already have one, Lumio has been created with the full flexibility required for the modern couples finances.

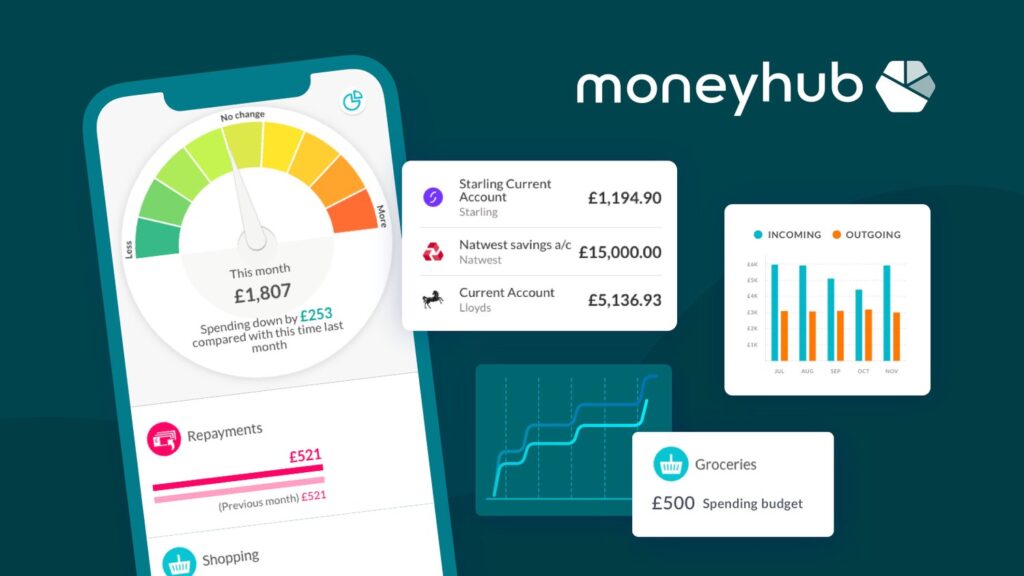

2. Moneyhub

Moneyhub is a financial powerhouse known for its Open Banking integrations and goal-based financial planning. Launched in 2014, Moneyhub has earned a reputation for its cutting-edge data aggregation features. It’s not just an app but a full-fledged financial management tool that can also assist with tax reporting and investment planning.

Core Features:

- Bank Account Integration: Connects to multiple accounts, including pensions, ISAs, and investments.

- Spending Insights: Provides category-based breakdowns of expenses.

- Budget Tracking: Allows users to create detailed budgets for specific timeframes.

- Net Worth Tracker: Calculates overall net worth by syncing assets and liabilities.

Pros and Top Features:

- Robust Reporting: Offers detailed and customisable financial reports.

- Financial Coaching: Provides insights that guide better financial decision-making.

- Versatile Integrations: Supports a wide range of banks and financial institutions.

- Subscription Transparency: Helps users track subscription spending.

Cons and Potential Drawbacks:

- Learning Curve: The extensive features may feel overwhelming for new users.

- Paid Subscription: Some key features are locked behind a monthly subscription fee.

Best For:

Moneyhub is ideal for couples with complex finances, such as those managing mortgages, investments, and retirement funds. If you and your partner want to get serious about financial growth and need deep insights, Moneyhub will keep you both on track.

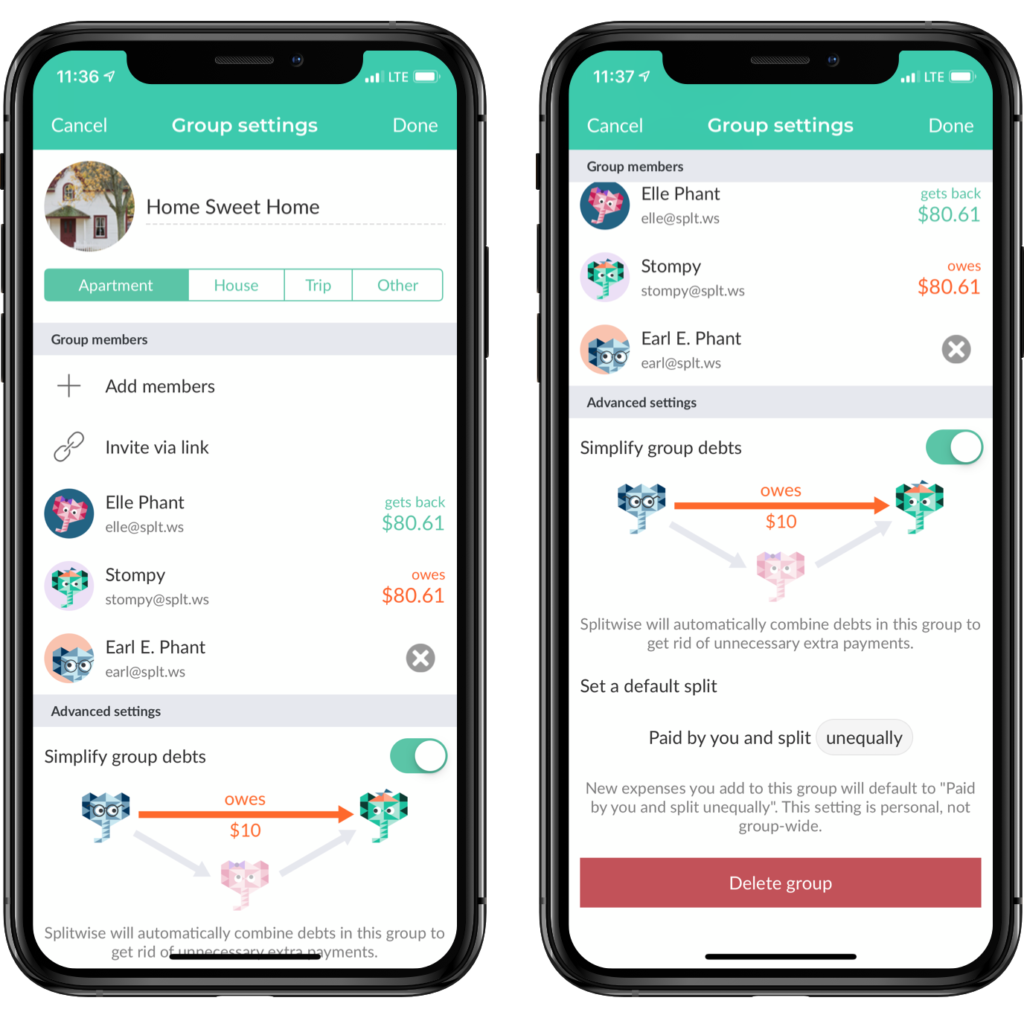

3. Splitwise

Splitwise is simple app for friends who split expenses on holiday or live together. While it’s popular among friends for travel and group expenses, it could be equally as valuable for couples managing shared costs such as rent, groceries, and utilities. Splitwise was founded in 2011 with the goal of simplifying shared expenses and avoiding awkward money discussions.

Core Features:

- Expense Splitting: Easily tracks shared expenses and calculates who owes what.

- Debt Simplification tools: Groups multiple transactions into a single, simplified balance.

- Reminders: Notifies users about upcoming payments or balances due.

- Integrations: Syncs with PayPal and Venmo for easy payments.

Pros and Top Features:

- Ease of Use: Simple, intuitive interface that makes splitting bills easy.

- Cloud Sync: Accessible across devices, so you and your partner stay up-to-date.

- Multi-Currency Support: Great for international travel.

- Free Core Features: The basic app covers most day-to-day needs without cost.

Cons and Potential Drawbacks:

- Manual Input: Splitwise can require a lot of manual input compared to other budgeting apps.

- Limited Analytics: Not designed for holistic financial planning or budgeting.

- Premium Features: Features like receipt scanning and detailed reporting require a paid upgrade.

Best For:

Couples who frequently split day-to-day expenses, whether for household costs or travel. If you want a simple way to track shared expenses without diving into detailed budgeting, Splitwise is an excellent choice.

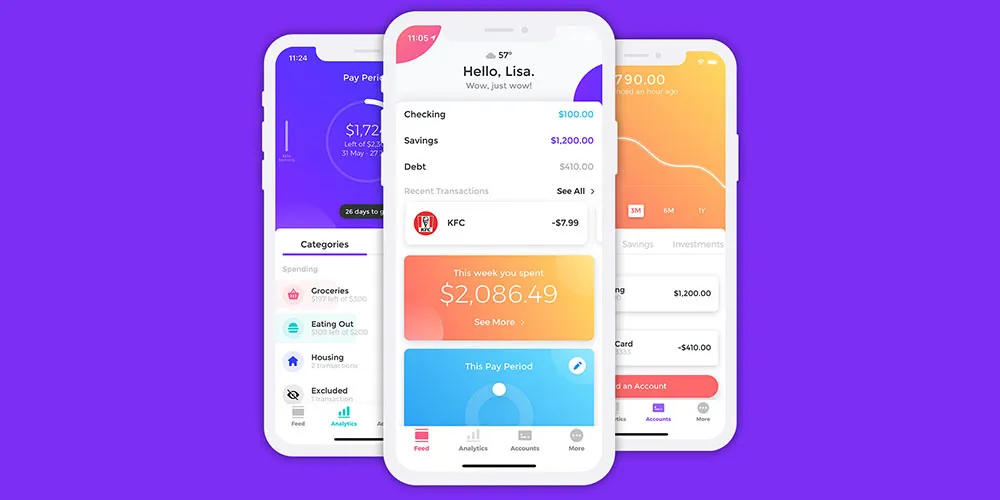

4. Emma

Emma is a financial management app that has gained popularity for its playful design and powerful features. Launched in 2018, Emma brands itself as the “financial friend” that helps users stay on top of their money. The app is particularly appealing to younger users due to its gamified approach to budgeting and tracking.

Core Features:

- Subscription Tracking: Detects recurring subscriptions and provides cancellation reminders.

- Budget Creation: Custom budgets based on categories such as food, entertainment, and travel.

- Debt Tracking: Helps users monitor debt payments.

- Daily Summaries: Provides bite-sized updates on spending habits.

Pros and Top Features:

- Bright and Engaging Design: Fun, modern UI that appeals to millennials and Gen Z.

- Subscription Cancellations: Assists in identifying and cancelling unused subscriptions.

- Expense Categorisation: Automatically categorises transactions for easier budgeting.

- Multi-Bank Sync: Connects seamlessly with major UK banks.

Cons and Potential Drawbacks:

- Limited Investment Tools: Lacks in-depth investment tracking compared to apps like Moneyhub.

- Premium Price: Emma Pro is required for advanced insights and features.

Best For:

Emma is primarily aimed at Gen Z individuals who want to take control of their day-to-day spending and minimise unnecessary expenses. It’s especially useful for individuals trying to rein in subscription costs or stick to a budget.

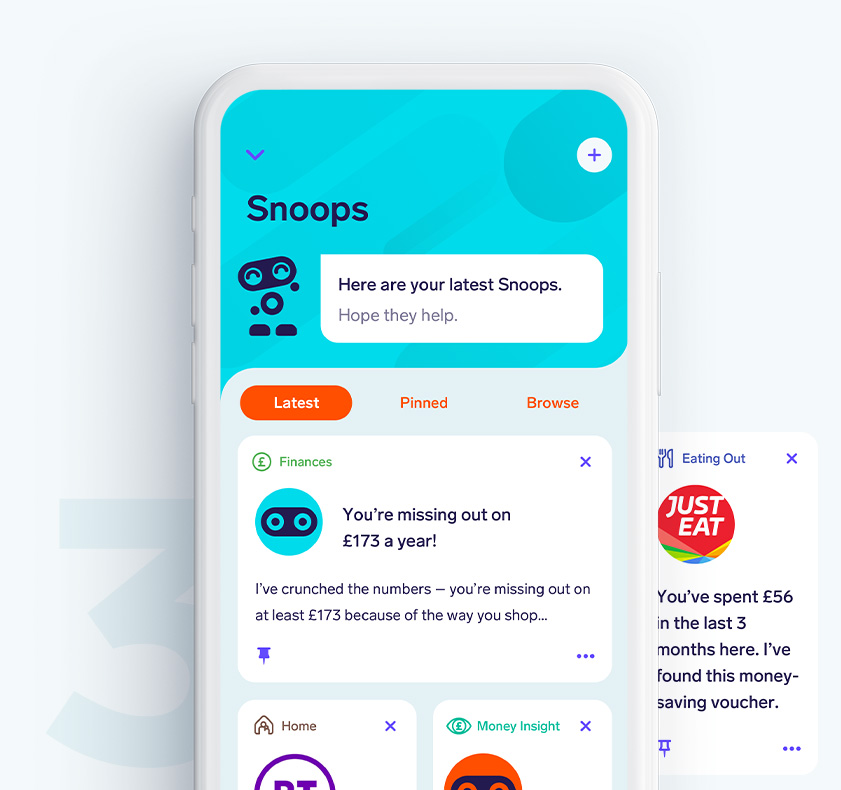

5. Snoop

Launched in 2020, Snoop is a financial assistant app designed to help users save money by providing personalised insights and recommendations. Snoop is built on Open Banking technology and aims to help people spend smarter and save more by highlighting deals and avoiding wasteful spending.

Core Features:

- Personalised “Snoops”: Tailored money-saving tips based on your spending habits.

- Recurring Payment Tracker: Keeps tabs on subscription services and recurring payments.

- Bank Integration: Syncs with major UK banks and financial services.

- Expense Notifications: Alerts users about unusual spending or opportunities to save.

Pros and Top Features:

- Money-Saving Focus: Helps couples cut unnecessary costs with personalised deals.

- User-Friendly: Minimal learning curve with actionable insights.

- Custom Alerts: Keeps users informed about unexpected charges or offers.

- Free to Use: Most of Snoop’s features are free.

Cons and Potential Drawbacks:

- Limited Budgeting Tools: Not as comprehensive for goal tracking or detailed budgeting.

- Occasional Ads: The app may suggest third-party offers that feel like ads.

Best For

Individuals focused on maximising their savings. If you and your partner are looking for smart ways to cut costs and find better deals, you might find Snoop helpful. Snoop’s money-saving insights will help you get the most out of your spending.

How to Start Budgeting as a Couple

Budgeting as a couple involves communication, collaboration, and mutual trust. Here’s a step-by-step guide to help you get started:

- Discuss Financial Goals: Have an open conversation about short-term and long-term goals, such as saving for a home, paying off debt, or planning for a holiday.

- Assess Your Combined Income and Expenses: Review your individual and shared incomes, bills, and recurring expenses.

- Identify Spending Patterns: Track your expenses for at least one month to see where your money is going.

- Create a Joint Budget: Decide how much you’ll allocate for essentials, discretionary spending, and savings.

- Choose a Budgeting Method: Whether it’s the 50/30/20 rule or a zero-based budget, find a system that works for both of you.

- Use a Budgeting App: Select an app that aligns with your needs to simplify tracking and updates. Check out the list above of the top 5 money management and budgeting apps for UK couples.

- Set Regular Check-Ins: Schedule monthly or weekly reviews to adjust your budget and ensure you’re meeting your financial goals.

The Benefits of Using a Budget App for Couples

- Improved Transparency: Budgeting apps provide a clear overview of shared finances, eliminating confusion or miscommunication.

- Expense Tracking: Automatic tracking helps couples stay on top of their spending without manual spreadsheets.

- Goal Setting: Many apps allow users to create savings goals and track their progress, keeping financial plans on course.

- Time-Saving: Automated syncing and categorisation save hours of manual budget management.

- Reduced Financial Stress: By using an app, couples can avoid financial surprises and foster healthier money discussions.

Conclusion

The best budgeting app for your relationship depends on your financial habits and goals as a couple. Whether you need detailed financial insights (Moneyhub), a simple money management app built for couples (Lumio), a friendly budgeting companion for just you as an individual (Emma), or a simple expense-splitting tool (Splitwise) – there’s an app tailored for you. Start by identifying your needs, testing the free versions, and sticking at it! We have taken many hours to test and review the above money management apps to settle on this top 5 money management and budgeting apps for UK couples, so we hope it’s helpful in taking the first step towards financial harmony.

References

- Moneyhub Is Shutting Down – 5 Best Alternatives for Managing Your Finances - February 12, 2025

- Too Many Subscriptions Draining Your Budget? New FTC Click-to-Cancel Rule Aims to Simplify Cancellations – And What it Means for the UK - January 14, 2025

- How to Cancel Digital Subscriptions on Your Apple and Google Accounts (in 2025) - January 14, 2025