Stocks, shares, mutual funds, bonds, commodities, the list goes on.

There are also structured products. Structured products offer an alternative investment vehicle to traditional investment means.

In this article, we’ll go over structured products, how they work, along with their pros and cons. We’ll also discuss the more prominent role that structured products play in the financial and investment ecosystem.

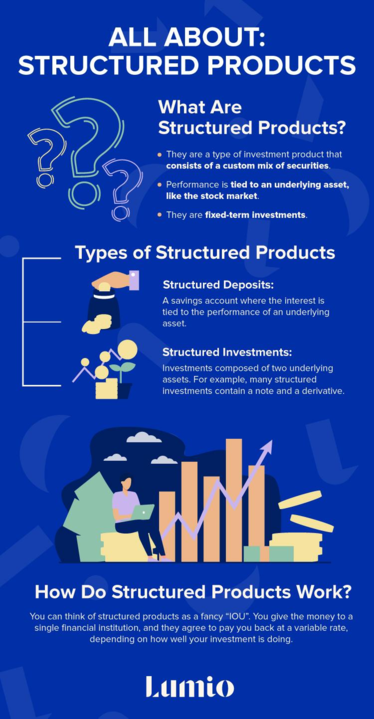

What Are Structured Products?

Here’s the lowdown on what structured products are:

- Structured products, also called structured notes, are a type of investment product that consists of a custom mix of securities.

- The performance of a structured product is tied to an underlying asset, like the stock market.

- Structured notes are fixed-term investments, and the return you get from a structured product depends on what it is tracking.

Structured products are similar to ETFs in that they consist of a bundle of securities that track performance. However, they differ from ETFs because they can’t be bought and sold on the market like shares (and have a fixed term). Structured products are often issued directly to an investor from the bank, not through an exchange.

Structured products are also used as a way to gain exposure to derivatives. They also allow you to customise your risk-return objectives. For example, instead of receiving regular interest payments from a bond, structured notes might instead tie the return on that bond to its performance. This type of “choose-your-own-investment” model emerged due to banks needing to issue cheap debt.

Structured products give investors a way to gain exposure to multiple asset classes and balance their portfolios. Structured investments are a way to make money when the stock market falls and hedge against common investment risks.

Types of Structured Products

There are two significant kinds of structured products: structured deposits and structured investments.

Structured Deposits: A structured deposit is a savings account where the interest is tied to the performance of some other underlying asset, such as the stock market. When the stock market is doing well, the interest payments will be higher. Generally speaking, the money that you put into a structured product is protected, just like any other savings bank account. So in that sense, there is relatively little risk exposure compared to other investments tied to an underlying asset like the stock market.

Structured Investments. Structured investments are composed of two underlying assets. For example, many structured investments contain a note and a derivative. Most of the time, the derivative is an option or something that has a similar derivative structure. Structured investments are more like traditional investments — they are tied to the performance of a stock market index.

Structured investments are considered capital at risk’, meaning that funds are placed in a contract that holds various asset classes.

How Do Structured Products Work?

Generally speaking, structured products tie up your money for a set amount of time. You tie up your money in exchange for some lump sum at maturity.

The exact amount you earn depends on the performance of whatever underlying security the financial instruments are tied to.

You can think of structured products as a fancy “IOU”. You give the money to a single financial institution, and they agree to pay you back at a variable rate, depending on how well your investment is doing. These kinds of investments are usually tied to the performance of a large index, such as the FTSE 100. The exact specifics of how the product is designed depends on your agreement with the financial institution.

Structured products often give extremely high yields. This might seem strange to some. After all, they mostly feature bonds, so how can they get such high returns?

The secret is derivatives.

An investor might find a low-risk bond and invest just enough to reach the originally invested amount by the maturity date. The remaining money is placed into a high-risk derivative like an option to generate extremely high returns.

Here is what I mean.

- Say that an investor puts in £10,000. That means that they must get at least £10,000 no matter what happens.

- The investor will pick a low-yield bond and only deposit enough (say £9,000) so that it will appreciate to £10,000 by the end date.

- The remaining £1,000 is placed into a derivative.

- The investors need a way to make good on the structured product deal if the market rises. So they will invest that £1,000 in an option.

- The amount invested is enough to generate the 14% promised return if the FTSE 100 goes in the right direction.

So, the larger the amount put into a structured product, the larger the return managers can make. That is how they can generate such high returns on the order of 10%+.

Example of a Structured Product

Here is a quick hypothetical structured product, so you can get the gist of how they work.

Say there is a 3-year deposit-based product that promises a potential return of 14% (that is equal to 4.66% per year).

Say that this product is linked to the performance of the FTSE 100. However, the condition is that you only get paid if the FTSE closes higher after 3 years than where it started.

If it closes below its starting level, then you only get the original amount you invested returned at the end of the 3 years.

Notice how this works? It does not matter how much the index is above, only that it is above where it started at the end of the 3 years.

Even if it only rises by 1%, then you will get that 14% total return.

However, even if it falls by 1% or 50%, you will get only your original investment back.

This capital protection feature ensures a modicum of principal protection. Principal protection is an excellent feature of an investment strategy.

This is a very different dynamic than traditional investments. The return on traditional shares is based entirely on the market return. For this structured product, the return is not based on the specific performance of the FTSE 100 but just whether it goes in a particular direction or not. The fact that the investment return is not tied directly to the index performance is one of the unique features of structured products that distinguishes them from other asset classes.

This means two things. First, you are giving up the chance to participate in the swings of the stock market. But it also means that you will be more insulated against market downturns. A deposit-based structured product will generally protect your original investment.

Now let’s look at a hypothetical example. This investment promises a 10-% return on investment for a 6-year time frame. However, it also has a ‘kick-out’ clause. A kick-out clause states that if the underlying asset goes in some direction, then the investment ends and you get any returns plus your original money back. So for example, a structured investment might have a kick out clause enacted within 2 years or 12 months.

Also, structured investments also have a “capital loss” rule. A capital loss rule states that if the index loses a specific value, then you will suffer the same percentage loss. So if a capital loss rule triggers a loss at a 40% drop, then you will also suffer a 40% loss. If the index drops 60%, then you will also lose 60%.

It is hard to give an exhaustive overview of structured products because they are so different. The whole point of a structured product is that you can customise an investment product to your liking.

Structured Products and Taxes

Structured products that are held outside of a tax-deferred shelter will be subject to taxes. Specifically, the returns of a growth structured product or call product are counted as capital gains taxes. In the UK, this can be highly beneficial because of capital gains tax allowance. As of 2021, the capital gains tax allowance for the UK is £12,300.

Other kinds of structured products can be counted as income. Returns from these kinds of products will usually (though not always) be taxed at income tax rates at the highest marginal bracket that applies.

The exact kind of tax treatment you get depends on the specific agreement on the product. Make sure that you have all pertinent information about the tax structures of these kinds of financial instruments. It always helps to talk to a professional financial manager if you are confused about the terms of a structured product.

Pros and Cons of Structured Products

Pros

- Hedge risk. One of the unique features of structured products is how they hedge risk. A structured product typically has a defensive barrier of some kind. Either it’s deposit-based and you are guaranteed to get at least your original deposit back, or they have a capital loss rule that only triggers beyond a certain loss, say 40%. To be clear, an FTSE 100 structured product might make more than the project return on a structured product, but there is less risk of losing your money to a swing that big.

- Planning. Since structured products have a well-defined maturity date, they can play a useful role in financial planning. The regular fixed-payment nature of a structured product makes them a potential source of income as you near retirement. You know exactly how much you are going to get and when you will get it.

- Flexibility. Arguably, the most unique part of structured products is how they can be customised. They can be formed around virtually any derivative in the market and have whatever combination of factors pursuant to its conditions. They are a highly customisable asset, so you can build on to suit your portfolio. This also means that they are a way to diversify your assets through exposure to uncommon investments.

- Taxes. Structured product gains are considered long-term capital gains, meaning that they are tax-efficient. You can use a structured product similar to how you would use other long-term investments to save on taxes.

- High returns. Structured products are capable of generating extremely high returns compared to other kinds of investments. The way they combine bond assets and derivatives allows them to manage returns in the neighborhood of 10% per year for 6 years.

Cons

- Illiquid. Unlike assets traded on an exchange like shares or ETFs; structured products are relatively illiquid. The majority of the principal is held in a bond with a maturation date while the other part is in a derivative that is tracked to a market index. This makes them highly illiquid by nature, and that is kind of the point. They are a kind of fixed return investment. Investopedia describes structured products as “punishingly, excruciatingly illiquid,” if that is any indication of what we are dealing with.

- Not guaranteed. Despite the fact that many of these products might have the word “guaranteed” in their name, they are not principal guaranteed. You can lose your investment with a structured product, though admittedly you need to meet complicated conditions first. They are generally set up to not fail but they can.

- No reinvestment. With shares and ETFs, aunty dividends that are paid out can be reinvested, thus increasing your principal and your future returns. With structured products, these kinds of payments are excluded so you are missing out on the potential gains from dividend reinvestment.

- Miss out on bull trends. Structured products offer a high return, but they also mean you can miss out on bill runs in the market. If you invest in an FTES 100 structured product for a 10% return but then the FTSE 100 rises 20%-25%, then you will miss out on those bullish trends.

- Complexity. Most structured products are subject to fairly complex limitations and specific conditions. Depending on the type of product, there might be a capital loss rule or two products might track different indexes. Some structured products are designed to track more than one index so they can get complex quickly. The complexity is both a benefit and a drawback.

Are Structured Products Worth It?

To everyday retail investors, structured products look like a great idea. They offer a very high return with some protection for your principal investment. But, some hidden risks may make structured products not a good choice for your portfolio.

The deal of a structured product is between you and the bank. That means if the bank fails then, even if the underlying asset is valuable, your specific agreement might be worthless. This is actually what occurred in 2008 when the Lehman Brothers collapsed.

In other words, structured products incur a credit risk in addition to market risk. Not only does the market have to tip in your favour, but you also have to count on the banking institution not failing. And we know that big investment banks sometimes fail, even if they are big.

Also, structured products come with some hidden costs that might not immediately be obvious. For example, most structured products are handled by brokers who charge a commission fee. These fees are built into the value of the principal itself, so you won’t see them unless you look at the actual prospectus. According to Morningstar, the average markup on structured products for commission fees is about 3%.

Despite these drawbacks, a structured product can be a useful tool to take advantage of market swings for a large payout. That makes them useful during times of market volatility, which certainly describes recent states of affairs. Some investors may think they are more complicated than they are worth, though. Whether they are worth it or not comes down to how you like to structure your portfolio and whether you are willing to deal with the double layer of risk that they incur.

Final Thoughts

Like any asset, a structured product can be a part of a balanced portfolio. But the key is balance. A structured product might offer double-digit returns, but the complexity, illiquidity, double-layer or risk, and costs are all reasons to be wary. That alone by no means that you should never consider a structured product, only that there may be better options to pursue first.

However, if you are ok with playing the double-layer or risk and are confident in your prediction of index movements, then a structured product might be the missing piece to your portfolio.

- The 9 Best UK Money Management Apps (2025) – for individuals and couples - August 8, 2024

- What Salary Should You Be Making At Your Age? (UK Guide) - August 8, 2024

- The Top 10 Most Ethical Banks in the UK: A Comprehensive Review for 2025 - August 8, 2024